Form CT 1040NR PY Connecticut Nonresident and Part Year 2021

What is the Form CT 1040NR PY Connecticut Nonresident And Part Year

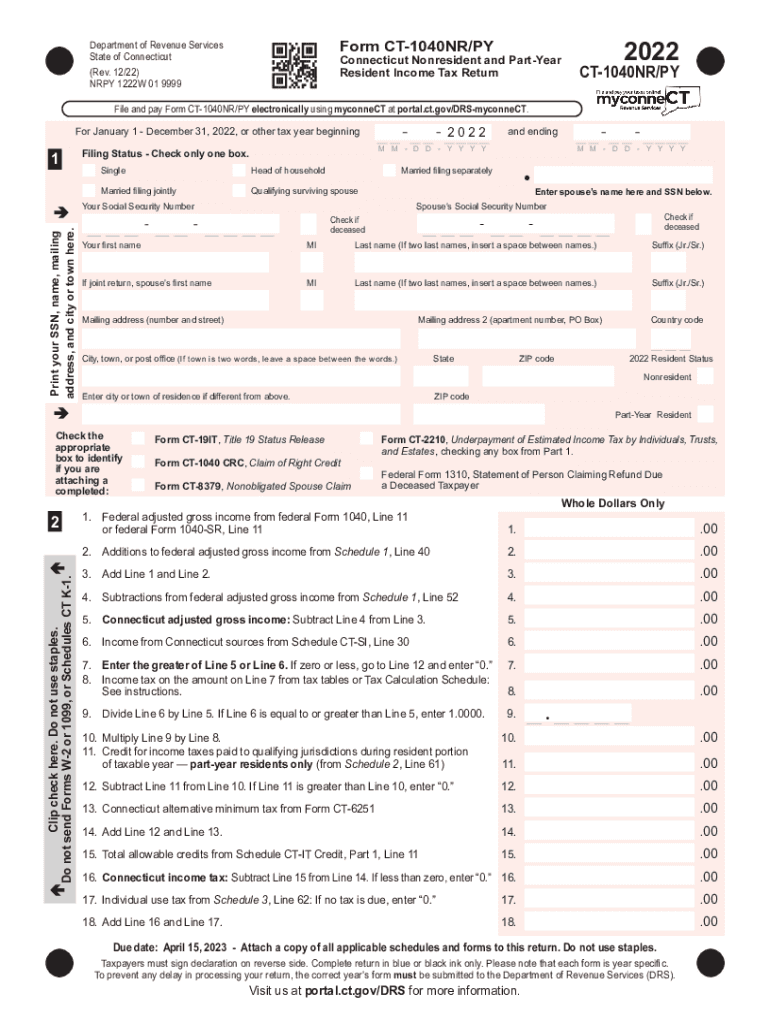

The Form CT 1040NR PY is designed for individuals who are nonresidents or part-year residents of Connecticut. This form is essential for reporting income earned in Connecticut during the tax year. It allows taxpayers to calculate their Connecticut income tax obligations based on the income sourced from the state. Nonresidents must report only the income earned within Connecticut, while part-year residents report income earned during the period they were residents.

How to use the Form CT 1040NR PY Connecticut Nonresident And Part Year

Using the Form CT 1040NR PY involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and other income statements. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Report your Connecticut-sourced income and any deductions or credits applicable to your situation. After completing the form, review it carefully for accuracy before submitting it to the Connecticut Department of Revenue Services.

Steps to complete the Form CT 1040NR PY Connecticut Nonresident And Part Year

Completing the Form CT 1040NR PY requires a systematic approach:

- Start by entering your personal information at the top of the form.

- Report your total income earned in Connecticut.

- Deduct any applicable expenses or exemptions.

- Calculate your total tax liability based on the state tax rates.

- Sign and date the form to certify its accuracy.

Filing Deadlines / Important Dates

For the tax year 2021, the filing deadline for the Form CT 1040NR PY is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to deadlines or extensions announced by the Connecticut Department of Revenue Services.

Required Documents

When preparing to file the Form CT 1040NR PY, gather the following documents:

- W-2 forms from employers for income earned in Connecticut.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income.

- Documentation for deductions or credits you plan to claim.

Penalties for Non-Compliance

Failure to file the Form CT 1040NR PY or inaccuracies in reporting can result in penalties. The Connecticut Department of Revenue Services may impose fines, interest on unpaid taxes, and potential legal action for non-compliance. It is essential to file on time and ensure all information is accurate to avoid these consequences.

Quick guide on how to complete form ct 1040nr py connecticut nonresident and part year

Prepare Form CT 1040NR PY Connecticut Nonresident And Part Year effortlessly on any gadget

Digital document management has gained traction among enterprises and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Form CT 1040NR PY Connecticut Nonresident And Part Year across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to alter and eSign Form CT 1040NR PY Connecticut Nonresident And Part Year without hassle

- Find Form CT 1040NR PY Connecticut Nonresident And Part Year and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Form CT 1040NR PY Connecticut Nonresident And Part Year and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1040nr py connecticut nonresident and part year

Create this form in 5 minutes!

How to create an eSignature for the form ct 1040nr py connecticut nonresident and part year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Connecticut state income tax form 2021?

The Connecticut state income tax form 2021 is a document that residents must complete to report their income and calculate taxes owed for the year 2021. This form includes information about your income, deductions, and credits, ensuring compliance with state tax laws.

-

How can I access the Connecticut state income tax form 2021?

You can easily access the Connecticut state income tax form 2021 through the Connecticut Department of Revenue Services website. Additionally, airSlate SignNow provides templates and tools to help you complete and eSign your tax forms securely and efficiently.

-

What features does airSlate SignNow offer for managing the Connecticut state income tax form 2021?

airSlate SignNow allows you to prepare, sign, and share the Connecticut state income tax form 2021 seamlessly. Key features include e-signature capabilities, cloud storage for data security, and easy sharing options with tax professionals or partners.

-

Is there a cost associated with using airSlate SignNow for the Connecticut state income tax form 2021?

Yes, airSlate SignNow offers a variety of pricing plans, including options for individual users and businesses. These plans provide valuable features for managing the Connecticut state income tax form 2021, with pricing designed to be cost-effective and budget-friendly.

-

Can I integrate airSlate SignNow with my accounting software for the Connecticut state income tax form 2021?

Absolutely! airSlate SignNow supports integrations with several popular accounting software options, allowing you to streamline the process of handling the Connecticut state income tax form 2021. This integration ensures that all your financial data is easily accessible and accurately reflected in your tax documents.

-

What are the benefits of using airSlate SignNow for my Connecticut state income tax form 2021?

Using airSlate SignNow for the Connecticut state income tax form 2021 enhances efficiency, security, and convenience. You can save time with electronic signatures, reduce paperwork, and ensure your documents are stored securely in the cloud, simplifying tax preparation.

-

How do I ensure the accuracy of my Connecticut state income tax form 2021 when using airSlate SignNow?

To ensure the accuracy of your Connecticut state income tax form 2021 while using airSlate SignNow, double-check all entered information and utilize available checklists. The platform also provides features that allow for easy revisions and error corrections before final submission.

Get more for Form CT 1040NR PY Connecticut Nonresident And Part Year

- Change made on form

- How to file police report philadelphia form

- Re registration form our lady of good counsel school

- 1 backflow preventer inspection and field test report form

- Www facebook comgeneva county solid wastegeneva county solid waste postsfacebook form

- Cep 1 form

- Journal ad template form

- Azalea trail maid homeschool application moffett road christian mobilemrcs form

Find out other Form CT 1040NR PY Connecticut Nonresident And Part Year

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer