5081 Sales, Use and Withholding Taxes Annual Return 5081 Sales, Use and Withholding Taxes Annual Return 2022

Understanding the Michigan Form 5081

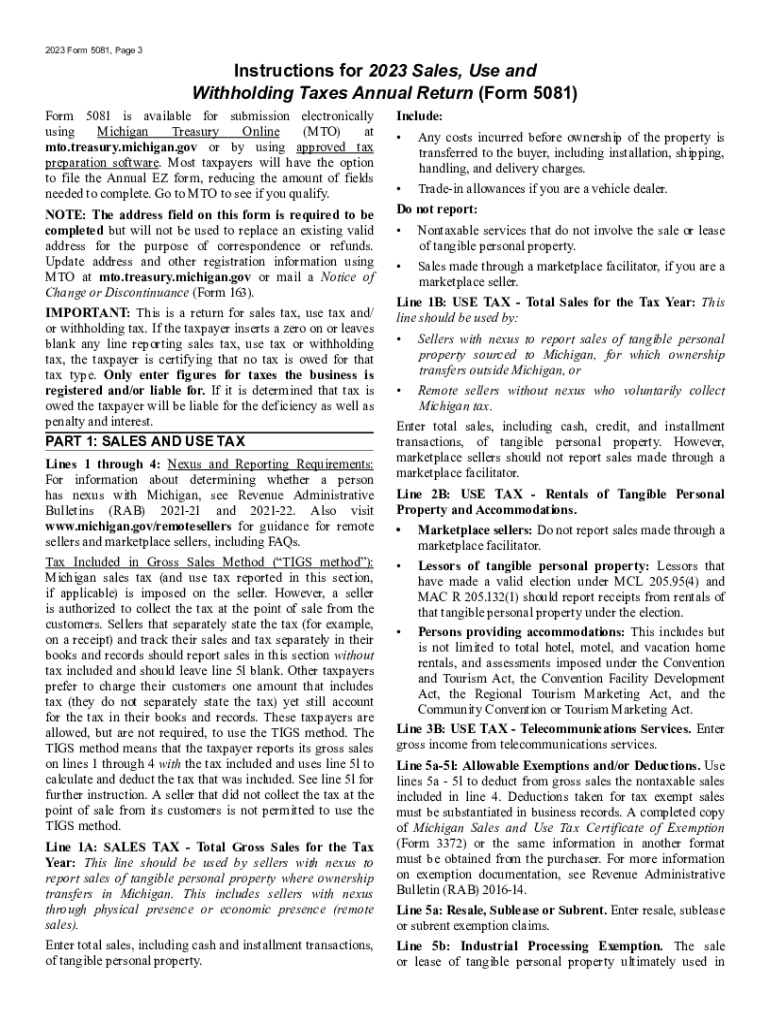

The Michigan Form 5081 is an essential document used for reporting sales, use, and withholding taxes within the state. This annual return consolidates various tax obligations into a single form, making it easier for businesses to comply with state tax regulations. The form is particularly relevant for entities that collect sales tax or have withholding obligations for employees. Understanding its purpose and requirements is crucial for ensuring compliance and avoiding penalties.

Steps to Complete the Michigan Form 5081

Completing the Michigan Form 5081 involves several key steps:

- Gather all necessary financial records, including sales data and employee withholding information.

- Accurately calculate the total sales tax collected and any withholding amounts for the reporting period.

- Fill out the form by entering the calculated figures in the appropriate sections.

- Review the completed form for accuracy to prevent errors that could lead to penalties.

- Submit the form by the designated deadline, ensuring that all payment obligations are fulfilled.

Legal Use of the Michigan Form 5081

The Michigan Form 5081 serves a legal purpose by ensuring that businesses meet their tax obligations. It is a requirement for any entity that engages in taxable sales or has employees subject to withholding. Proper use of this form helps maintain compliance with state tax laws, thereby avoiding potential legal issues or fines. Businesses should be aware of the specific legal guidelines surrounding the use of this form to ensure they are fulfilling their responsibilities accurately.

Filing Deadlines for the Michigan Form 5081

Timely filing of the Michigan Form 5081 is crucial for compliance. The form is typically due on February twenty-eighth of each year for the previous calendar year's activities. However, businesses should verify any changes to deadlines or extensions that may apply. Late submissions can result in penalties, making it important to stay informed about these critical dates.

Required Documents for the Michigan Form 5081

To complete the Michigan Form 5081, businesses must gather specific documents, including:

- Sales records detailing taxable and non-taxable sales.

- Employee payroll records for withholding calculations.

- Any previous tax returns that may provide context for current filings.

- Supporting documentation for any exemptions claimed.

Having these documents ready will streamline the completion process and help ensure accuracy.

Submission Methods for the Michigan Form 5081

The Michigan Form 5081 can be submitted in various ways, catering to different business needs:

- Online submission through the Michigan Department of Treasury’s website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated state offices, if preferred.

Each method has its own set of guidelines and requirements, so businesses should choose the one that best fits their operational capabilities.

Quick guide on how to complete 5081 sales use and withholding taxes annual return 5081 sales use and withholding taxes annual return

Complete 5081 Sales, Use And Withholding Taxes Annual Return 5081 Sales, Use And Withholding Taxes Annual Return effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle 5081 Sales, Use And Withholding Taxes Annual Return 5081 Sales, Use And Withholding Taxes Annual Return on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign 5081 Sales, Use And Withholding Taxes Annual Return 5081 Sales, Use And Withholding Taxes Annual Return with ease

- Locate 5081 Sales, Use And Withholding Taxes Annual Return 5081 Sales, Use And Withholding Taxes Annual Return and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign 5081 Sales, Use And Withholding Taxes Annual Return 5081 Sales, Use And Withholding Taxes Annual Return and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5081 sales use and withholding taxes annual return 5081 sales use and withholding taxes annual return

Create this form in 5 minutes!

How to create an eSignature for the 5081 sales use and withholding taxes annual return 5081 sales use and withholding taxes annual return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the michigan form 5081 use withholding?

The Michigan form 5081 use withholding is a tax form used by employers to report and withhold state income tax from employee wages. This form is essential for ensuring compliance with Michigan tax laws and provides a standard method for employers to manage state withholding. Understanding its purposes helps businesses streamline their payroll processes.

-

How can airSlate SignNow help with michigan form 5081 use withholding?

airSlate SignNow simplifies the process of signing and submitting the michigan form 5081 use withholding by providing a secure electronic signature platform. This allows businesses to easily gather necessary signatures and manage documentation efficiently. With its user-friendly interface, companies can ensure timely compliance with Michigan's tax regulations.

-

What are the pricing options for airSlate SignNow in relation to michigan form 5081 use withholding?

airSlate SignNow offers competitive pricing plans designed to suit different business needs, including those requiring the michigan form 5081 use withholding. Pricing plans vary based on features, with options for individual users as well as businesses of all sizes. This flexibility ensures that companies can choose a plan that best meets their requirements without overspending.

-

Are there any integrations available for processing michigan form 5081 use withholding?

Yes, airSlate SignNow seamlessly integrates with various accounting and HR software that can help automate processes involving the michigan form 5081 use withholding. These integrations facilitate data transfer and enhance efficiency by reducing manual entry. Users can connect their existing systems to streamline compliance and documentation.

-

What features should I look for when handling michigan form 5081 use withholding?

When managing the michigan form 5081 use withholding, look for features like electronic signatures, document templates, and audit trails. These tools ensure that all documents are legally binding and compliant with state regulations. Additionally, robust security measures should be a priority to protect sensitive financial information.

-

How does airSlate SignNow ensure security for documents related to michigan form 5081 use withholding?

airSlate SignNow prioritizes security with advanced encryption protocols and secure cloud storage for documents related to the michigan form 5081 use withholding. This ensures that all signed documents are protected from unauthorized access. Regular security audits and compliance with industry standards further enhance data safety.

-

Can airSlate SignNow assist in tracking the submission of michigan form 5081 use withholding?

Yes, airSlate SignNow provides tracking features that allow businesses to monitor the status of their submissions for the michigan form 5081 use withholding. Users will receive notifications when documents are viewed and signed, providing full visibility into the completion process. This helps ensure that no deadlines are missed and compliance is maintained.

Get more for 5081 Sales, Use And Withholding Taxes Annual Return 5081 Sales, Use And Withholding Taxes Annual Return

- Specialty cake order becco form

- Credit card security code what is cvv where to find it form

- Orange county department of health goshen ny form

- 10000 beach channel drive rockaway beach ny 11694 form

- Smoke detection certificate form

- Fillable online schute bell badgery lumby form fax email

- Fsopex 013902 form

- Wotc form

Find out other 5081 Sales, Use And Withholding Taxes Annual Return 5081 Sales, Use And Withholding Taxes Annual Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors