Nebraska Tax Application, Form 20

What is the Nebraska Tax Application, Form 20

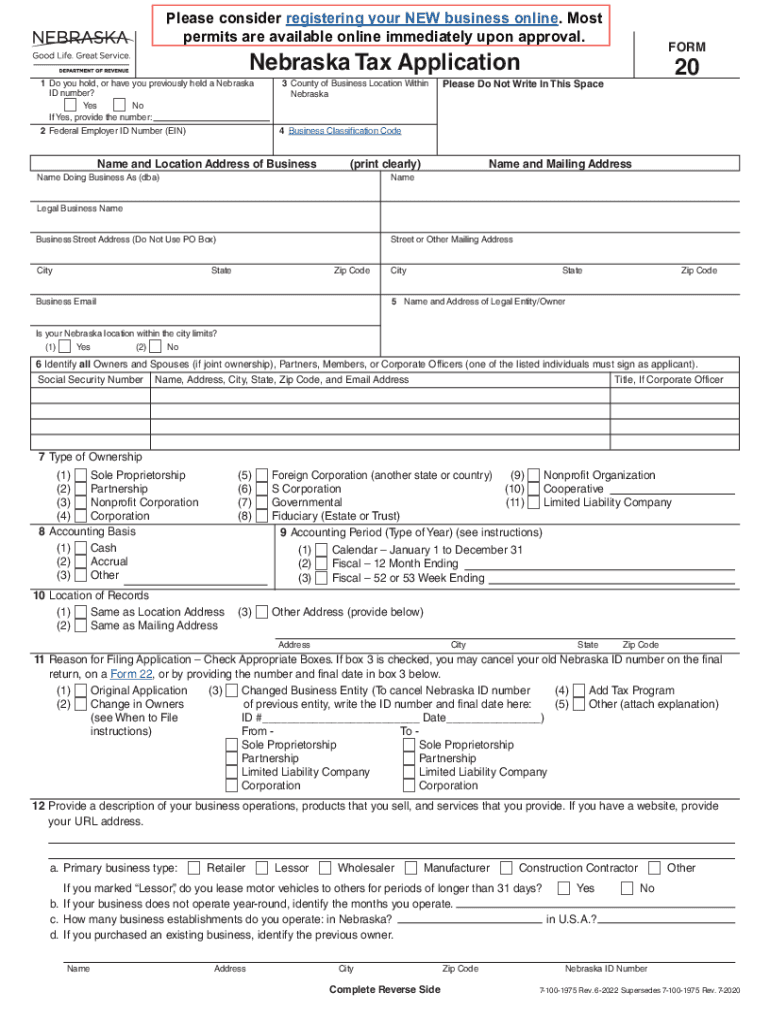

The Nebraska Tax Application, Form 20, is a crucial document used by businesses to apply for a sales tax permit in the state of Nebraska. This form is essential for any entity planning to sell tangible personal property or provide taxable services within the state. By completing Form 20, businesses can obtain a Nebraska sales tax permit number, which allows them to collect sales tax from customers and remit it to the state. The form is specifically designed to streamline the application process for new businesses and ensure compliance with Nebraska tax laws.

Steps to Complete the Nebraska Tax Application, Form 20

Completing the Nebraska Tax Application, Form 20, involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business name, address, and federal Employer Identification Number (EIN). Next, fill out the form with details about your business structure, such as whether you are a sole proprietor, partnership, or corporation. Be sure to provide information about the nature of your business activities and the types of products or services you plan to sell. After completing the form, review it carefully for any errors before submission.

How to Obtain the Nebraska Tax Application, Form 20

The Nebraska Tax Application, Form 20, can be obtained through the Nebraska Department of Revenue website. The form is available for download in a PDF format, making it easy to print and fill out. Additionally, businesses can also request a paper copy of the form by contacting the Department of Revenue directly. It is important to ensure that you are using the most current version of the form to avoid any issues during the application process.

