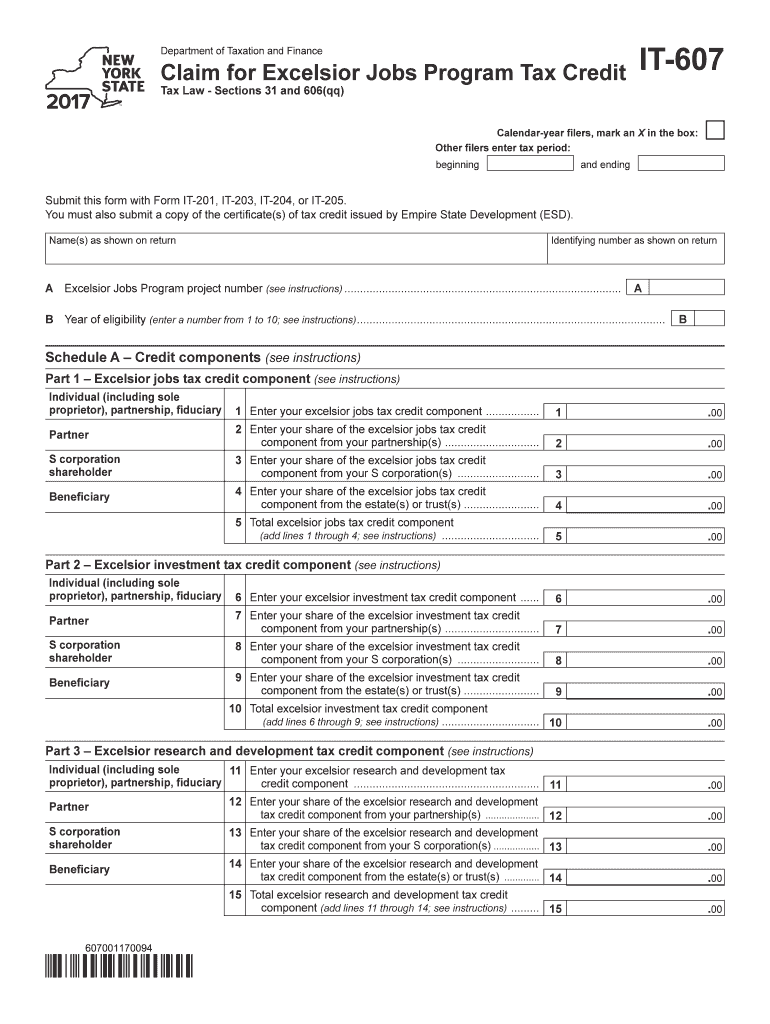

It 607Claim for Excelsior Jobs Program Tax Creditit607 Form

What is the IT-607 Claim For Excelsior Jobs Program Tax Credit

The IT-607 Claim For Excelsior Jobs Program Tax Credit is a tax form used by businesses in New York State to claim a credit for hiring and retaining employees in certain targeted industries. This program aims to encourage the growth of jobs in the state by providing tax incentives to eligible employers. The credit can significantly reduce a business's tax liability, making it an attractive option for companies looking to expand their workforce while benefiting from state support.

Eligibility Criteria

To qualify for the Excelsior Jobs Program Tax Credit, businesses must meet specific criteria, including:

- Operating in a targeted industry such as biotechnology, advanced manufacturing, or software development.

- Creating a minimum number of new jobs within a specified time frame.

- Offering competitive wages and benefits to new employees.

- Complying with all applicable state and federal laws.

It is essential for businesses to review these eligibility requirements thoroughly before submitting the IT-607 form to ensure compliance and maximize potential benefits.

Steps to Complete the IT-607 Claim For Excelsior Jobs Program Tax Credit

Completing the IT-607 form involves several key steps:

- Gather necessary documentation, including proof of new job creation and employee wages.

- Fill out the IT-607 form accurately, ensuring all required fields are completed.

- Calculate the credit amount based on the number of new jobs created and the wages paid.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the New York State Department of Taxation and Finance by the specified deadline.

Following these steps carefully can help ensure that the claim is processed smoothly and efficiently.

Required Documents

When filing the IT-607 Claim For Excelsior Jobs Program Tax Credit, businesses must provide several supporting documents, including:

- Payroll records demonstrating new job creation.

- Employee tax forms, such as W-2s, for new hires.

- Documentation of wages paid to eligible employees.

- Any additional forms required by the New York State Department of Taxation and Finance.

Having these documents ready will facilitate the filing process and help substantiate the claim.

Form Submission Methods

The IT-607 form can be submitted through various methods, allowing businesses flexibility in how they file:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can depend on the business's preferences and the urgency of the filing.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the IT-607 form. Typically, the form must be submitted by the due date of the tax return for the year in which the credit is claimed. Additionally, businesses should keep track of any changes in deadlines announced by the New York State Department of Taxation and Finance, as these can vary.

Quick guide on how to complete it 607claim for excelsior jobs program tax creditit607

Finalize [SKS] effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, exhausting searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IT 607Claim For Excelsior Jobs Program Tax Creditit607

Create this form in 5 minutes!

How to create an eSignature for the it 607claim for excelsior jobs program tax creditit607

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 607Claim For Excelsior Jobs Program Tax Creditit607?

The IT 607Claim For Excelsior Jobs Program Tax Creditit607 is a tax credit application form designed to incentivize businesses to create new jobs in New York. By filing this form, eligible businesses can receive signNow tax reductions, ultimately benefiting their bottom line and encouraging growth.

-

How does airSlate SignNow assist with the IT 607Claim For Excelsior Jobs Program Tax Creditit607?

airSlate SignNow provides a user-friendly platform to prepare and eSign the IT 607Claim For Excelsior Jobs Program Tax Creditit607 efficiently. With its streamlined document management features, businesses can ensure timely submission and compliance with tax regulations.

-

What are the pricing options for using airSlate SignNow for the IT 607Claim For Excelsior Jobs Program Tax Creditit607?

airSlate SignNow offers competitive pricing plans tailored to different business needs. From basic to advanced features, you can select a plan that suits your requirements, making it a cost-effective solution for managing the IT 607Claim For Excelsior Jobs Program Tax Creditit607.

-

Can I integrate airSlate SignNow with other software while managing the IT 607Claim For Excelsior Jobs Program Tax Creditit607?

Yes, airSlate SignNow supports various integrations allowing you to connect with popular software solutions seamlessly. This functionality enhances your workflow when processing the IT 607Claim For Excelsior Jobs Program Tax Creditit607 and other essential documents.

-

What features does airSlate SignNow offer for eSigning the IT 607Claim For Excelsior Jobs Program Tax Creditit607?

airSlate SignNow provides robust eSigning features, including multi-party signing, document tracking, and templates. These capabilities enhance the efficiency of completing the IT 607Claim For Excelsior Jobs Program Tax Creditit607, ensuring faster processing times.

-

How secure is airSlate SignNow when handling the IT 607Claim For Excelsior Jobs Program Tax Creditit607?

Security is a top priority for airSlate SignNow. The platform employs industry-standard encryption and compliance measures to protect sensitive information, making it a reliable choice for managing the IT 607Claim For Excelsior Jobs Program Tax Creditit607.

-

What benefits can businesses expect from using airSlate SignNow for the IT 607Claim For Excelsior Jobs Program Tax Creditit607?

By using airSlate SignNow, businesses can expedite their documentation processes, reduce paper usage, and ensure compliance. This leads to increased productivity and allows them to focus more on core business activities while efficiently managing the IT 607Claim For Excelsior Jobs Program Tax Creditit607.

Get more for IT 607Claim For Excelsior Jobs Program Tax Creditit607

Find out other IT 607Claim For Excelsior Jobs Program Tax Creditit607

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT