12C 2 INTANGIBLE PERSONAL PROPERTY TAX Form

What is the 12C 2 Intangible Personal Property Tax?

The 12C 2 Intangible Personal Property Tax is a tax levied on certain intangible assets in Florida. This includes assets such as stocks, bonds, and other financial instruments. The tax is assessed annually and is applicable to individuals and businesses that own intangible property. Understanding this tax is crucial for compliance and financial planning, as it can impact overall tax liability.

Steps to Complete the 12C 2 Intangible Personal Property Tax

Completing the 12C 2 Intangible Personal Property Tax involves several key steps:

- Determine your intangible assets: Identify all stocks, bonds, and other financial instruments that you own.

- Calculate the total value: Assess the market value of each asset as of January first of the tax year.

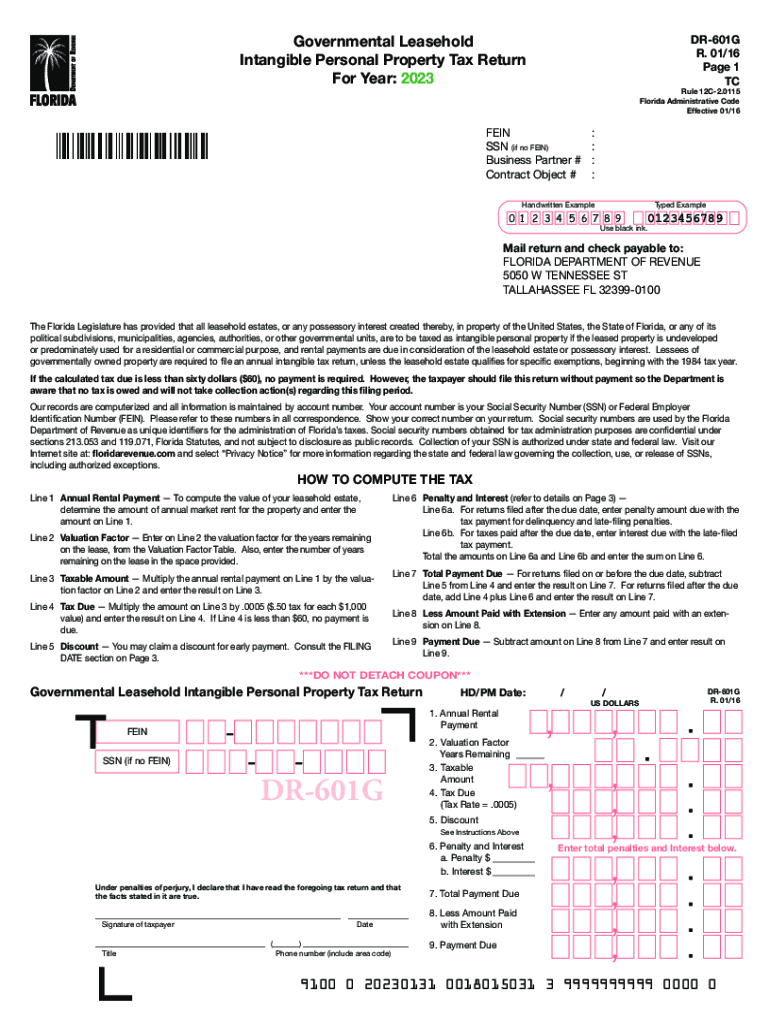

- Fill out the appropriate form: Use the DR-601 form to report your intangible assets and calculate the tax owed.

- Submit the form: File the completed form with the Florida Department of Revenue by the designated deadline.

Required Documents

To complete the filing process for the 12C 2 Intangible Personal Property Tax, you will need to gather several documents:

- Proof of ownership for each intangible asset.

- Valuation documents or statements reflecting the market value of the assets.

- The completed DR-601 form, which details your intangible property holdings.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the 12C 2 Intangible Personal Property Tax to avoid penalties:

- The tax return must be filed by April first of each year.

- If you miss the deadline, you may face penalties and interest on the unpaid tax.

Who Issues the Form

The Florida Department of Revenue is responsible for issuing the DR-601 form for the 12C 2 Intangible Personal Property Tax. This department provides guidelines and resources to assist taxpayers in understanding their obligations and the filing process.

Penalties for Non-Compliance

Failure to comply with the 12C 2 Intangible Personal Property Tax requirements can result in significant penalties. These may include:

- Late filing penalties, which can increase the total tax owed.

- Interest charges on any unpaid tax amounts.

- Potential legal action for continued non-compliance.

Eligibility Criteria

Eligibility for the 12C 2 Intangible Personal Property Tax applies to individuals and businesses that own intangible assets in Florida. There are no specific exemptions based solely on income or entity type, making it important for all asset holders to assess their tax obligations annually.

Quick guide on how to complete 12c 2 intangible personal property tax

Complete 12C 2 INTANGIBLE PERSONAL PROPERTY TAX with ease on any device

Online document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 12C 2 INTANGIBLE PERSONAL PROPERTY TAX on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign 12C 2 INTANGIBLE PERSONAL PROPERTY TAX effortlessly

- Obtain 12C 2 INTANGIBLE PERSONAL PROPERTY TAX and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Decide how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign 12C 2 INTANGIBLE PERSONAL PROPERTY TAX and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 12c 2 intangible personal property tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the filing fee Florida businesses need to consider when using eSignature platforms?

The filing fee Florida businesses incur varies based on the type of document being filed. It's essential to check specific requirements related to your filings, as they can affect the overall cost when eSigning documents. airSlate SignNow integrates with your workflow, ensuring you can keep track of these fees efficiently.

-

How does airSlate SignNow help manage filing fees in Florida?

airSlate SignNow provides tools that simplify the management of filing fees in Florida. Our platform allows users to track and automatically calculate these fees during the eSigning process, ensuring you stay compliant and informed. This minimizes the risk of missed deadlines and unexpected costs.

-

Are there additional costs associated with using airSlate SignNow for document filing in Florida?

In addition to the standard filing fee Florida sets, airSlate SignNow offers a competitive pricing structure that eliminates hidden fees. Users can take advantage of flexible plans tailored to their business needs without incurring extra costs for eSigning or document management. Always check for potential discounts and offers that may apply.

-

What features does airSlate SignNow offer to streamline the eSigning process?

airSlate SignNow includes features such as customizable templates, real-time tracking, and automated reminders that enhance the eSigning experience. These features ensure that users can efficiently manage document workflows while considering the filing fee Florida regulations. This makes the process smooth and effortless.

-

Can airSlate SignNow integrate with other software used for filing in Florida?

Yes, airSlate SignNow seamlessly integrates with various applications that businesses often use for document filing in Florida. This connectivity allows for easy transfer of data, and helps ensure that you are complying with all relevant filing fees in Florida. Enjoy a streamlined workflow combined with robust eSigning capabilities.

-

How does using airSlate SignNow impact the overall cost of filing fees in Florida?

Using airSlate SignNow can lead to cost savings associated with filing fees in Florida, by reducing the time spent on document preparation and submission. By automating the eSigning process, businesses can decrease administrative overhead, allowing more focus on essential operations while ensuring that all fees are handled correctly.

-

Is there customer support available for questions about filing fees in Florida?

Absolutely! airSlate SignNow provides expert customer support to assist with any questions regarding filing fees in Florida. Our knowledgeable team can guide you through using our platform effectively and address any concerns related to your eSigning and document filing process.

Get more for 12C 2 INTANGIBLE PERSONAL PROPERTY TAX

- Procedures how to serve legal papers by sheriff juvenile how to serve legal papers by sheriff form

- Academic improvement plan form

- Rlau form

- Ajax hotel reservation form pdf multinational finance society

- M007b acupuncture invoice m007b acupuncture invoice wcb ab form

- Fill fillable itravelinsured trip cancellation form

- Face to face progress note and home health orders form

- F 11 029 940 automated clearing house ach transfer authorization f 11 029 940 automated clearing house ach transfer form

Find out other 12C 2 INTANGIBLE PERSONAL PROPERTY TAX

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free