Required Documents for Nebraska Tax Application, Form 20

When submitting the Nebraska Tax Application, Form 20, certain documents are required to support your application. These typically include your federal EIN, a copy of your business formation documents (such as Articles of Incorporation or a partnership agreement), and any other relevant licenses or permits specific to your business type. Having these documents ready will help expedite the application process and ensure that your submission is complete.

Form Submission Methods for Nebraska Tax Application, Form 20

Businesses can submit the Nebraska Tax Application, Form 20, through various methods. The form can be submitted online via the Nebraska Department of Revenue's website, which offers a user-friendly interface for electronic submissions. Alternatively, businesses may also choose to print the completed form and mail it to the appropriate address provided on the form. In-person submissions are also accepted at designated Department of Revenue offices, allowing for direct assistance if needed.

Eligibility Criteria for Nebraska Tax Application, Form 20

To be eligible for the Nebraska Tax Application, Form 20, applicants must be engaged in business activities that require a sales tax permit in Nebraska. This includes selling tangible goods or providing taxable services. Additionally, businesses must be registered with the state and comply with all local regulations. It is essential to review the eligibility criteria carefully to ensure that your business meets all requirements before applying.

Quick guide on how to complete nebraska tax application form 20

Complete Nebraska Tax Application, Form 20 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Nebraska Tax Application, Form 20 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Nebraska Tax Application, Form 20 with ease

- Locate Nebraska Tax Application, Form 20 and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Nebraska Tax Application, Form 20 to ensure outstanding communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska tax application form 20

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ne form 20 and why is it important?

The ne form 20 is a critical document used for various business and regulatory purposes. It provides necessary details for compliance and ensures that organizations can operate smoothly within legal parameters. Understanding the ne form 20 is essential for any business looking to maintain proper documentation and avoid potential legal issues.

-

How does airSlate SignNow assist with completing the ne form 20?

airSlate SignNow simplifies the process of filling out the ne form 20 by providing a user-friendly platform that allows users to easily input necessary information. Our solution also allows for secure electronic signatures, ensuring that your completed documents are both legal and accessible. This streamlines the entire document management process related to the ne form 20.

-

What features does airSlate SignNow offer for managing the ne form 20?

airSlate SignNow offers a variety of features tailored to effectively manage the ne form 20, including template creation, customizable fields, and real-time collaboration. These features enhance efficiency and accuracy in document completion. Additionally, our platform's tracking and reporting functionalities provide insights into document status, which is crucial for managing deadlines.

-

Is airSlate SignNow cost-effective for handling the ne form 20?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes needing to manage the ne form 20. Our pricing plans are competitive and provide excellent value, allowing companies to save on traditional printing and mailing costs. Furthermore, the time saved through automation and ease of use translates into signNow long-term savings.

-

Can airSlate SignNow integrate with other software for managing the ne form 20?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, providing a comprehensive solution for managing the ne form 20. This includes CRM systems, cloud storage services, and productivity tools, enabling businesses to work within their existing workflows. These integrations enhance overall productivity and ensure that the ne form 20 fits into your organization’s ecosystem.

-

How secure is my data when using airSlate SignNow for the ne form 20?

Your data security is a top priority at airSlate SignNow. We utilize industry-standard encryption and security protocols to protect all information related to the ne form 20. Additionally, our platform ensures compliance with global data protection regulations, giving users peace of mind that their documents are safe and secure.

-

What are the benefits of using airSlate SignNow for the ne form 20?

The primary benefits of using airSlate SignNow for the ne form 20 include increased efficiency, enhanced accuracy, and streamlined workflows. By automating the signing process and eliminating the need for paper, businesses can reduce errors and save time. Additionally, easy access to completed documents contributes to a more organized and effective document management system.

Get more for Nebraska Tax Application, Form 20

- Trade payment wizardtm form

- Notice of employment form

- State bank of india washington branch remittance form

- Dental health certificate pdf form

- Revised consent disclose simcoe holistic health form

- New mexico pit x form

- Operating llc puerto rico agreement template form

- Operating single member llc agreement template form

Find out other Nebraska Tax Application, Form 20

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form