Form M 1310 Statement of Person Claiming Refund Due a

What is the Form M 1310 Statement Of Person Claiming Refund Due A

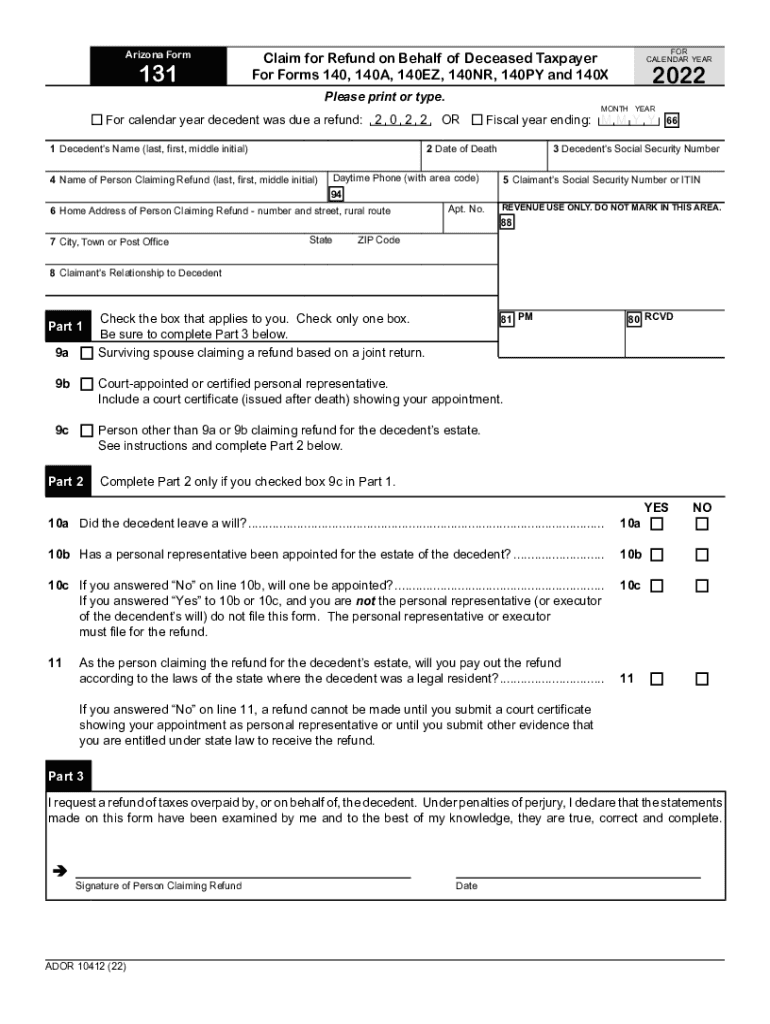

The Form M 1310, known as the Statement Of Person Claiming Refund Due A, is a document used in the United States to request a tax refund for a deceased taxpayer. This form is essential for individuals who are claiming a refund on behalf of someone who has passed away, ensuring that the rightful beneficiaries can receive any funds owed. It serves to provide the necessary information to the IRS, confirming the claimant's identity and their legal right to the refund.

How to use the Form M 1310 Statement Of Person Claiming Refund Due A

Using the Form M 1310 involves filling out the document accurately and submitting it to the IRS. The form must be completed by the individual claiming the refund, typically a spouse, child, or legal representative of the deceased. It is crucial to provide all required information, including the deceased's details and the claimant's relationship to them. Once completed, the form can be submitted along with any necessary supporting documents to ensure the claim is processed efficiently.

Steps to complete the Form M 1310 Statement Of Person Claiming Refund Due A

Completing the Form M 1310 requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the IRS website or through other official channels.

- Fill in the deceased taxpayer's information, including their name, Social Security number, and date of death.

- Provide your information as the claimant, including your name, address, and relationship to the deceased.

- Specify the reason for the refund claim and include any relevant tax return information.

- Sign and date the form, certifying that the information provided is accurate.

- Attach any required documentation, such as a death certificate or proof of your relationship to the deceased.

- Submit the completed form to the appropriate IRS address based on your location.

Required Documents

When submitting the Form M 1310, certain documents are necessary to support the claim. These may include:

- A copy of the deceased's tax return for the year in which the refund is being claimed.

- A certified copy of the death certificate to verify the taxpayer's passing.

- Documentation proving your relationship to the deceased, such as a marriage certificate or birth certificate.

Filing Deadlines / Important Dates

It is important to be aware of the deadlines for filing the Form M 1310. Generally, claims for tax refunds must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Keeping track of these deadlines ensures that the claim is submitted in a timely manner, allowing for the potential recovery of funds owed.

Form Submission Methods

The Form M 1310 can be submitted to the IRS through various methods. Claimants have the option to file the form by mail or electronically, depending on the specific instructions provided by the IRS. For those submitting by mail, it is advisable to use a secure method of delivery to ensure the form arrives safely at the IRS. Electronic submission may be available through certain tax preparation software, which can streamline the process.

Quick guide on how to complete form m 1310 statement of person claiming refund due a

Easily Prepare Form M 1310 Statement Of Person Claiming Refund Due A on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents quickly without delays. Manage Form M 1310 Statement Of Person Claiming Refund Due A on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Form M 1310 Statement Of Person Claiming Refund Due A Effortlessly

- Obtain Form M 1310 Statement Of Person Claiming Refund Due A and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for such purposes.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form M 1310 Statement Of Person Claiming Refund Due A to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m 1310 statement of person claiming refund due a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form M 1310 Statement Of Person Claiming Refund Due A?

The Form M 1310 Statement Of Person Claiming Refund Due A is a document used by individuals to claim a tax refund on behalf of a deceased person. It enables the rightful claimant to receive funds that are due to the estate. With airSlate SignNow, you can easily fill out and eSign this form to expedite the refund process.

-

How can airSlate SignNow help me complete the Form M 1310 Statement Of Person Claiming Refund Due A?

airSlate SignNow provides an intuitive platform to complete the Form M 1310 Statement Of Person Claiming Refund Due A efficiently. You can use our user-friendly interface to fill out all necessary fields, ensuring that no details are missed. Additionally, our eSigning feature allows you to sign the document securely and quickly, streamlining the entire filing process.

-

Is there a cost associated with using airSlate SignNow for the Form M 1310 Statement Of Person Claiming Refund Due A?

Yes, airSlate SignNow offers various pricing plans tailored to fit different user needs. While there may be a small fee for using our services, the cost is competitive and provides signNow value by simplifying the completion and submission of critical documents like the Form M 1310 Statement Of Person Claiming Refund Due A. You can choose the plan that best suits your business or personal needs.

-

What features does airSlate SignNow offer for the Form M 1310 Statement Of Person Claiming Refund Due A?

airSlate SignNow includes several standout features for the Form M 1310 Statement Of Person Claiming Refund Due A, such as customizable document templates, secure cloud storage, and advanced eSignature capabilities. These features not only enhance your document management but also ensure compliance and security throughout the entire process. With our platform, you can manage all your forms efficiently in one place.

-

Can I integrate airSlate SignNow with other tools for handling the Form M 1310 Statement Of Person Claiming Refund Due A?

Absolutely! airSlate SignNow offers various integrations with popular tools and software that can streamline your workflow when handling the Form M 1310 Statement Of Person Claiming Refund Due A. Whether you use project management apps or customer relationship management systems, our platform can seamlessly integrate, allowing you to enhance productivity and efficiency.

-

What are the benefits of using airSlate SignNow for my Form M 1310 Statement Of Person Claiming Refund Due A?

Using airSlate SignNow for your Form M 1310 Statement Of Person Claiming Refund Due A offers numerous benefits, including time savings, increased accuracy, and document security. Our platform simplifies the signing and sharing process, minimizes errors that can occur with manual entries, and ensures your sensitive information remains protected. These aspects make our solution a worthwhile investment.

-

How do I get started with airSlate SignNow for the Form M 1310 Statement Of Person Claiming Refund Due A?

Getting started with airSlate SignNow for the Form M 1310 Statement Of Person Claiming Refund Due A is simple. Begin by signing up for an account on our website, and explore our user-friendly interface which guides you through filling out the necessary details for your form. Our support team is also available to assist you with any questions to ensure a smooth experience.

Get more for Form M 1310 Statement Of Person Claiming Refund Due A

- Form of deed of gift

- Vahps fill and sign printable template onlineus legal forms

- North zone volunteer project and emergency response combined pdf form

- Fs 2700 3a request for revocation of a special use authorization example only please complete in nrm form

- Enter company name amp insert company logo above if desired form

- Division of motor vehicles dmv form

- Cg 7543 statement of financial status submitted for consideration in connection with indebtedness to the united states uscg form

- You can use this form to surrender your washington state or out of

Find out other Form M 1310 Statement Of Person Claiming Refund Due A

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template