Partnership FAQ SC Department of Revenue 2019-2026

Understanding the Composite Affidavit

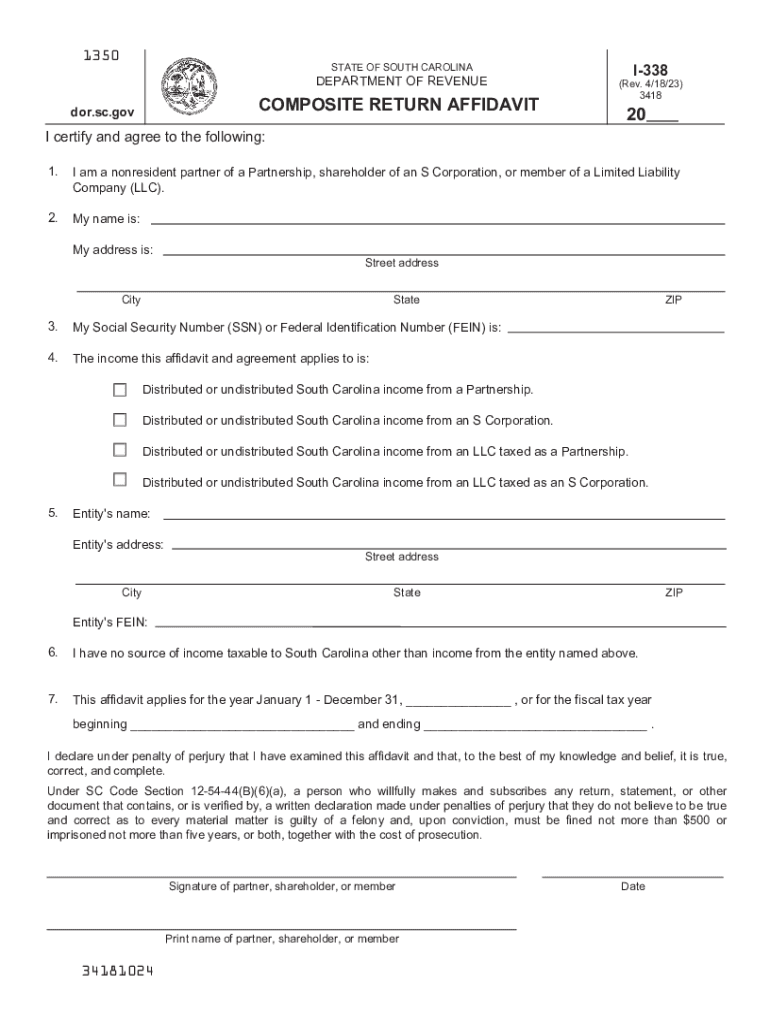

A composite affidavit is a legal document that combines multiple statements or declarations into one cohesive form. This type of affidavit is often used to streamline processes in various legal and business contexts, allowing individuals or entities to provide necessary information in a consolidated manner. In the United States, composite affidavits can serve various purposes, including verifying identity, confirming facts, or supporting applications for licenses and permits.

Key Elements of a Composite Affidavit

When preparing a composite affidavit, it is essential to include specific key elements to ensure its validity and effectiveness. These elements typically include:

- Title: Clearly label the document as a composite affidavit.

- Affiant Information: Include the full name, address, and contact information of the person making the affidavit.

- Statement of Facts: Provide a detailed account of the facts being attested to, organized in a clear and logical manner.

- Signature and Notarization: The affiant must sign the document in the presence of a notary public, who will then add their seal to verify the authenticity.

Steps to Complete a Composite Affidavit

Completing a composite affidavit involves several straightforward steps. Following these steps can help ensure that the document meets all necessary legal requirements:

- Gather all relevant information and documents that support the statements being made.

- Draft the affidavit, ensuring clarity and accuracy in the statement of facts.

- Review the document for completeness and correctness before finalizing it.

- Sign the affidavit in the presence of a notary public, who will then notarize the document.

Legal Use of Composite Affidavits

Composite affidavits are legally binding documents that can be used in various situations, such as court proceedings, business transactions, or government applications. It is crucial to understand the legal implications of submitting a composite affidavit, as providing false information can lead to penalties, including fines or criminal charges. Therefore, ensuring the accuracy of all statements is vital.

Filing Deadlines and Important Dates

When dealing with composite affidavits, it is important to be aware of any relevant filing deadlines or important dates. These can vary depending on the specific context in which the affidavit is being used, such as court cases or regulatory submissions. Always check local regulations or consult with a legal professional to ensure compliance with all deadlines.

Required Documents for a Composite Affidavit

To successfully complete and submit a composite affidavit, certain documents may be required. These documents can include:

- Identification documents, such as a driver's license or passport.

- Supporting evidence that substantiates the claims made in the affidavit.

- Any prior affidavits or related legal documents that may be relevant to the case.

Examples of Using a Composite Affidavit

Composite affidavits can be utilized in various scenarios, including:

- Affirming the identity of individuals in legal proceedings.

- Providing evidence in support of a business license application.

- Documenting witness statements in civil or criminal cases.

Quick guide on how to complete partnership faq sc department of revenue

Effortlessly Prepare Partnership FAQ SC Department Of Revenue on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents promptly without any holdups. Manage Partnership FAQ SC Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Partnership FAQ SC Department Of Revenue Without Stress

- Find Partnership FAQ SC Department Of Revenue and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow handles your document management needs in just a few clicks from any device of your choice. Modify and eSign Partnership FAQ SC Department Of Revenue and ensure exceptional communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partnership faq sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the partnership faq sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a composite affidavit?

A composite affidavit is a legal document that combines multiple affidavits into a single document for ease of use. It consolidates various statements or declarations from different witnesses, making it more efficient for legal proceedings. This can signNowly streamline the documentation process for businesses.

-

How can airSlate SignNow assist with composite affidavits?

airSlate SignNow provides a robust platform for creating, signing, and managing composite affidavits efficiently. With its user-friendly interface, businesses can easily prepare and send composite affidavits for electronic signatures. The integration of templates further simplifies the process, saving time and hassle.

-

Is there a pricing structure for using airSlate SignNow for composite affidavits?

Yes, airSlate SignNow offers a transparent pricing model that caters to different business needs for managing composite affidavits. Users can choose from various plans that suit their volume of document signing and storage requirements. Each plan includes features that enhance the creation and management of composite affidavits.

-

What features does airSlate SignNow provide for creating composite affidavits?

The platform includes features like customizable templates, the ability to merge documents, and collaborative editing tools to facilitate the creation of composite affidavits. Additionally, advanced text fields and signing workflows enhance the document management process. These features ensure that all pertinent information is accurately captured in one document.

-

Can I integrate airSlate SignNow with other tools for managing composite affidavits?

Absolutely! airSlate SignNow supports integration with numerous business applications, allowing users to streamline their workflow for composite affidavits. Whether you are using CRM systems or document management software, the integration capabilities ensure seamless operations. This makes managing composite affidavits much more efficient.

-

What are the benefits of using airSlate SignNow for composite affidavits?

Using airSlate SignNow for composite affidavits offers numerous benefits, including efficiency and enhanced security. The ability to eSign documents legally and securely speeds up the signing process and improves compliance. Additionally, digital storage of composite affidavits simplifies document retrieval and management.

-

Is airSlate SignNow legally compliant for sending composite affidavits?

Yes, airSlate SignNow is fully compliant with various electronic signature laws and regulations, ensuring that your composite affidavits are legally binding. The platform adheres to the ESIGN Act and UETA, providing peace of mind for businesses. This compliance reinforces the integrity of electronic transactions involving composite affidavits.

Get more for Partnership FAQ SC Department Of Revenue

- Iep process cvf form

- Pdf gadsden city high school transcript request form

- Dangerous dog registration form and

- Get the lcps change of address form pdffiller

- Loan or lien payoff request form

- Church waiver release liability form

- Regional refuse disposal district 1 r r d d 1 site form

- Get share the season application us legal forms

Find out other Partnership FAQ SC Department Of Revenue

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form