Department of Revenue Services State of Connecticu 2022

What is the Department Of Revenue Services State Of Connecticut

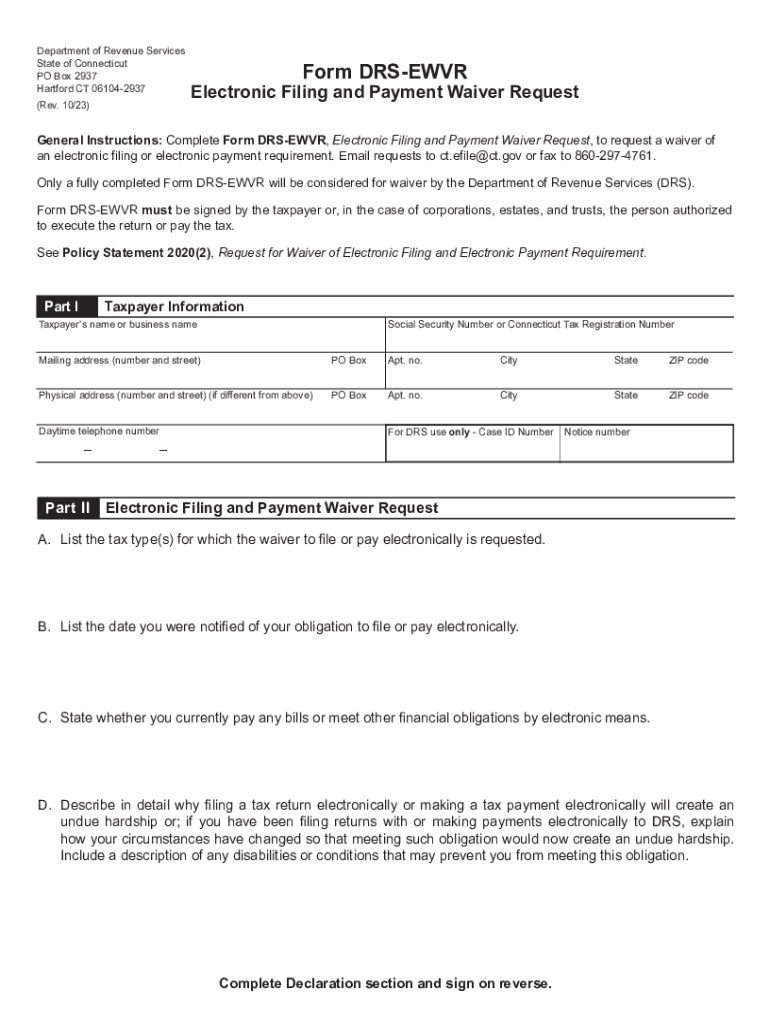

The Department Of Revenue Services State Of Connecticut (DRS) is the state agency responsible for administering tax laws and collecting revenue for the state. It oversees various tax types, including income, sales, and property taxes. The DRS ensures compliance with tax regulations and provides guidance to taxpayers on their obligations. This agency plays a crucial role in the financial health of Connecticut by managing tax collection and distribution of funds for public services.

How to use the Department Of Revenue Services State Of Connecticut

Utilizing the Department Of Revenue Services State Of Connecticut involves understanding the various services and resources it offers. Taxpayers can access forms, instructions, and online services through the DRS website. It is essential to familiarize oneself with the specific tax requirements relevant to individual circumstances, such as income tax filing or sales tax collection for businesses. The DRS also provides assistance through customer service channels for any inquiries or clarification needed regarding tax obligations.

Steps to complete the Department Of Revenue Services State Of Connecticut

Completing the necessary forms associated with the Department Of Revenue Services State Of Connecticut typically involves several steps:

- Identify the correct form based on your tax situation, such as income tax or sales tax.

- Gather required documentation, including income statements and previous tax returns.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Required Documents

When dealing with the Department Of Revenue Services State Of Connecticut, specific documents are typically required to ensure accurate processing of tax forms. Commonly needed documents include:

- W-2 forms from employers for income verification.

- 1099 forms for reporting additional income.

- Proof of residency, such as a utility bill or lease agreement.

- Previous tax returns for reference and consistency.

Form Submission Methods

The Department Of Revenue Services State Of Connecticut offers various methods for submitting tax forms. Taxpayers can choose from the following options:

- Online Submission: Many forms can be filed electronically through the DRS website, providing a fast and efficient option.

- Mail Submission: Taxpayers can print forms and send them via postal service to the designated DRS address.

- In-Person Submission: Forms can also be submitted at designated DRS offices for those who prefer face-to-face assistance.

Penalties for Non-Compliance

Failure to comply with the regulations set forth by the Department Of Revenue Services State Of Connecticut can result in various penalties. These may include:

- Late filing fees for not submitting forms by the deadline.

- Interest on unpaid taxes, which accrues over time.

- Potential legal action for severe cases of tax evasion or fraud.

Quick guide on how to complete department of revenue services state of connecticu 693992266

Effortlessly Prepare Department Of Revenue Services State Of Connecticu on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow provides all the tools necessary to quickly create, modify, and eSign your documents without delays. Manage Department Of Revenue Services State Of Connecticu on any device using airSlate SignNow’s apps for Android or iOS and simplify your document-related processes today.

How to Alter and eSign Department Of Revenue Services State Of Connecticu with Ease

- Locate Department Of Revenue Services State Of Connecticu and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow supplies specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Department Of Revenue Services State Of Connecticu and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of revenue services state of connecticu 693992266

Create this form in 5 minutes!

How to create an eSignature for the department of revenue services state of connecticu 693992266

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the Department Of Revenue Services State Of Connecticut?

airSlate SignNow is a robust eSignature solution designed to empower businesses in Connecticut to streamline document management processes. The Department Of Revenue Services State Of Connecticut recognizes the importance of efficient documentation, and SignNow provides a user-friendly platform to eSign and send important documents securely.

-

How does airSlate SignNow ensure compliance with the Department Of Revenue Services State Of Connecticut regulations?

airSlate SignNow is compliant with various eSignature laws, including those enforced by the Department Of Revenue Services State Of Connecticut. Our platform adheres to strict security protocols, ensuring that your signed documents meet all regulatory requirements and remain legally binding.

-

What features does airSlate SignNow offer for users in the Department Of Revenue Services State Of Connecticut?

airSlate SignNow provides a variety of features tailored for efficient document handling, including customizable templates, workflow automation, and secure eSignature capabilities. These features are designed to assist users in the Department Of Revenue Services State Of Connecticut in managing their documents effortlessly and effectively.

-

Is airSlate SignNow a cost-effective solution for businesses needing services from the Department Of Revenue Services State Of Connecticut?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes needing support from the Department Of Revenue Services State Of Connecticut. Our cost-effective solutions ensure that you receive high-quality document signing services without straining your budget.

-

Can airSlate SignNow integrate with other software used in the Department Of Revenue Services State Of Connecticut?

Absolutely, airSlate SignNow provides seamless integrations with popular software tools that businesses in Connecticut may already be using. This makes it easy to incorporate our platform into your existing workflows as you engage with the Department Of Revenue Services State Of Connecticut.

-

What are the benefits of using airSlate SignNow for dealing with the Department Of Revenue Services State Of Connecticut?

Using airSlate SignNow enhances efficiency by allowing for fast document turnaround times and reducing the need for physical paperwork when interacting with the Department Of Revenue Services State Of Connecticut. Additionally, our platform offers secure storage and retrieval options, ensuring your documents are always accessible and protected.

-

How does airSlate SignNow help with document tracking for the Department Of Revenue Services State Of Connecticut?

airSlate SignNow includes comprehensive tracking features that allow users to monitor the status of their documents as they are sent to and signed by recipients. This transparency ensures that businesses engaging with the Department Of Revenue Services State Of Connecticut can stay informed about their documentation workflow.

Get more for Department Of Revenue Services State Of Connecticu

- Pemberton township recreation department 500 pemberton form

- Assistance for seniorsfood and nutrition service usda form

- South bound brook fire department chili cook off form

- Www countyoffice orglyndhurst police departmentlyndhurst police department lyndhurst nj address and phone form

- Www centuryfarmmeridian com09century farm acc formacc request form centuryfarmmeridian com

- Vendor hold harmless indemnity agreement form

- Get nrr swim test v3 navesink river rowing us legal forms

- Wall ayf cheer registration form bwallknightsayfbborgb

Find out other Department Of Revenue Services State Of Connecticu

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease