Form IL 1120 ST, Small Business Corporation Replacement Tax Return

What is the Form IL 1120 ST, Small Business Corporation Replacement Tax Return

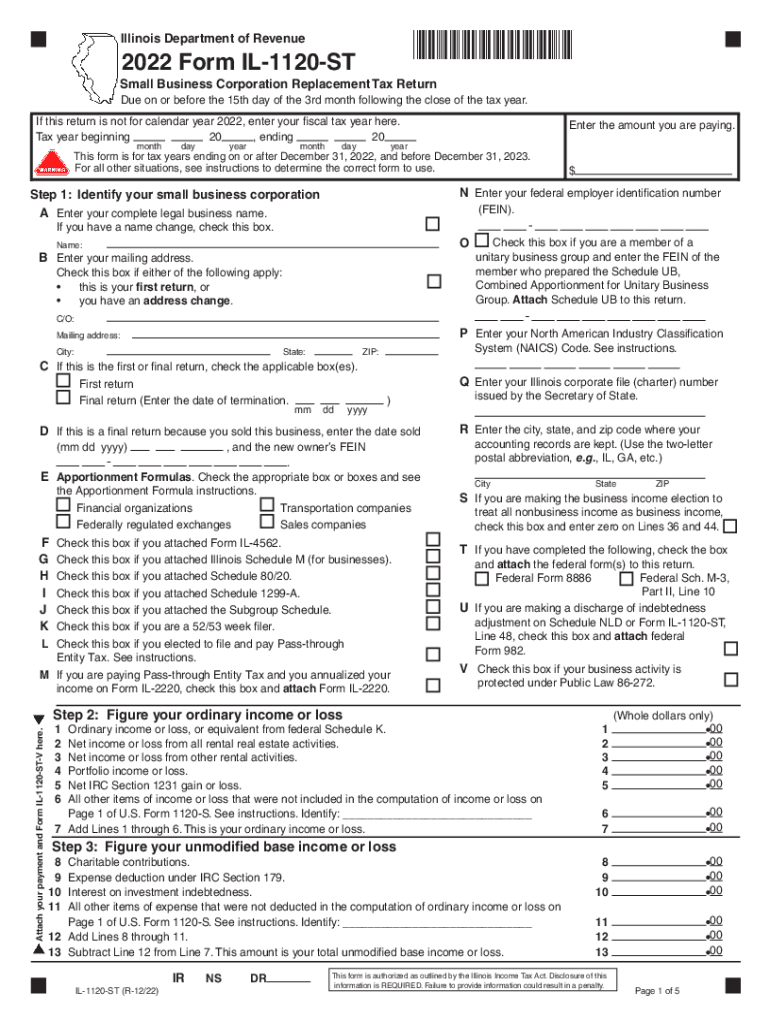

The Form IL 1120 ST is a tax return specifically designed for small business corporations operating in Illinois. This form is utilized to report the income, deductions, and credits of a corporation that is subject to the state's replacement tax. The replacement tax is a tax imposed on corporations in lieu of the traditional corporate income tax. This form is essential for compliance with Illinois tax regulations and helps ensure that small businesses fulfill their tax obligations accurately.

How to use the Form IL 1120 ST, Small Business Corporation Replacement Tax Return

Using the Form IL 1120 ST involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements and expense records. Next, complete the form by entering the required information, such as total income, allowable deductions, and credits. It is important to follow the instructions carefully to avoid errors. Once the form is completed, it can be filed electronically or mailed to the appropriate tax authority, depending on your preference.

Steps to complete the Form IL 1120 ST, Small Business Corporation Replacement Tax Return

Completing the Form IL 1120 ST requires a systematic approach:

- Gather financial records, including revenue and expense statements.

- Fill out the identification section with your corporation's name, address, and tax identification number.

- Report total income from all sources, including sales and other revenues.

- List allowable deductions, such as operating expenses and tax credits.

- Calculate the replacement tax owed based on the net income reported.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form IL 1120 ST are crucial for compliance. Typically, the form is due on the 15th day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is generally due by March 15. It is advisable to keep track of any changes to deadlines or extensions that may be announced by the Illinois Department of Revenue.

Key elements of the Form IL 1120 ST, Small Business Corporation Replacement Tax Return

Several key elements are essential when completing the Form IL 1120 ST:

- Identification Information: This includes the corporation's name, address, and identification number.

- Total Income: The total revenue generated by the corporation during the tax year.

- Deductions: Allowable expenses that can reduce taxable income.

- Replacement Tax Calculation: The formula used to determine the amount of tax owed based on net income.

Legal use of the Form IL 1120 ST, Small Business Corporation Replacement Tax Return

The legal use of the Form IL 1120 ST is governed by Illinois tax law. Corporations are required to file this form if they are subject to the replacement tax. Failure to file can result in penalties and interest on unpaid taxes. It is important for corporations to understand their obligations under state law and ensure timely and accurate filing to avoid legal repercussions.

Quick guide on how to complete form il 1120 st small business corporation replacement tax return

Complete Form IL 1120 ST, Small Business Corporation Replacement Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without waiting. Manage Form IL 1120 ST, Small Business Corporation Replacement Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form IL 1120 ST, Small Business Corporation Replacement Tax Return without breaking a sweat

- Obtain Form IL 1120 ST, Small Business Corporation Replacement Tax Return and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the information and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious searches for forms, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IL 1120 ST, Small Business Corporation Replacement Tax Return and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form il 1120 st small business corporation replacement tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 Illinois IL 1120ST form?

The 2022 Illinois IL 1120ST form is a state tax return for corporations claiming a special election under the Illinois Small Business Corporation Act. This form allows businesses to report their income, deductions, and credits for the tax year. Utilizing airSlate SignNow simplifies the eSigning process for these forms, ensuring compliance and efficiency.

-

How can airSlate SignNow help with the 2022 Illinois IL 1120ST filing?

AirSlate SignNow streamlines the filing process for the 2022 Illinois IL 1120ST by allowing businesses to easily fill out and eSign documents electronically. Our platform can help reduce paperwork burdens, enabling faster submissions and ensuring that deadlines are met. Using airSlate SignNow, you can manage your tax documents with confidence and ease.

-

What are the pricing options for using airSlate SignNow for the 2022 Illinois IL 1120ST?

AirSlate SignNow offers competitive pricing plans tailored to suit different business needs, including those who need to file the 2022 Illinois IL 1120ST. Our subscription plans provide various features that enhance document management at an affordable cost. You can choose the plan that best fits your business to streamline tax document processes.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides a range of features that are essential for effective document management, especially for forms like the 2022 Illinois IL 1120ST. These include templates, eSigning, document tracking, and integration with other software. Our platform ensures that you can manage your documents efficiently while staying compliant with state regulations.

-

Can airSlate SignNow integrate with accounting software for the 2022 Illinois IL 1120ST?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions, making it easier to prepare and file your 2022 Illinois IL 1120ST. Integrations enable users to transfer data smoothly, minimizing the risk of errors and streamlining the overall tax filing process. This allows users to maintain accurate records while saving time.

-

How does airSlate SignNow ensure the security of documents like the 2022 Illinois IL 1120ST?

AirSlate SignNow prioritizes the security of your documents, including the 2022 Illinois IL 1120ST, by employing advanced encryption protocols and secure access controls. All signed documents are stored securely, ensuring that sensitive financial information is protected from unauthorized access. Our commitment to security gives businesses peace of mind when managing their tax documents.

-

What benefits can businesses expect when using airSlate SignNow for the 2022 Illinois IL 1120ST?

Businesses using airSlate SignNow to manage the 2022 Illinois IL 1120ST can expect improved efficiency, reduced paperwork, and faster turnaround times for document processing. The ease of eSigning allows for quicker collaboration among team members. Ultimately, this leads to a smoother filing experience and helps ensure timely submissions.

Get more for Form IL 1120 ST, Small Business Corporation Replacement Tax Return

- Resp educational assistance payment withdrawal form owly

- Call audit form

- Longhorn foundation patron membership application ufcu form

- New accounts morgan form

- Morgan stanley durable power of attorney form

- Fill in the blank domicile form

- Morgan stanley affidavit of domicile form

- 3 5 mentoring needs and goal setting worksheet adapp advance msu form

Find out other Form IL 1120 ST, Small Business Corporation Replacement Tax Return

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter