I 070 Schedule WD Capital Gains and Losses Wisconsin Schedule WD Capital Gains and Losses 2022

What is the I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses

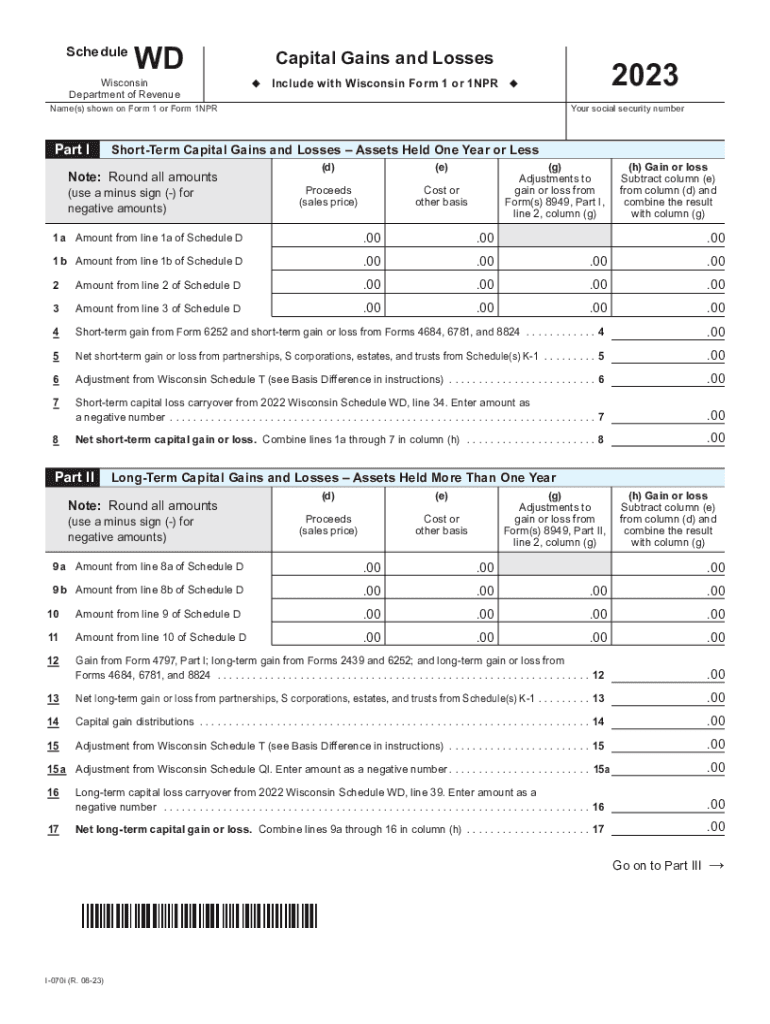

The I 070 Schedule WD is a tax form used in Wisconsin to report capital gains and losses. This schedule is specifically designed for individuals and entities who have realized gains or losses from the sale of assets, such as stocks, bonds, or real estate. It is essential for accurately calculating state tax obligations and ensuring compliance with Wisconsin tax laws. The form allows taxpayers to detail their transactions, providing necessary information to the Wisconsin Department of Revenue.

How to use the I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses

Using the I 070 Schedule WD involves several steps. Taxpayers must first gather all relevant documentation regarding their capital gains and losses for the tax year. This includes records of asset purchases, sales, and any associated costs. Once all information is compiled, taxpayers can fill out the form by entering details such as the type of asset, date of acquisition, date of sale, and the gain or loss realized. It is important to ensure accuracy to avoid discrepancies during tax assessments.

Steps to complete the I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses

Completing the I 070 Schedule WD involves a systematic approach:

- Gather necessary documents, including purchase and sale records.

- Calculate total capital gains and losses for each transaction.

- Fill out the form by entering details for each asset sold, including dates and amounts.

- Review the completed form for accuracy and completeness.

- Submit the form along with your Wisconsin income tax return.

State-specific rules for the I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses

Wisconsin has specific rules regarding the reporting of capital gains and losses. Taxpayers must adhere to state regulations, which may differ from federal guidelines. For instance, certain types of gains may be treated differently at the state level, and specific deductions or credits may apply. Understanding these nuances is crucial for accurate reporting and compliance with Wisconsin tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the I 070 Schedule WD align with the overall Wisconsin income tax return deadlines. Typically, taxpayers must submit their forms by April 15 of the following year. However, extensions may be available, allowing additional time for submission. It is important to stay informed about any changes in deadlines to avoid penalties.

Required Documents

To complete the I 070 Schedule WD, several documents are necessary:

- Purchase and sale records for all assets sold.

- Documentation of any improvements or costs associated with the assets.

- Previous tax returns, if applicable, for reference.

- Any notices or correspondence from the Wisconsin Department of Revenue.

Quick guide on how to complete i 070 schedule wd capital gains and losses wisconsin schedule wd capital gains and losses

Effortlessly Prepare I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses on Any Device

Managing documents online has gained signNow traction among businesses and personal users. It offers a great environmentally friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without interruptions. Handle I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses on any device with the airSlate SignNow apps available for Android or iOS and enhance any document-driven process today.

The easiest way to modify and eSign I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses effortlessly

- Obtain I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize essential sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of misplaced or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct i 070 schedule wd capital gains and losses wisconsin schedule wd capital gains and losses

Create this form in 5 minutes!

How to create an eSignature for the i 070 schedule wd capital gains and losses wisconsin schedule wd capital gains and losses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the I 070 Schedule WD Capital Gains And Losses in Wisconsin?

The I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses is a tax form used by Wisconsin residents to report capital gains and losses from the sale of assets. This form helps individuals accurately calculate their tax liabilities while complying with state laws. Completing this form correctly is vital for ensuring you pay the correct amount in taxes.

-

How does airSlate SignNow simplify the process of submitting the I 070 Schedule WD?

airSlate SignNow streamlines the process of preparing and submitting the I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses by providing an easy-to-use platform for eSigning required documents. This helps ensure that all necessary signatures are collected quickly and efficiently. With our service, you can focus on your finances while we handle the paperwork.

-

What are the pricing options for using airSlate SignNow with the I 070 Schedule WD?

airSlate SignNow offers various pricing plans to accommodate different business needs, providing options that are affordable for both individuals and businesses. Each plan includes features that help users manage and sign documents, including the I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses form. It’s important to select a plan that aligns with your volume of document handling.

-

Can airSlate SignNow integrate with other tax software for the I 070 Schedule WD?

Yes, airSlate SignNow can integrate seamlessly with various tax software solutions, making it easy to manage the I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses documents in your existing workflow. This ensures that all your financial data flows smoothly, reducing the time spent on manual entries. Integrations enhance efficiency and accuracy during tax preparation.

-

What features does airSlate SignNow offer that assist with the I 070 Schedule WD?

airSlate SignNow provides multiple features that are beneficial when dealing with the I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses, including customizable templates, automated reminders, and secure cloud storage. These features help to organize documents effectively and ensure deadlines are met without hassle. With our software, managing tax documents has never been easier.

-

What benefits does airSlate SignNow offer for businesses using the I 070 Schedule WD?

Using airSlate SignNow for the I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses enables businesses to enhance productivity and reduce downtime associated with document processing. Our platform offers a fast and secure way to collect signatures and manage documents, ultimately improving your operational efficiency. Businesses can save valuable time and resources while ensuring compliance.

-

Is airSlate SignNow secure for handling the I 070 Schedule WD documents?

Absolutely! airSlate SignNow employs advanced security measures to protect all documents, including the I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses. We utilize encryption and secure access protocols to keep your sensitive information safe. Our commitment to security guarantees that your data is protected during document transactions.

Get more for I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses

- Fort knox form 5097 ammunition inspection fort knox ky knox army

- Navsup form 1046

- Da form 7455

- Muzzle velocity record da form 4982 jan apd army

- Solid waste management facility pbr application form deq virginia

- Application for a bowling alley license cityofwestfield form

- Application for a billiard license form

- Application for zoning ampamp use permit in huntington woods mi form

Find out other I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile