CONNECTICUT Tax Forms and Instructions State Tax 2020

Understanding Connecticut Tax Forms and Instructions

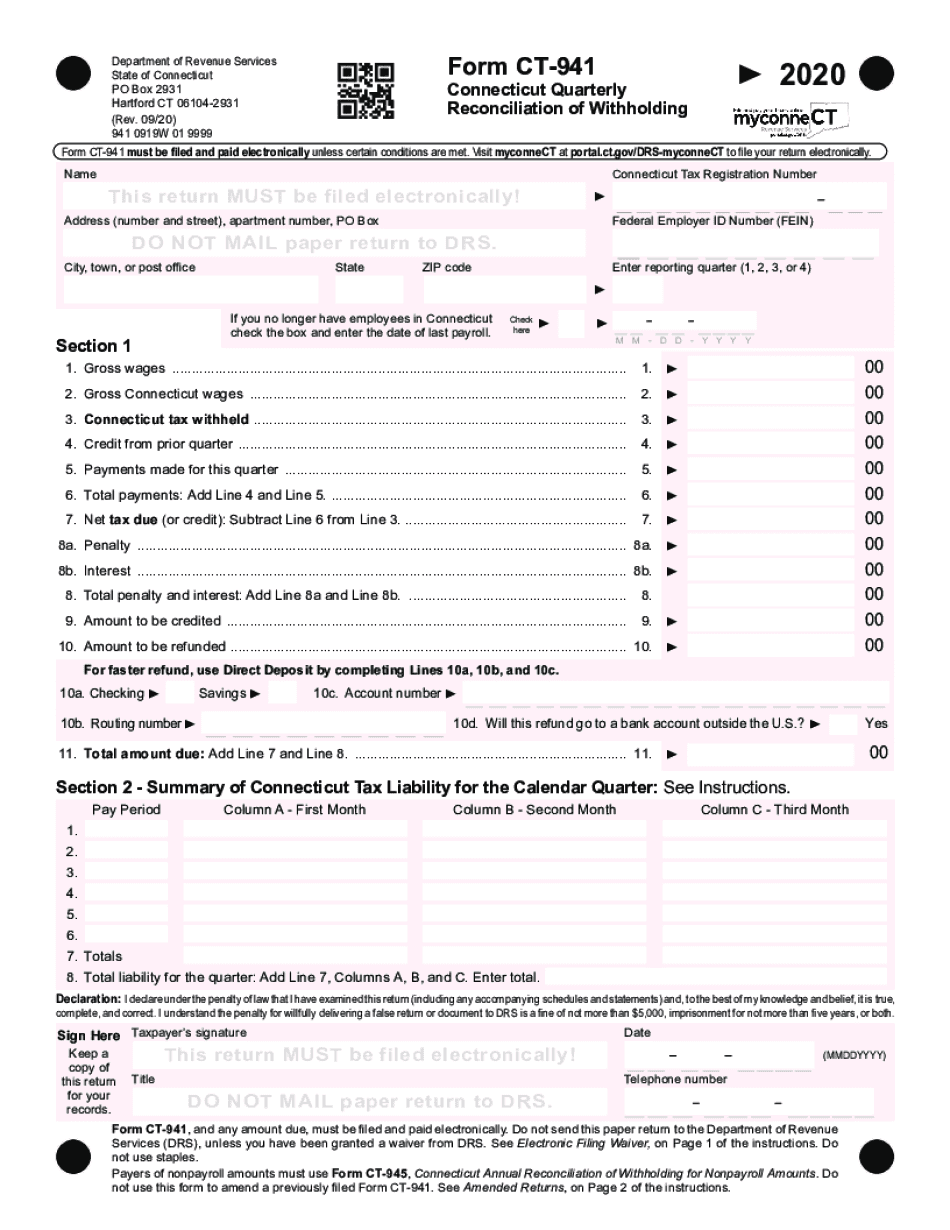

The Connecticut tax forms, including the CT-941, are essential documents for businesses and employers to report and remit state income tax withholding. These forms provide detailed instructions on how to accurately complete tax filings in compliance with state regulations. Each form is tailored to specific tax obligations, ensuring that taxpayers understand their responsibilities under Connecticut law.

Steps to Complete the CT-941 Form

Completing the CT-941 form involves several key steps. First, gather all necessary financial records, including employee wages and tax withholdings for the quarter. Next, accurately fill out the form by entering the total wages paid, the amount withheld, and any adjustments necessary. Ensure that all calculations are correct to avoid penalties. Finally, review the completed form for accuracy before submitting it to the Connecticut Department of Revenue Services.

Filing Deadlines for the CT-941

Timely filing of the CT-941 is crucial to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. For example, the first quarter's form is due by April 30, the second quarter by July 31, the third quarter by October 31, and the fourth quarter by January 31 of the following year. It is important to mark these dates on your calendar to ensure compliance.

Form Submission Methods for the CT-941

Taxpayers can submit the CT-941 form through various methods. The form can be filed online using the Connecticut Department of Revenue Services’ e-file system, which is the preferred method for many due to its convenience and speed. Alternatively, taxpayers may choose to mail a paper copy of the form to the appropriate address. In-person submissions may also be available at designated state offices.

Penalties for Non-Compliance with CT-941 Requirements

Failure to comply with the CT-941 filing requirements can result in significant penalties. These may include fines for late submissions, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is essential for employers to understand these consequences and take proactive measures to ensure timely and accurate filings to avoid any financial repercussions.

Key Elements of the CT-941 Form

The CT-941 form includes several critical components that taxpayers must understand. Key elements include the identification of the employer, total wages paid during the quarter, the amount of state income tax withheld, and any adjustments for prior periods. Each section must be filled out accurately to reflect the employer's tax obligations and ensure compliance with state regulations.

Quick guide on how to complete connecticut tax forms and instructions state tax

Effortlessly manage CONNECTICUT Tax Forms And Instructions State Tax on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle CONNECTICUT Tax Forms And Instructions State Tax across any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

How to modify and eSign CONNECTICUT Tax Forms And Instructions State Tax with ease

- Locate CONNECTICUT Tax Forms And Instructions State Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and hit the Done button to save your modifications.

- Select your preferred method to share your form, be it via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Edit and eSign CONNECTICUT Tax Forms And Instructions State Tax to ensure excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct connecticut tax forms and instructions state tax

Create this form in 5 minutes!

How to create an eSignature for the connecticut tax forms and instructions state tax

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What are ct 941 instructions and why are they important?

ct 941 instructions outline the requirements for completing the Connecticut state tax form for employers. These instructions are crucial for ensuring that businesses comply with tax regulations and avoid penalties, making it essential for every employer in Connecticut to be familiar with them.

-

How can airSlate SignNow assist with completing the ct 941 instructions?

airSlate SignNow offers essential tools to streamline the completion of ct 941 instructions by providing templates and electronic signatures. This simplifies the process, allowing users to quickly fill out and submit the necessary tax documents securely and efficiently.

-

What features does airSlate SignNow offer that relate to ct 941 instructions?

With airSlate SignNow, users can access customizable templates that include fields specifically for ct 941 instructions. Additionally, the platform supports eSigning and allows for document tracking, which is invaluable during tax season for employers needing timely submissions.

-

Are there any costs involved with using airSlate SignNow for ct 941 instructions?

airSlate SignNow offers various pricing plans that cater to different business sizes, starting from a basic plan that covers essential features. The investment in our service can help save time and reduce errors when handling ct 941 instructions, ultimately resulting in cost efficiency.

-

Can airSlate SignNow integrate with other software for handling ct 941 instructions?

Yes, airSlate SignNow seamlessly integrates with numerous accounting and HR software, enabling users to manage their ct 941 instructions alongside other payroll processes. This integration creates a streamlined workflow that enhances accuracy and saves valuable time.

-

What benefits does airSlate SignNow provide when processing ct 941 instructions?

Using airSlate SignNow to process ct 941 instructions allows for enhanced convenience, improved organization, and reduced paperwork. The electronic signature feature ensures that documents can be signed quickly, making the entire tax filing process more efficient for businesses.

-

Is airSlate SignNow secure for handling ct 941 instructions?

Absolutely. airSlate SignNow prioritizes security, offering encrypted data transmission and strict access controls. This ensures that all documents, including those related to ct 941 instructions, are stored and shared securely to protect sensitive information.

Get more for CONNECTICUT Tax Forms And Instructions State Tax

- Ut llc 497427640 form

- Living trust for husband and wife with no children utah form

- Living trust for individual who is single divorced or widow or widower with no children utah form

- Living trust for individual who is single divorced or widow or widower with children utah form

- Living trust for husband and wife with one child utah form

- Living trust for husband and wife with minor and or adult children utah form

- Utah trust 497427646 form

- Living trust property record utah form

Find out other CONNECTICUT Tax Forms And Instructions State Tax

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT