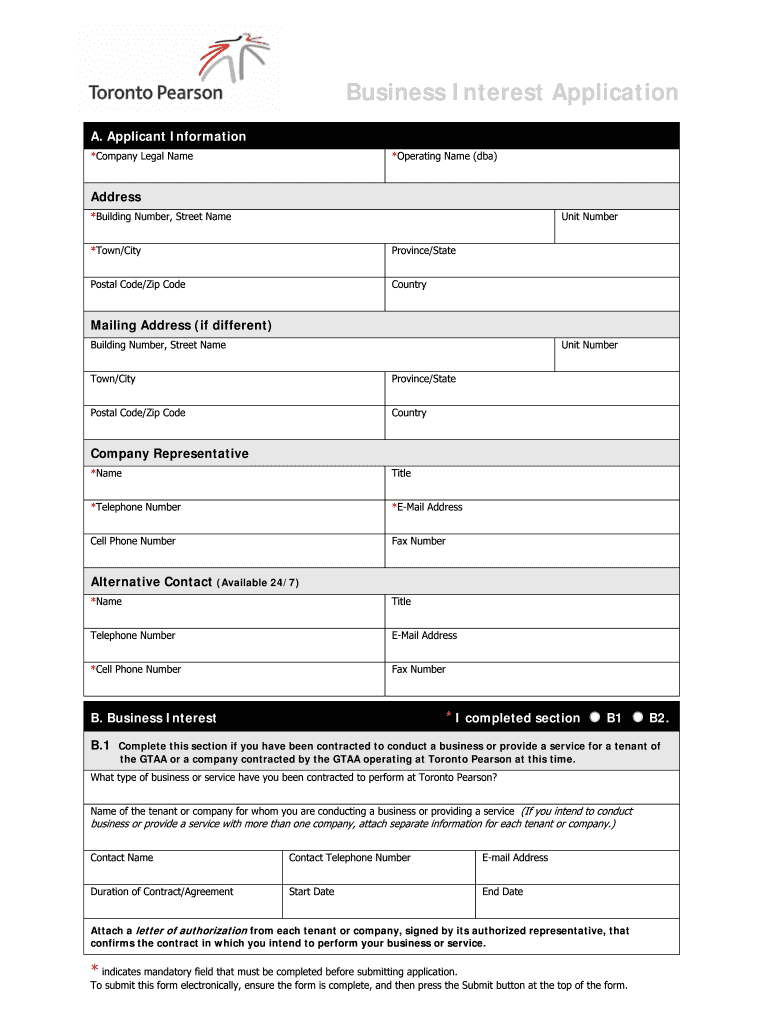

Business Interest Application Form

What is the Business Interest Application Form

The Business Interest Application Form is a crucial document used by businesses in the United States to formally express interest in a specific business opportunity or program. This form collects essential information about the business, including its name, type, ownership structure, and the nature of the interest being pursued. It serves as a foundational step for businesses looking to engage with various entities, such as government agencies, financial institutions, or potential partners.

How to use the Business Interest Application Form

Using the Business Interest Application Form involves several straightforward steps. First, ensure you have all necessary information about your business, including its legal structure and any relevant financial details. Next, fill out the form accurately, providing clear and concise responses to each section. After completing the form, review it for any errors or omissions. Once verified, submit the form according to the specified submission methods, which may include online submission, mailing, or in-person delivery.

Steps to complete the Business Interest Application Form

Completing the Business Interest Application Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather required information about your business, including its legal name, address, and type of entity (e.g., LLC, corporation).

- Identify the specific business interest you are applying for and gather any supporting documentation.

- Fill out the form, ensuring all fields are completed accurately and clearly.

- Review the form for completeness and correctness, making any necessary adjustments.

- Submit the form through the designated method, ensuring you keep a copy for your records.

Legal use of the Business Interest Application Form

The Business Interest Application Form is legally recognized and must be filled out in compliance with applicable laws and regulations. Businesses should ensure that the information provided is truthful and accurate, as false statements may lead to legal repercussions. Additionally, it is essential to understand the specific regulations governing the business interest being pursued, as these may vary by state or industry.

Required Documents

When submitting the Business Interest Application Form, certain documents may be required to support your application. These may include:

- Proof of business registration, such as articles of incorporation or a business license.

- Financial statements or tax returns to demonstrate the business's financial health.

- Identification documents for the business owner(s) or authorized representatives.

- Any additional documentation specific to the business interest being pursued.

Form Submission Methods

The Business Interest Application Form can typically be submitted through various methods, depending on the requirements of the entity receiving the form. Common submission methods include:

- Online submission via a secure portal, which may expedite processing times.

- Mailing the form to the designated address, ensuring it is sent via a reliable service.

- In-person delivery to the appropriate office or agency, allowing for immediate confirmation of receipt.

Quick guide on how to complete business interest application form

Fill out [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the features you need to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign [SKS] effortlessly

- Acquire [SKS] and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you'd like to send your form—via email, text message (SMS), or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Business Interest Application Form

Create this form in 5 minutes!

How to create an eSignature for the business interest application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Business Interest Application Form?

A Business Interest Application Form is a crucial document used by companies to express intent for interest in a particular business opportunity. With airSlate SignNow, businesses can easily create, send, and eSign this form digitally, ensuring a streamlined process and reducing paperwork.

-

How can I create a Business Interest Application Form with airSlate SignNow?

Creating a Business Interest Application Form with airSlate SignNow is simple. You can use our intuitive drag-and-drop editor to customize your form, add necessary fields, and then send it out for electronic signatures, all within a matter of minutes.

-

What are the benefits of using airSlate SignNow for a Business Interest Application Form?

Using airSlate SignNow for your Business Interest Application Form allows for faster processing times and increased efficiency. Our solution minimizes delays associated with manual signatures and paper forms, enabling your business to act quickly on opportunities.

-

Is there a mobile app for managing Business Interest Application Forms?

Yes, airSlate SignNow has a mobile app that allows you to manage your Business Interest Application Forms on the go. You can complete and eSign documents directly from your smartphone or tablet, making it easy to handle business interests anytime, anywhere.

-

How does airSlate SignNow handle data security for Business Interest Application Forms?

AirSlate SignNow prioritizes data security by employing robust encryption protocols to protect your Business Interest Application Forms. Our compliance with industry standards ensures that all sensitive information is secure during transmission and storage.

-

Can I integrate airSlate SignNow with other software to manage Business Interest Application Forms?

Absolutely! airSlate SignNow offers seamless integrations with various business applications. You can easily connect your CRM or project management tools to automate the workflow surrounding your Business Interest Application Forms.

-

What is the pricing structure for using airSlate SignNow for Business Interest Application Forms?

AirSlate SignNow offers a flexible pricing structure tailored to the needs of various businesses. You can choose from different plans based on features and usage, allowing you to efficiently manage Business Interest Application Forms without overspending.

Get more for Business Interest Application Form

- Probability word problems worksheet 283109867 form

- 130 immunology questions and answers form

- Kyc related parties mandated persons form

- Oklahoma child support forms

- Declaration of interest example form

- Phq 9 form pdf printable for teens

- Subcontractor verification form hillsborugh county

- Minnesota voluntary recognition of parentage spouse non parentage statement form

Find out other Business Interest Application Form

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy