Form CT941 Must Be Filed and Paid Electronically unless Certain Conditions Are Met 2022

Understanding the CT 941 Form Requirements

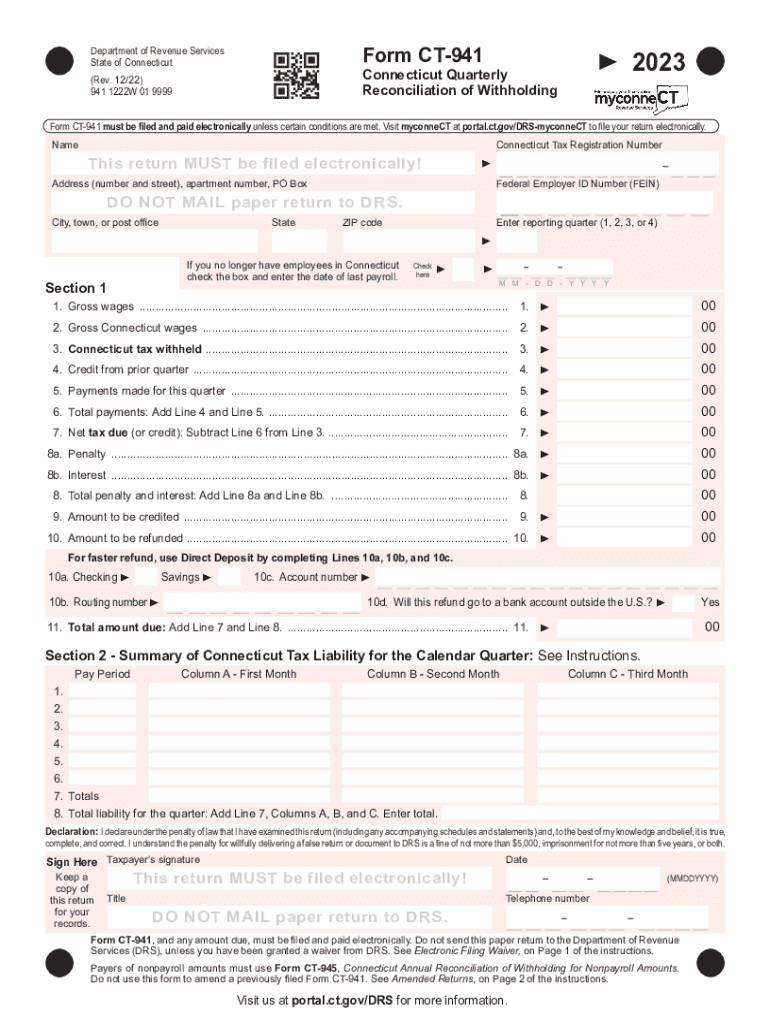

The CT 941 form is a crucial document for employers in Connecticut, used to report and pay state income tax withheld from employees' wages. It must be filed and paid electronically unless specific conditions are met. Employers are required to submit this form quarterly, detailing the amount of income tax withheld during the reporting period. Understanding the requirements for filing this form is essential for compliance with state tax regulations.

Steps to Complete the CT 941 Form

Completing the CT 941 form involves several key steps:

- Gather necessary information, including employee wages and the total amount of state tax withheld.

- Access the form through the Connecticut Department of Revenue Services website or a trusted e-signature platform.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically, following the guidelines provided by the state.

Filing Deadlines for the CT 941 Form

Timely filing of the CT 941 form is critical to avoid penalties. The form is due on the last day of the month following the end of each quarter. For example, the deadlines for the 2023 tax year are:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Penalties for Non-Compliance

Failure to file the CT 941 form on time can result in significant penalties. The state may impose fines based on the amount of tax owed, and continued non-compliance can lead to further legal consequences. It is essential for employers to adhere to filing deadlines to maintain good standing with the Connecticut Department of Revenue Services.

Digital Submission Methods for the CT 941 Form

Employers are encouraged to file the CT 941 form electronically. This can be done through the Connecticut Department of Revenue Services' online portal or through compatible software that supports electronic filing. Electronic submission not only streamlines the process but also ensures faster processing and confirmation of receipt.

Key Elements of the CT 941 Form

The CT 941 form includes several important sections that employers must complete:

- Employer identification information, including name and address.

- Details of employee wages and the total amount of state tax withheld.

- Signature of the authorized person certifying the accuracy of the information provided.

Quick guide on how to complete form ct941 must be filed and paid electronically unless certain conditions are met

Effortlessly Prepare Form CT941 Must Be Filed And Paid Electronically Unless Certain Conditions Are Met on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any hindrances. Handle Form CT941 Must Be Filed And Paid Electronically Unless Certain Conditions Are Met on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Alter and eSign Form CT941 Must Be Filed And Paid Electronically Unless Certain Conditions Are Met with Ease

- Find Form CT941 Must Be Filed And Paid Electronically Unless Certain Conditions Are Met and click Get Form to commence.

- Leverage the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional signature made with ink.

- Review all the details and click on the Done button to preserve your changes.

- Choose your preferred method to send your form via email, text message (SMS), or an invitation link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Alter and eSign Form CT941 Must Be Filed And Paid Electronically Unless Certain Conditions Are Met to ensure remarkable communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct941 must be filed and paid electronically unless certain conditions are met

Create this form in 5 minutes!

How to create an eSignature for the form ct941 must be filed and paid electronically unless certain conditions are met

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 941 online and how can it benefit my business?

CT 941 online is a digital solution provided by airSlate SignNow that allows businesses to efficiently send and e-sign documents. This platform streamlines your document management process, resulting in faster turnaround times, improved compliance, and enhanced productivity for your business.

-

How much does it cost to use ct 941 online?

The pricing for ct 941 online varies based on the features and number of users you require. airSlate SignNow offers flexible subscription plans that cater to businesses of all sizes, ensuring cost-effective access to essential e-signature features and efficient document processing.

-

What features are included in ct 941 online?

CT 941 online includes a range of powerful features such as customizable templates, document tracking, and secure e-signature capabilities. These features combined make it a comprehensive solution for managing your documents seamlessly and securely.

-

Is ct 941 online secure for sending sensitive documents?

Yes, ct 941 online employs advanced security measures including encryption and secure authentication to protect your sensitive documents. With airSlate SignNow, you can confidently send and e-sign documents while maintaining utmost confidentiality and compliance.

-

Can I integrate ct 941 online with other applications?

Absolutely! CT 941 online easily integrates with various applications including CRMs, cloud storage, and productivity tools. This allows for a smoother workflow and better data management, streamlining your processes and enhancing overall efficiency.

-

Is there a free trial available for ct 941 online?

Yes, airSlate SignNow offers a free trial period for ct 941 online, allowing you to explore its features and benefits without any commitment. This is an excellent opportunity to assess how ct 941 online can enhance your document workflows and e-signature processes.

-

What type of customer support is available for ct 941 online users?

airSlate SignNow provides comprehensive customer support for ct 941 online users, including live chat, email assistance, and a rich knowledge base. This ensures you have the resources and help you need to maximize the use of your e-signature solution.

Get more for Form CT941 Must Be Filed And Paid Electronically Unless Certain Conditions Are Met

- Co permittee liability release form chester county pa

- Driving school enrollment form aaa central penn

- September march form

- If you havent already lower frederick fire company form

- Bellefonte area school district request for use of form

- Address information uspsaddressing your mailpostal exploreraddressing your mailpostal exploreraddressing your mailpostal

- Graduate transcript request alumni only central bucks school cbsd form

- Chapter 102 visual site inspection report instructions form

Find out other Form CT941 Must Be Filed And Paid Electronically Unless Certain Conditions Are Met

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form