Form Tr2 PDF Tax Registration 2023-2026

Understanding the tr1 Form for Tax Registration

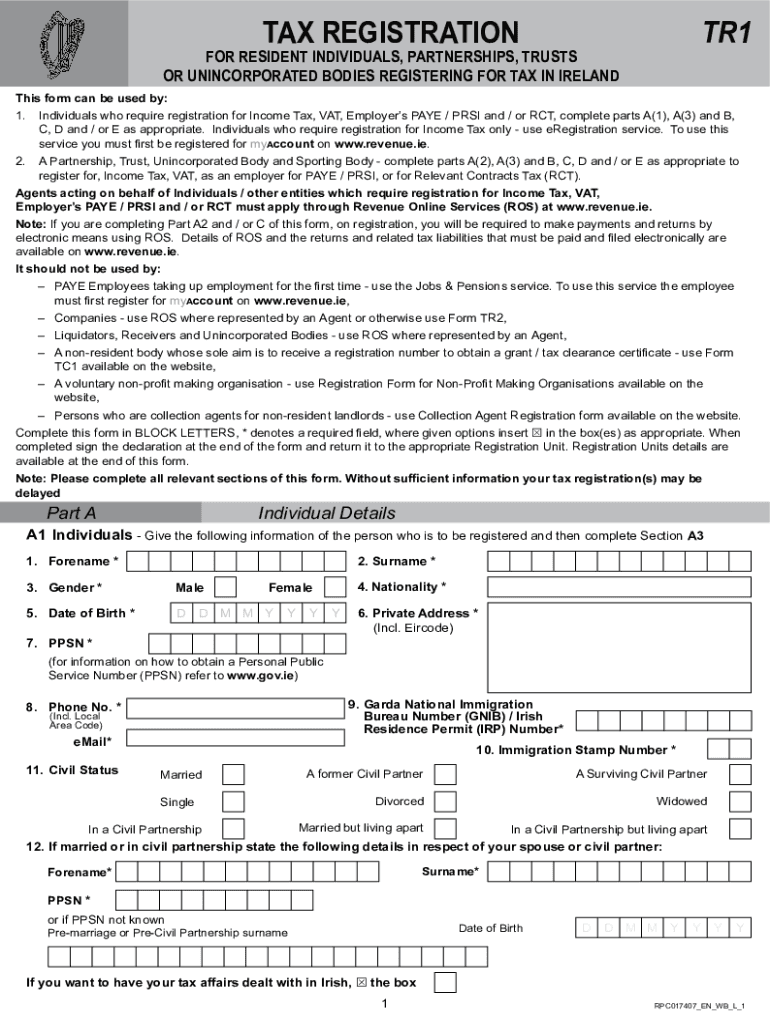

The tr1 form is essential for individuals and businesses in Ireland seeking to register for tax purposes. This document serves as a formal application to the Revenue Commissioners, allowing taxpayers to establish their tax obligations. It is crucial for ensuring compliance with Irish tax laws and can impact various aspects of financial management, including income tax, corporation tax, and VAT.

Steps to Complete the tr1 Form

Completing the tr1 form requires careful attention to detail. Here are the key steps:

- Gather necessary personal and business information, including identification details and financial records.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference and the requirements set by the Revenue Commissioners.

Legal Use of the tr1 Form

The tr1 form is legally binding once submitted to the Revenue Commissioners. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal issues. Understanding the legal implications of the tr1 form helps ensure compliance with tax regulations and protects against potential audits.

Required Documents for the tr1 Form

When filling out the tr1 form, certain documents are typically required to support your application. These may include:

- Proof of identity, such as a passport or driver's license.

- Business registration documents if applicable.

- Financial statements or records that demonstrate income sources.

Form Submission Methods

The tr1 form can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online submission via the Revenue Commissioners' website, which is often the fastest method.

- Mailing a physical copy to the appropriate tax office.

- In-person submission at designated tax offices, if required.

Penalties for Non-Compliance

Failure to submit the tr1 form or providing false information can result in significant penalties. These may include:

- Fines imposed by the Revenue Commissioners.

- Interest on any unpaid taxes.

- Potential legal action for severe cases of tax evasion.

Eligibility Criteria for the tr1 Form

Eligibility for submitting the tr1 form typically includes individuals and businesses that are required to register for tax in Ireland. This includes:

- Individuals earning income above a certain threshold.

- Businesses operating within Ireland, including sole traders and partnerships.

- Non-residents with income sourced from Ireland.

Quick guide on how to complete form tr2 pdf tax registration

Finalize Form tr2 pdf Tax Registration effortlessly on any gadget

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your files quickly and without delays. Handle Form tr2 pdf Tax Registration on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to modify and eSign Form tr2 pdf Tax Registration effortlessly

- Obtain Form tr2 pdf Tax Registration and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Form tr2 pdf Tax Registration while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tr2 pdf tax registration

Create this form in 5 minutes!

How to create an eSignature for the form tr2 pdf tax registration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TR1 form in Ireland?

The TR1 form in Ireland is a crucial document used for transferring property ownership. It contains essential details about the property and the parties involved in the transfer. Using airSlate SignNow, you can easily complete and eSign the TR1 form, streamlining the property transfer process.

-

How can airSlate SignNow help with the TR1 form in Ireland?

airSlate SignNow provides a user-friendly platform to fill out and electronically sign the TR1 form in Ireland. With its smart templates and easy navigation, users can efficiently manage the document signing process while ensuring compliance and security. This simplifies the often complex property transfer procedures.

-

Is there a cost associated with using airSlate SignNow for the TR1 form in Ireland?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when handling the TR1 form in Ireland. These plans are designed to be cost-effective while providing essential features for document management and eSigning. You can choose a plan that suits your budget and requirements.

-

What features does airSlate SignNow offer for handling the TR1 form in Ireland?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, making it ideal for managing the TR1 form in Ireland. Additionally, its real-time collaboration allows multiple parties to sign and review the document simultaneously, ensuring smooth communication.

-

How secure is signing the TR1 form in Ireland with airSlate SignNow?

Signing the TR1 form in Ireland with airSlate SignNow is highly secure, with encryption and compliance with legal standards. The platform adheres to industry standards to ensure that your documents are protected from unauthorized access. This provides peace of mind for both signers and businesses.

-

Can I integrate airSlate SignNow with other tools for managing the TR1 form in Ireland?

Yes, airSlate SignNow offers various integrations with popular tools and applications, which can help streamline the workflow for managing the TR1 form in Ireland. Whether you're using CRM systems or document storage services, these integrations enhance efficiency by simplifying the signing process.

-

What are the benefits of using airSlate SignNow for the TR1 form in Ireland?

Using airSlate SignNow for the TR1 form in Ireland provides numerous benefits, such as reduced turnaround times for document signing and improved tracking capabilities. It enhances overall productivity by allowing users to access and manage documents from anywhere, making the property transfer process faster and more convenient.

Get more for Form tr2 pdf Tax Registration

Find out other Form tr2 pdf Tax Registration

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy