I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions 2022

What is the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions

The I 111 Form 1 Instructions refer to the guidelines provided for completing the Wisconsin Income Tax Form 1. This form is essential for individuals filing their state income tax returns in Wisconsin. It outlines the necessary steps and requirements for taxpayers to accurately report their income, deductions, and credits to ensure compliance with state tax laws.

Steps to complete the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions

To successfully complete the I 111 Form 1, follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions carefully to understand the specific requirements for your filing situation.

- Fill out the personal information section accurately, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends, as outlined in the form.

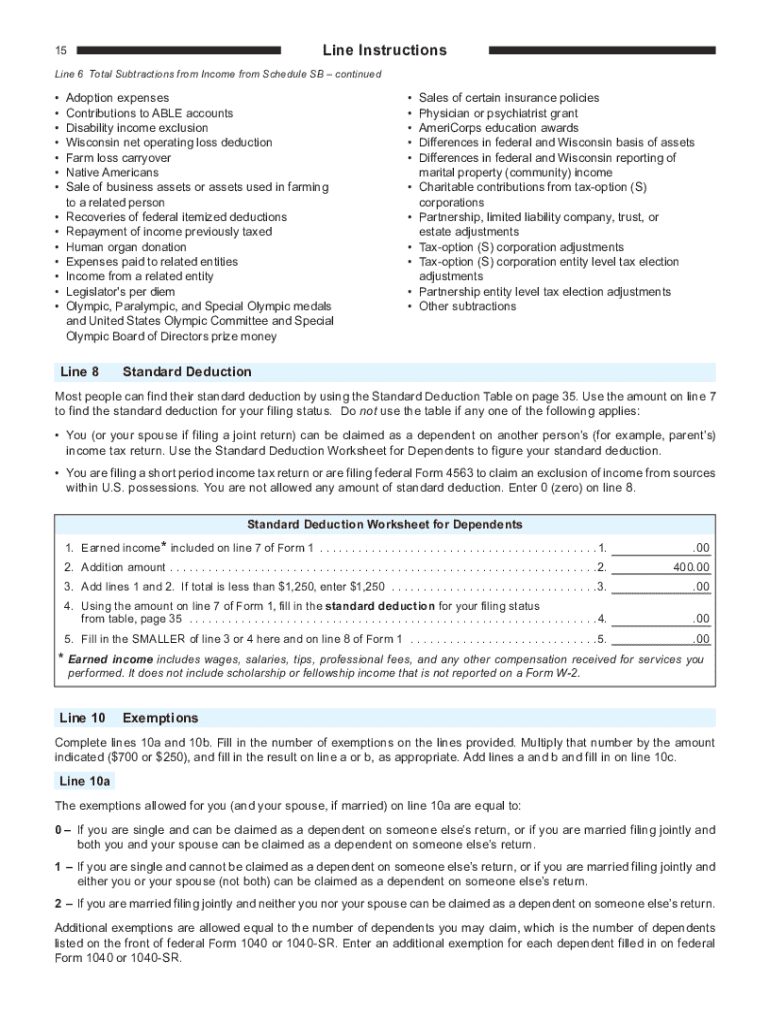

- Calculate your deductions and credits based on the guidelines provided in the instructions.

- Double-check all entries for accuracy before submitting the form.

- Choose your submission method: online, by mail, or in person, as detailed in the instructions.

How to obtain the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions

The I 111 Form 1 Instructions can be obtained through the Wisconsin Department of Revenue website. Taxpayers can download the instructions directly in PDF format. Additionally, physical copies may be available at local tax offices or public libraries. Ensure you have the most current version to avoid any discrepancies in your filing process.

Key elements of the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions

Understanding the key elements of the I 111 Form 1 Instructions is crucial for accurate filing. These elements include:

- Filing Status: Information on how to select the correct filing status based on your situation.

- Income Reporting: Guidelines on what constitutes taxable income and how to report it.

- Deductions and Credits: Detailed explanations of available deductions and credits to reduce your taxable income.

- Signature Requirements: Information on who must sign the form and how to do so electronically if applicable.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the I 111 Form 1. Typically, the deadline for submitting your Wisconsin income tax return is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any extensions that may apply and ensure they file accordingly to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the I 111 Form 1. These include:

- Online Submission: Many taxpayers prefer to file electronically through the Wisconsin Department of Revenue’s online portal, which offers a streamlined process.

- Mail: Completed forms can be mailed to the designated address provided in the instructions. Ensure you use the correct postage and keep a copy for your records.

- In-Person: Taxpayers may also submit their forms in person at local tax offices, where assistance may be available if needed.

Quick guide on how to complete i 111 form 1 instructions wisconsin income tax form 1 instructions

Complete I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions effortlessly on any gadget

Digital document handling has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions on any gadget using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions without breaking a sweat

- Locate I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions and click Obtain Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign function, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Finish button to save your edits.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your selected device. Modify and eSign I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct i 111 form 1 instructions wisconsin income tax form 1 instructions

Create this form in 5 minutes!

How to create an eSignature for the i 111 form 1 instructions wisconsin income tax form 1 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions?

The I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions provide detailed guidance on how to complete the Wisconsin Income Tax Form 1. This resource is essential for taxpayers looking to accurately file their income tax returns and understand the necessary steps involved in the process.

-

How can airSlate SignNow assist with the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions?

airSlate SignNow simplifies the eSignature process, allowing users to sign important documents, including those related to the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions. With our intuitive platform, businesses can streamline their document management and ensure timely submissions of these forms.

-

Are there any costs associated with using airSlate SignNow for the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions?

Yes, airSlate SignNow offers a variety of subscription plans tailored to suit different business needs. Depending on the features required for handling documents related to the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions, users can choose a plan that aligns with their budget while benefiting from an efficient eSignature solution.

-

What features does airSlate SignNow provide for better handling of income tax forms?

airSlate SignNow provides several features that enhance the handling of income tax forms, like customizable templates and bulk sending of documents. These capabilities allow businesses to efficiently manage their documents related to the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions, reducing errors and improving turnaround times.

-

Is airSlate SignNow compliant with legal standards for I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions?

Absolutely, airSlate SignNow is designed to comply with all legal regulations concerning electronic signatures. This compliance extends to documents associated with the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions, ensuring that users can confidently sign and submit their forms without legal concerns.

-

Can I integrate airSlate SignNow with other tools for better management of I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions?

Yes, airSlate SignNow offers various integrations with popular tools like Google Drive, Dropbox, and CRM systems. These integrations enhance the overall workflow, making it easier to manage and retrieve documents associated with the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions.

-

What are the benefits of using airSlate SignNow for managing tax documents?

Using airSlate SignNow for managing tax documents provides benefits such as reduced processing time, improved accuracy, and enhanced security. Specifically for the I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions, these advantages enable taxpayers to file their returns with confidence and convenience.

Get more for I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions

- Infrastructure definition ampamp meaning dictionary com form

- Oxford federal credit union routing number form

- Greenville county square 301 university rdg greenville form

- Application for foster home inspection guil randfire com form

- Application for abc license inspection form

- Www signnow comfill and sign pdf form36170gaston county missionary baptist association form signnow

- Permits licenses ampamp forms morristown new jersey

- Request for proposal fire pumper leasepurchasedeering nh form

Find out other I 111 Form 1 Instructions Wisconsin Income Tax Form 1 Instructions

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast