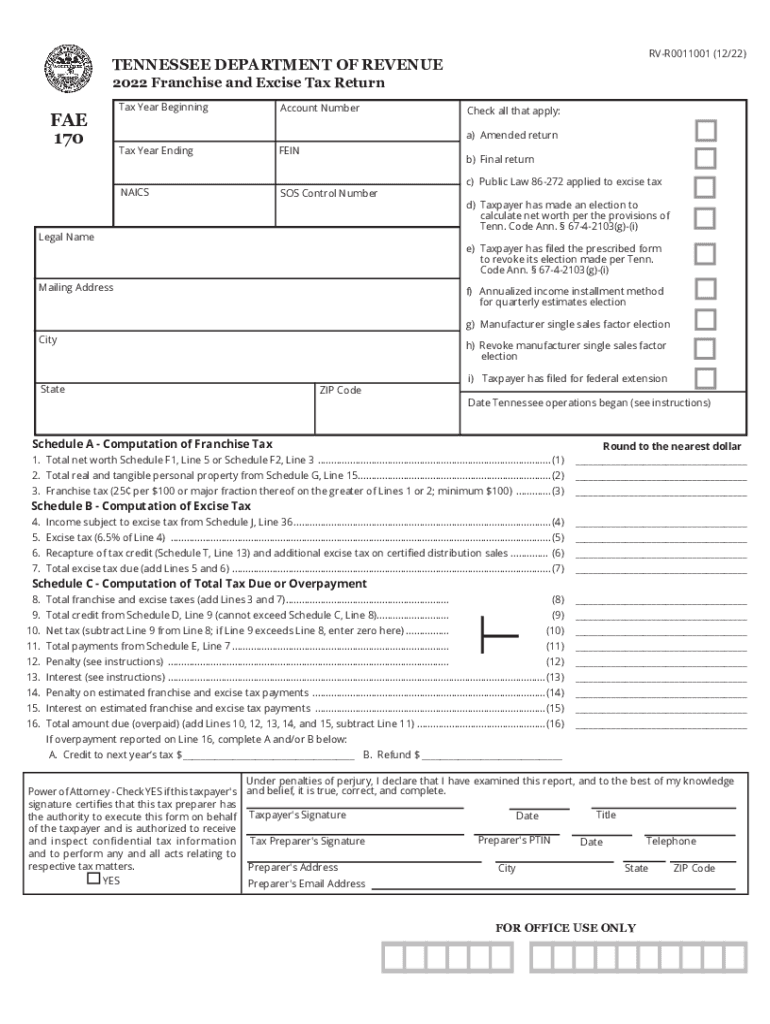

Franchise & Excise Tax Tennessee Department of Revenue Form

What is the Tennessee Franchise and Excise Tax?

The Tennessee Franchise and Excise Tax is a state-level tax imposed on businesses operating within Tennessee. This tax comprises two parts: the franchise tax, which is based on the net worth of the business, and the excise tax, which is based on the net earnings. The Tennessee Department of Revenue administers this tax, and it applies to various business entities, including corporations, limited liability companies (LLCs), and partnerships. Understanding this tax is crucial for compliance and financial planning for businesses in Tennessee.

Steps to Complete the Tennessee Franchise Excise Tax Return

Completing the Tennessee Franchise Excise Tax Return involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Calculate your franchise tax based on the business's net worth and the excise tax based on net earnings.

- Fill out the FAE 170 form, ensuring all required information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Tennessee Department of Revenue by the specified deadline.

Filing Deadlines for the Franchise Excise Tax Return

It is essential for businesses to be aware of the filing deadlines associated with the Tennessee Franchise Excise Tax Return. Typically, the return is due on the fifteenth day of the fourth month following the end of the business’s fiscal year. For most businesses operating on a calendar year, this means the return is due by April 15. Late submissions may incur penalties, so timely filing is critical.

Required Documents for the Franchise Excise Tax Return

When preparing to file the Tennessee Franchise Excise Tax Return, businesses need to gather specific documents:

- Financial statements, including profit and loss statements and balance sheets.

- Records of any previous tax payments made.

- Documentation of any deductions or credits claimed.

- Any relevant supporting documents that substantiate reported figures.

Form Submission Methods for the Franchise Excise Tax Return

Businesses can submit the Tennessee Franchise Excise Tax Return using various methods:

- Online submission through the Tennessee Department of Revenue’s e-filing system.

- Mailing a paper copy of the completed FAE 170 form to the appropriate address.

- In-person submission at designated Department of Revenue offices.

Penalties for Non-Compliance with the Franchise Excise Tax

Failure to comply with the filing requirements for the Tennessee Franchise Excise Tax can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, increasing the total amount owed.

- Potential legal action for persistent non-compliance.

Eligibility Criteria for the Franchise Excise Tax

Not all businesses are subject to the Tennessee Franchise Excise Tax. Eligibility criteria include:

- Operating as a corporation, LLC, or partnership within Tennessee.

- Generating income or having a physical presence in the state.

- Meeting the minimum thresholds for net worth and earnings as defined by state law.

Quick guide on how to complete franchise ampamp excise tax tennessee department of revenue

Complete Franchise & Excise Tax Tennessee Department Of Revenue effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly without delays. Handle Franchise & Excise Tax Tennessee Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and simplify any document-oriented tasks today.

The easiest way to edit and eSign Franchise & Excise Tax Tennessee Department Of Revenue with ease

- Find Franchise & Excise Tax Tennessee Department Of Revenue and click Get Form to commence.

- Utilize the features we offer to fill out your document.

- Mark essential sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and select the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Franchise & Excise Tax Tennessee Department Of Revenue and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the franchise ampamp excise tax tennessee department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TN franchise excise tax return?

A TN franchise excise tax return is a tax form required for businesses operating in Tennessee. It reports both the franchise and excise tax owed by the company based on its net earnings and net worth. Understanding how to complete this return accurately is essential for compliance and avoiding penalties.

-

How can airSlate SignNow help with filing a TN franchise excise tax return?

airSlate SignNow offers an easy-to-use platform that allows businesses to eSign their TN franchise excise tax return documents digitally. This eliminates the need for paper forms and streamlines the filing process. With its cost-effective solution, businesses can ensure accuracy and efficiency in their tax filings.

-

What are the benefits of using airSlate SignNow for TN franchise excise tax returns?

Using airSlate SignNow for TN franchise excise tax returns provides numerous benefits, including saving time and resources. The digital signing feature enables quick execution of documents, while the platform ensures secure storage and easy access. Additionally, it reduces the risk of errors common with paper paperwork.

-

Is there a pricing plan for airSlate SignNow that suits small businesses for TN franchise excise tax returns?

Yes, airSlate SignNow offers various pricing plans ideal for small businesses filing TN franchise excise tax returns. These plans are designed to be affordable while delivering essential features for document sharing and signing. You can choose a plan that fits your budget without compromising on functionality.

-

What features does airSlate SignNow offer for TN franchise excise tax returns?

airSlate SignNow features include customizable templates, secure eSigning, and real-time collaboration, making it effective for TN franchise excise tax returns. These features simplify the creation, signing, and management of tax documents. Additionally, users can track document status for better organization.

-

Can airSlate SignNow integrate with accounting software for TN franchise excise tax returns?

Absolutely! airSlate SignNow can easily integrate with various accounting software solutions, allowing for seamless management of TN franchise excise tax returns. This integration enhances workflow by connecting eSignatures directly with your accounting records, ensuring all information is up to date.

-

How secure is airSlate SignNow when handling TN franchise excise tax returns?

airSlate SignNow prioritizes security, employing industry-standard encryption to protect your documents, including TN franchise excise tax returns. The platform also complies with various data protection regulations, ensuring that sensitive tax information remains confidential. You can trust airSlate SignNow with your financial documents.

Get more for Franchise & Excise Tax Tennessee Department Of Revenue

Find out other Franchise & Excise Tax Tennessee Department Of Revenue

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now