Withholding Forms CT GOV Connecticut's Official State Website 2021

Understanding Form CT-941

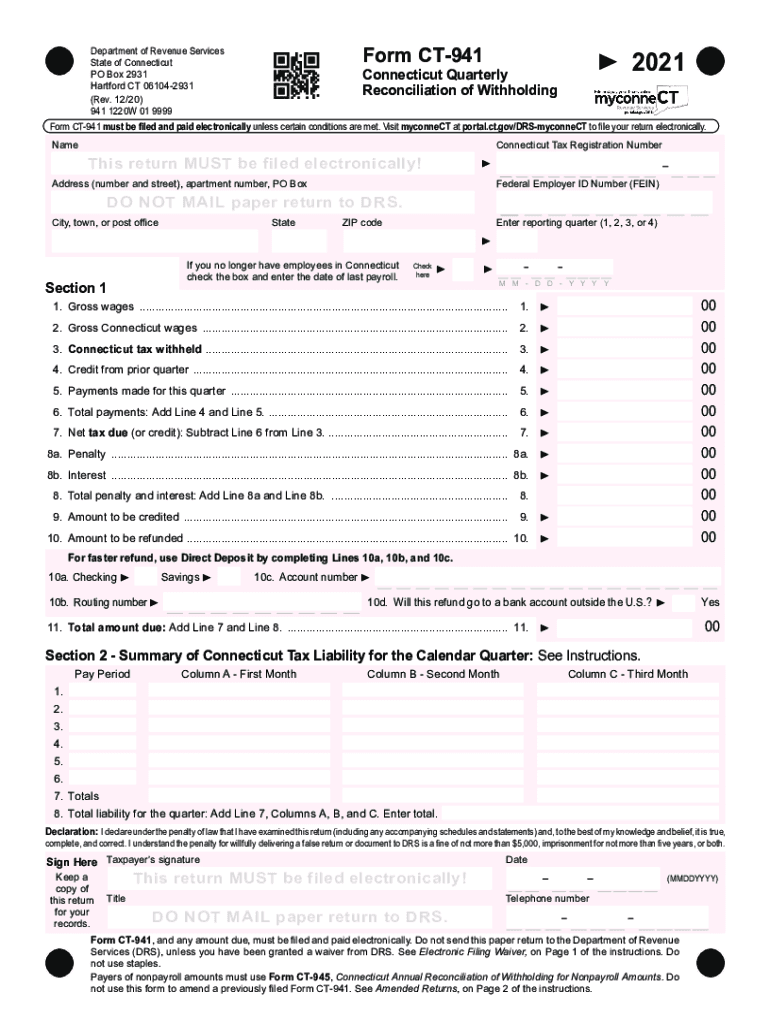

Form CT-941 is a crucial document used for reporting Connecticut income tax withheld from employee wages. This form is essential for employers in Connecticut, as it helps ensure compliance with state tax laws. The form must be filed quarterly, detailing the amounts withheld during the respective periods. Understanding the purpose and requirements of Form CT-941 is vital for accurate tax reporting and avoiding penalties.

Steps to Complete Form CT-941

Completing Form CT-941 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary payroll records for the quarter. This includes total wages paid, the amount of income tax withheld, and any adjustments from previous filings. Next, fill out the form with the required information, including your employer identification number, the quarter being reported, and the total amount withheld. Finally, review the form for accuracy before submitting it to the Connecticut Department of Revenue Services.

Filing Deadlines for Form CT-941

Timely filing of Form CT-941 is critical to avoid penalties. The form must be submitted quarterly, with specific deadlines for each quarter. For the first quarter, the deadline is typically April 30; for the second quarter, July 31; for the third quarter, October 31; and for the fourth quarter, January 31 of the following year. Employers should mark these dates on their calendars to ensure they remain compliant with state tax regulations.

Legal Use of Form CT-941

Form CT-941 is legally binding when completed accurately and submitted on time. It serves as an official record of the income tax withheld from employees, which is crucial for both the employer and employees. Failure to file this form correctly can result in penalties and interest charges. Employers must ensure that they adhere to all state guidelines and maintain accurate records to support the information reported on the form.

Penalties for Non-Compliance with Form CT-941

Non-compliance with Form CT-941 can lead to significant penalties. If the form is not filed by the deadline, employers may face fines or interest charges on the unpaid tax amounts. Additionally, inaccuracies in reporting can result in audits and further legal implications. It is essential for employers to understand the importance of timely and accurate submissions to avoid these consequences.

Digital vs. Paper Version of Form CT-941

Employers have the option to file Form CT-941 either digitally or via paper. Filing online can streamline the process, allowing for quicker submissions and confirmation of receipt. Digital filing also reduces the risk of errors associated with manual entry. However, some employers may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, it is important to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete withholding forms ctgov connecticuts official state website

Effortlessly prepare Withholding Forms CT GOV Connecticut's Official State Website on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the required format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Withholding Forms CT GOV Connecticut's Official State Website on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Withholding Forms CT GOV Connecticut's Official State Website with ease

- Find Withholding Forms CT GOV Connecticut's Official State Website and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click Done to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Withholding Forms CT GOV Connecticut's Official State Website and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding forms ctgov connecticuts official state website

Create this form in 5 minutes!

How to create an eSignature for the withholding forms ctgov connecticuts official state website

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an e-signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is form ct941 and why is it important?

Form ct941 is a key document used for reporting and paying Connecticut sales and use taxes. It is essential for businesses operating in Connecticut to keep track of their tax obligations accurately. Properly completing form ct941 helps businesses avoid potential penalties and ensures compliance with state tax laws.

-

How can airSlate SignNow help with form ct941?

airSlate SignNow provides a user-friendly platform for businesses to fill out, sign, and send form ct941 digitally. This streamlines the process, reducing paperwork and potential errors. Additionally, the platform allows for easy storage and retrieval of tax documents.

-

Is there a cost associated with using airSlate SignNow for form ct941?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. This includes access to features that facilitate the completion and management of form ct941. Explore our pricing to find a plan that fits your budget while streamlining your tax document processes.

-

Can I integrate airSlate SignNow with other software for handling form ct941?

Absolutely! airSlate SignNow offers integrations with various business software, enhancing your workflow when managing form ct941. Whether you're using accounting software or a CRM, our platform can seamlessly fit into your existing systems to simplify tax reporting.

-

What are the benefits of using airSlate SignNow for form ct941?

Using airSlate SignNow for form ct941 offers several benefits including increased efficiency, reduced paper waste, and enhanced security for sensitive tax information. The platform's easy-to-use interface simplifies the process of preparing and signing documents, saving you time and resources.

-

Is airSlate SignNow secure for handling sensitive documents like form ct941?

Yes, airSlate SignNow employs advanced security measures to protect your sensitive documents, including form ct941. With encryption and robust user authentication, you can trust that your tax documents are safe throughout the signing process. Security is a top priority for us.

-

Can multiple users collaborate on form ct941 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form ct941 efficiently. Team members can review, edit, and sign the document simultaneously, minimizing delays and ensuring that the form is submitted on time. This collaborative feature enhances teamwork and accountability.

Get more for Withholding Forms CT GOV Connecticut's Official State Website

- Abandoned vehicle guide idaho transportation department form

- Salvage dealer form

- Abandoned vehicle packet douglas county form

- Abandoned vehicle affidavit from insurance department of revenue form

- Instructions for claiming abandoned vehicles mainegov form

- Commonwealth of massachusetts motor vehicle crash massgov form

- State of alabama order establishing paternity case number form

- Petition for expungement of records alabama law form

Find out other Withholding Forms CT GOV Connecticut's Official State Website

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word