Form CT 941 Connecticut Quarterly Reconciliation of 2022-2026

What is the Form CT 941 Connecticut Quarterly Reconciliation Of

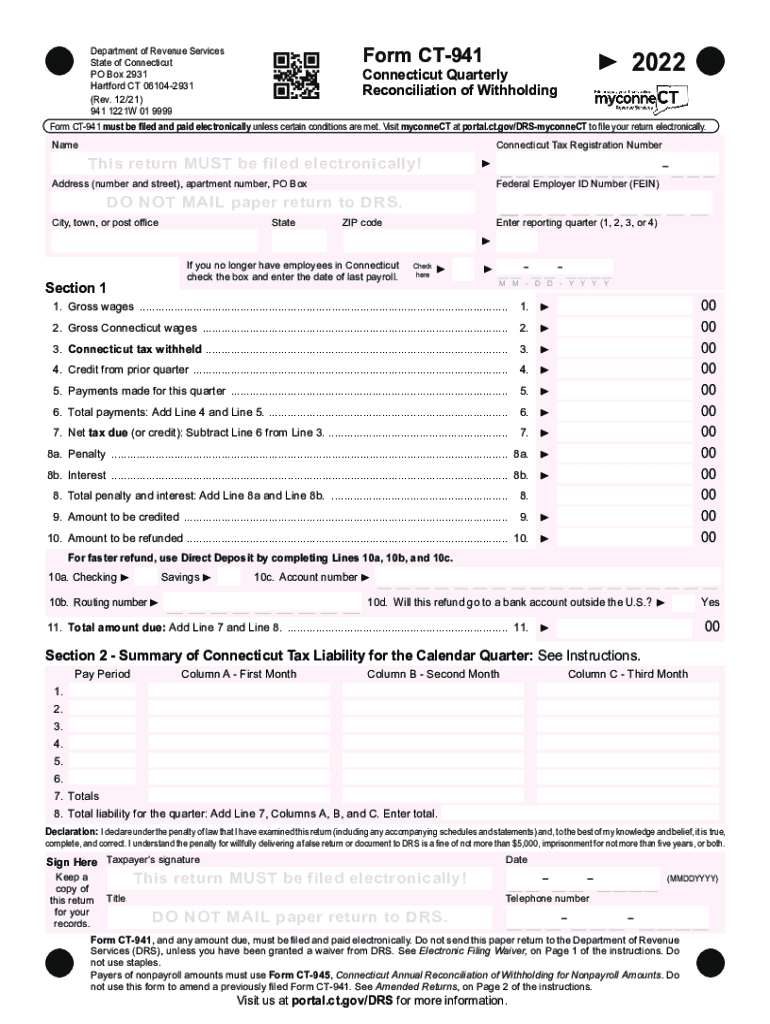

The Form CT 941 is a crucial document used by employers in Connecticut to report and reconcile their quarterly withholding taxes. This form is essential for businesses that withhold state income tax from employee wages, ensuring compliance with state tax regulations. The CT 941 form provides a summary of the total wages paid and the corresponding amount of tax withheld during each quarter of the calendar year. By accurately completing this form, employers fulfill their obligation to report payroll taxes to the Connecticut Department of Revenue Services.

Steps to complete the Form CT 941 Connecticut Quarterly Reconciliation Of

Completing the Form CT 941 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary payroll records for the quarter, including total wages paid and taxes withheld. Next, follow these steps:

- Enter the employer's information, including name, address, and federal employer identification number (FEIN).

- Report the total wages paid to employees during the quarter in the designated section.

- Calculate the total amount of Connecticut income tax withheld from employee wages.

- Include any adjustments for prior periods if applicable.

- Sign and date the form to certify that the information provided is accurate.

After completing the form, ensure that all figures are verified for accuracy before submission.

How to obtain the Form CT 941 Connecticut Quarterly Reconciliation Of

The Form CT 941 can be easily obtained from the Connecticut Department of Revenue Services website. Employers can download the form directly in PDF format, allowing for easy access and printing. Additionally, physical copies may be available at local tax offices or through request by contacting the department directly. It is important to ensure that you are using the correct version of the form for the applicable tax year.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form CT 941 to avoid penalties. The filing due date for the CT 941 is the last day of the month following the end of each quarter. This means that:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

Timely submission is crucial to ensure compliance and avoid any potential fines.

Legal use of the Form CT 941 Connecticut Quarterly Reconciliation Of

The Form CT 941 is legally required for all employers in Connecticut who withhold state income tax from employee wages. Proper use of this form ensures compliance with state tax laws and regulations. Failure to file the CT 941 can result in penalties, interest on unpaid taxes, and potential legal action from the Connecticut Department of Revenue Services. It is important for employers to maintain accurate records and file this form on time to avoid any legal repercussions.

Digital vs. Paper Version

Employers have the option to file the Form CT 941 either digitally or via paper submission. The digital version allows for quicker processing and may offer features such as automatic calculations and error-checking. Filing online can streamline the submission process, reducing the likelihood of errors. Conversely, some employers may prefer the traditional paper method, which allows for physical documentation. Regardless of the method chosen, it is essential to ensure that all information is accurate and submitted by the deadlines.

Quick guide on how to complete form ct 941 2021 connecticut quarterly reconciliation of

Complete Form CT 941 Connecticut Quarterly Reconciliation Of effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the features necessary to create, adjust, and eSign your documents swiftly without delays. Manage Form CT 941 Connecticut Quarterly Reconciliation Of on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form CT 941 Connecticut Quarterly Reconciliation Of without hassle

- Locate Form CT 941 Connecticut Quarterly Reconciliation Of and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of the documents or black out confidential information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the concern of lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form CT 941 Connecticut Quarterly Reconciliation Of and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 941 2021 connecticut quarterly reconciliation of

Create this form in 5 minutes!

People also ask

-

What is ct 941 2011 and how does it relate to airSlate SignNow?

The ct 941 2011 is a tax form used for reporting employment taxes in Connecticut. airSlate SignNow allows businesses to easily eSign this important document, ensuring compliance and accuracy in tax reporting. By utilizing airSlate SignNow, you can streamline your processes and manage ct 941 2011 efficiently.

-

How much does it cost to use airSlate SignNow for ct 941 2011 eSigning?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring that you have the necessary tools to eSign documents like the ct 941 2011. Visit our pricing page for detailed options.

-

What features does airSlate SignNow offer for handling ct 941 2011 documents?

airSlate SignNow provides a range of features tailored for document management, including templates, collaboration tools, and secure storage. These features make it easy for businesses to manage the ct 941 2011 form and other essential documents digitally. You’ll enjoy a seamless eSigning experience.

-

Is airSlate SignNow compliant with regulations for eSigning ct 941 2011?

Yes, airSlate SignNow complies with all relevant electronic signature laws, making it safe and legal to eSign the ct 941 2011. Our platform ensures that your signatures are authenticated and secure, allowing you to trust the efficiency and legality of your signed documents.

-

Can I integrate airSlate SignNow with other tools for managing ct 941 2011?

Absolutely! airSlate SignNow offers integrations with various business tools and applications that can help streamline your workflow involving the ct 941 2011 form. These integrations allow you to connect with CRM systems, cloud storage, and more, enhancing your overall efficiency.

-

What benefits does airSlate SignNow provide for businesses managing ct 941 2011?

Using airSlate SignNow, businesses can enjoy numerous benefits when managing ct 941 2011 forms, including increased efficiency, reduced paperwork, and faster turnaround times. This platform simplifies the eSigning process, allowing teams to collaborate and finalize documents quickly and conveniently.

-

How can I track the status of my ct 941 2011 eSignatures on airSlate SignNow?

airSlate SignNow provides robust tracking features that allow users to monitor the status of their eSignatures for documents like the ct 941 2011. You can receive notifications when documents are viewed and signed, ensuring you are always informed about the progress of your important filings.

Get more for Form CT 941 Connecticut Quarterly Reconciliation Of

- Site work contractor package north carolina form

- Siding contractor package north carolina form

- Refrigeration contractor package north carolina form

- Drainage contractor package north carolina form

- Tax free exchange package north carolina form

- Nc sublease 497317257 form

- Nc buy 497317258 form

- Nc purchase form

Find out other Form CT 941 Connecticut Quarterly Reconciliation Of

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract