50 765 Designation of Tax Refund 50 765 Designation of Tax Refund Form

Understanding the 50 765 Designation of Tax Refund

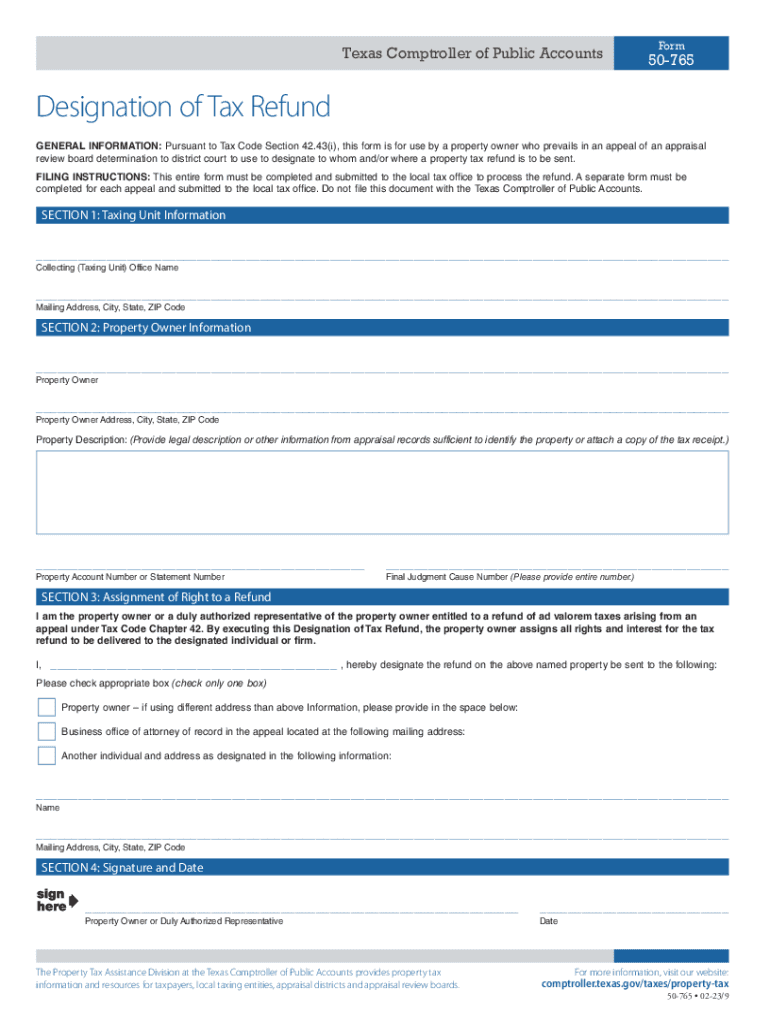

The 50 765 form, known as the Designation of Tax Refund, is essential for taxpayers seeking to designate a specific individual or entity to receive their tax refund. This form is particularly relevant for property owners who may be eligible for a tax refund due to overpayment or other adjustments. By completing the 50 765, taxpayers can ensure that their refund is directed to the appropriate party, which can streamline the refund process and prevent delays.

Steps to Complete the 50 765 Designation of Tax Refund

Completing the 50 765 form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your tax account details and the recipient's information. Fill out the form clearly, ensuring all fields are completed. It is crucial to review the form for any errors before submission. After completing the form, submit it to the relevant tax authority, either online or by mail, depending on the options available in your state.

Required Documents for the 50 765 Designation of Tax Refund

When filing the 50 765 form, certain documents may be necessary to support your designation. These typically include your tax return, proof of identity, and any documentation related to the refund claim. Having these documents ready can facilitate a smoother submission process and help resolve any potential issues quickly.

Eligibility Criteria for the 50 765 Designation of Tax Refund

To use the 50 765 form, taxpayers must meet specific eligibility criteria. Generally, individuals who have filed a tax return and are expecting a refund are eligible. Additionally, the designated recipient must be a legal entity or individual capable of receiving the refund. Understanding these criteria is important to avoid complications during the refund process.

Legal Use of the 50 765 Designation of Tax Refund

The legal framework surrounding the 50 765 form ensures that taxpayers can designate recipients for their tax refunds in a manner that is compliant with state and federal regulations. This form serves as a legal document that confirms the taxpayer's intent regarding their refund. Ensuring that the form is filled out correctly is vital to uphold its legal standing and prevent disputes over the refund allocation.

IRS Guidelines for the 50 765 Designation of Tax Refund

The IRS provides specific guidelines for the completion and submission of the 50 765 form. These guidelines outline the necessary information required on the form, submission methods, and any relevant deadlines. Familiarizing yourself with these guidelines can help ensure compliance and facilitate a smooth refund process.

Quick guide on how to complete 50 765 designation of tax refund 50 765 designation of tax refund

Complete 50 765 Designation Of Tax Refund 50 765 Designation Of Tax Refund effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle 50 765 Designation Of Tax Refund 50 765 Designation Of Tax Refund on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The easiest method to modify and electronically sign 50 765 Designation Of Tax Refund 50 765 Designation Of Tax Refund without any hassle

- Access 50 765 Designation Of Tax Refund 50 765 Designation Of Tax Refund and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method of delivering your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign 50 765 Designation Of Tax Refund 50 765 Designation Of Tax Refund and ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 50 765 designation of tax refund 50 765 designation of tax refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the number 50 765 in airSlate SignNow?

The number 50 765 represents a key product offering from airSlate SignNow that enhances document management efficiency. This solution is designed to empower businesses to streamline their eSigning processes, making it a cost-effective choice for organizations of all sizes.

-

How does airSlate SignNow pricing work for the 50 765 plan?

The 50 765 plan offers competitive pricing tailored to meet diverse business needs. Users can select a subscription model that suits their volume of document signing, ensuring they only pay for what they use while accessing powerful features.

-

What features come with the 50 765 solution from airSlate SignNow?

The 50 765 solution includes features such as customizable templates, team collaboration tools, and advanced tracking options. These elements help facilitate smoother workflows and enhance the overall user experience for eSigning.

-

Can I integrate airSlate SignNow with other applications using the 50 765 offering?

Yes, the 50 765 offering supports integration with various applications such as CRM systems and cloud storage services. This interoperability helps businesses streamline their document workflows effectively.

-

What are the benefits of using the 50 765 plan for my business?

Utilizing the 50 765 plan enhances operational efficiency by reducing the time needed for document signing and approval. With its user-friendly interface, even non-technical users can swiftly manage eSignatures, thus saving valuable time.

-

Is there a mobile app for the 50 765 plan by airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that supports the features of the 50 765 plan. This allows users to create, send, and sign documents on the go, ensuring flexibility and productivity wherever they are.

-

What kind of support is available for the 50 765 users of airSlate SignNow?

Users of the 50 765 plan have access to dedicated customer support, including tutorials, FAQs, and direct assistance. This ensures that any questions or issues are promptly addressed, allowing users to maximize their experience.

Get more for 50 765 Designation Of Tax Refund 50 765 Designation Of Tax Refund

- Heart failure daily weight log form

- Texas school fire drill form

- Novo nordisk patient assistance program application benefitscheckup form

- Itel application form

- Contency contract template form

- Contency recruit contract template form

- Software contract template form

- Software development contract template form

Find out other 50 765 Designation Of Tax Refund 50 765 Designation Of Tax Refund

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format