Form it 2105 Estimated Income Tax Payment Voucher Tax Year

What is the Form IT 2105 Estimated Income Tax Payment Voucher?

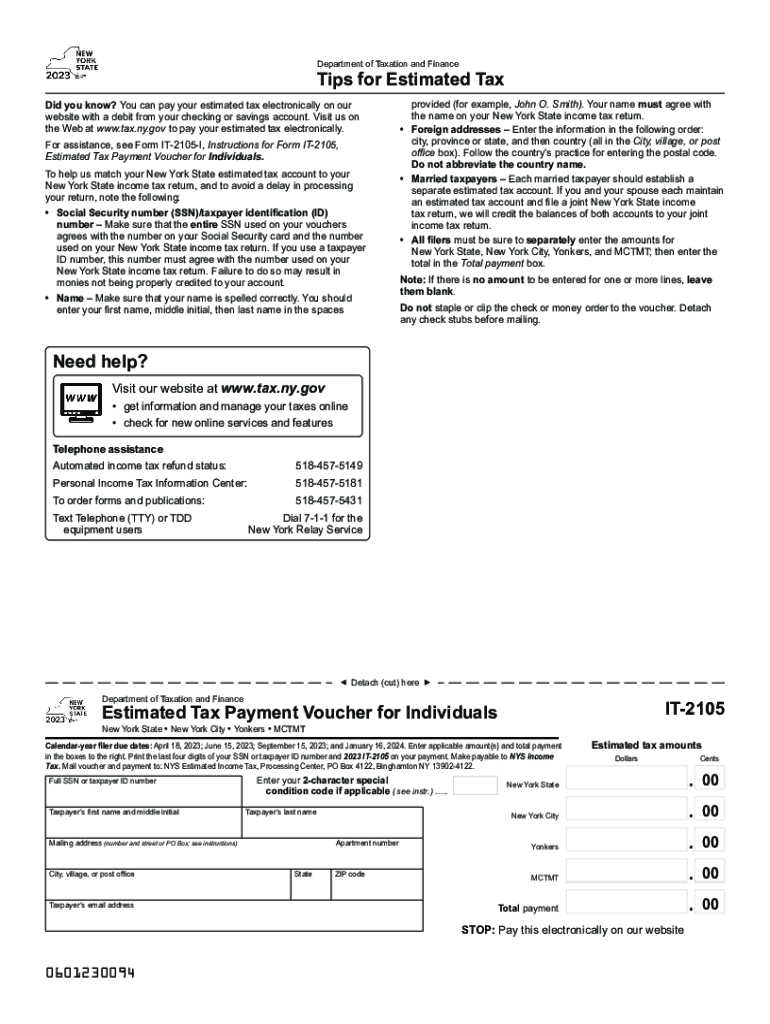

The Form IT 2105 is an estimated income tax payment voucher used by taxpayers in New York State. This form allows individuals and businesses to make estimated tax payments for the current tax year. It is particularly relevant for those who expect to owe tax of $300 or more when they file their annual return. The IT 2105 ensures that taxpayers can meet their tax obligations throughout the year, rather than facing a large bill at tax time.

How to use the Form IT 2105 Estimated Income Tax Payment Voucher

To use the Form IT 2105, taxpayers should first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated tax amount is established, taxpayers can fill out the IT 2105 form with their personal information and the calculated payment amount. The completed form should be submitted along with the payment to the New York State Department of Taxation and Finance by the specified due date.

Steps to complete the Form IT 2105 Estimated Income Tax Payment Voucher

Completing the Form IT 2105 involves several steps:

- Gather necessary financial information, including income estimates and deductions.

- Calculate your total estimated tax liability for the year.

- Fill out the form with your personal details, including name, address, and Social Security number.

- Indicate the amount of estimated tax you are paying with this voucher.

- Review the form for accuracy before submission.

Once completed, the form can be mailed or submitted electronically, depending on your preference.

Filing Deadlines / Important Dates

For the 2023 tax year, estimated tax payments using the Form IT 2105 are typically due on the following dates:

- April 15 for the first quarter payment

- June 15 for the second quarter payment

- September 15 for the third quarter payment

- January 15 of the following year for the fourth quarter payment

It is essential to adhere to these deadlines to avoid penalties and interest on late payments.

Legal use of the Form IT 2105 Estimated Income Tax Payment Voucher

The Form IT 2105 is legally recognized by the New York State Department of Taxation and Finance. It is used to fulfill tax obligations under New York State law. Taxpayers are required to use this form if they expect to owe a certain amount in taxes, ensuring compliance with state tax regulations. Proper use of the form helps maintain accurate tax records and supports the taxpayer's legal standing with the state.

Key elements of the Form IT 2105 Estimated Income Tax Payment Voucher

Key elements of the Form IT 2105 include:

- Taxpayer identification information, such as name and Social Security number.

- Estimated tax payment amount for the current tax year.

- Payment period, indicating which quarter the payment is for.

- Signature of the taxpayer, confirming the accuracy of the information provided.

These elements ensure that the form is complete and can be processed efficiently by the tax authorities.

Quick guide on how to complete form it 2105 estimated income tax payment voucher tax year 687415251

Complete Form IT 2105 Estimated Income Tax Payment Voucher Tax Year effortlessly on any device

Online document management has gained momentum among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed papers, as you can easily access the correct template and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Form IT 2105 Estimated Income Tax Payment Voucher Tax Year on any platform with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest way to edit and eSign Form IT 2105 Estimated Income Tax Payment Voucher Tax Year without hassle

- Find Form IT 2105 Estimated Income Tax Payment Voucher Tax Year and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a classic wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign Form IT 2105 Estimated Income Tax Payment Voucher Tax Year and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 2105 estimated income tax payment voucher tax year 687415251

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's it 2105 feature?

The it 2105 feature in airSlate SignNow allows users to seamlessly manage electronic signatures and document workflows. This feature is designed for businesses seeking an efficient, cost-effective method to send and eSign documents, ensuring compliance and security.

-

How much does airSlate SignNow cost with the it 2105 capabilities?

airSlate SignNow offers flexible pricing plans that include the it 2105 features. Depending on your business needs, you can choose from various subscription levels that provide great value for integrated eSigning solutions.

-

What are the key benefits of using airSlate SignNow's it 2105 feature?

The main benefits of the it 2105 feature include enhanced efficiency, reduced paper usage, and accelerated document turnaround times. Businesses leveraging this feature can streamline their workflows and improve productivity while ensuring secure electronic signatures.

-

Can I integrate airSlate SignNow with other applications while using it 2105?

Yes, airSlate SignNow supports various integrations with popular applications and tools while utilizing the it 2105 feature. This allows businesses to create a cohesive digital workflow tailored to their operational needs.

-

Is it 2105 compliant with legal regulations?

Absolutely, airSlate SignNow’s it 2105 features are designed to meet the legal requirements for electronic signatures. Our solution ensures that all signed documents are compliant with eSign Act and GDPR regulations, providing peace of mind for businesses.

-

What types of documents can I send and eSign with it 2105?

With the it 2105 feature, you can send and eSign a variety of documents, including contracts, agreements, and forms. This versatility makes it an ideal choice for businesses across different industries looking for streamlined document processing.

-

How does airSlate SignNow's it 2105 enhance user experience?

The it 2105 feature in airSlate SignNow is designed with user-friendliness in mind, providing an intuitive interface that simplifies the signing process. Users can easily navigate the platform, ensuring a smooth experience whether they are sending or signing documents.

Get more for Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

Find out other Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form