Form 1095 a

What is the Form 1095 A

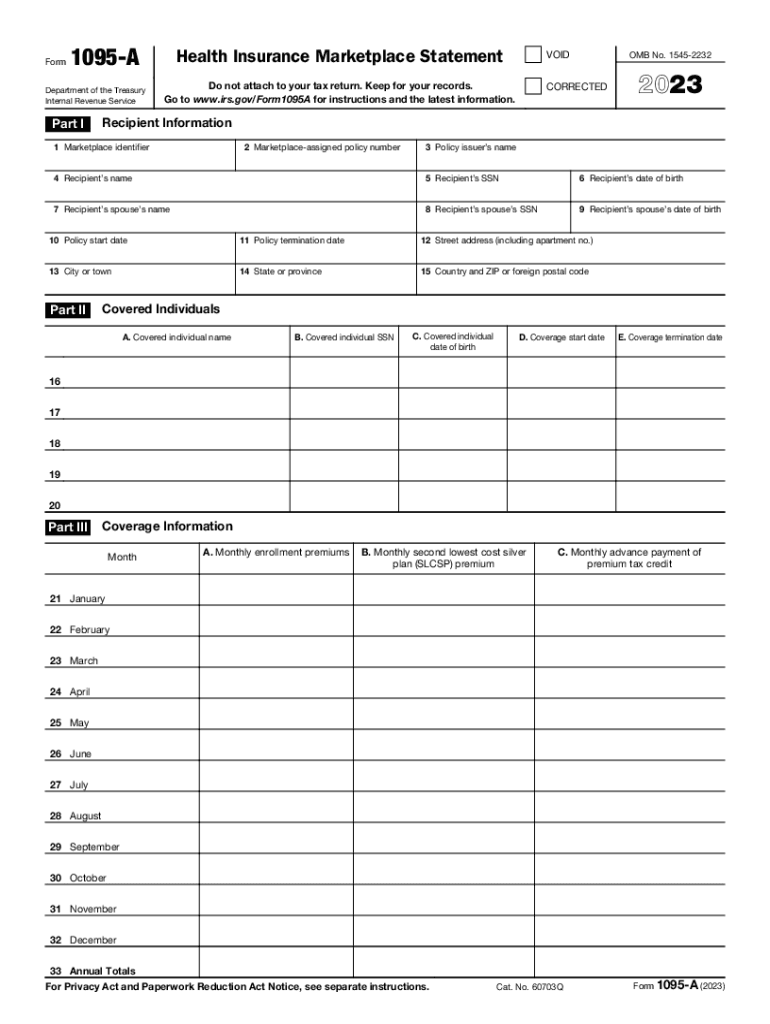

The Form 1095 A is a tax document issued by health insurance marketplaces. It provides important information about the health coverage you received through the marketplace, including details about the premiums paid and the months of coverage. This form is essential for individuals who wish to reconcile their premium tax credits on their federal tax returns. The IRS 1095 A form is a crucial part of the Affordable Care Act (ACA) compliance process, ensuring that taxpayers can accurately report their health insurance status.

How to obtain the Form 1095 A

You can obtain the blank 1095 A form from the health insurance marketplace where you purchased your coverage. Most marketplaces provide the form electronically through their websites, allowing you to download and print it. If you prefer a physical copy, you can request it directly from the marketplace. It is important to ensure that you have the correct form for the tax year you are filing, as the information may vary from year to year.

Steps to complete the Form 1095 A

Filling out the IRS form 1095 A involves several key steps:

- Gather necessary information: Collect your health insurance details, including policy numbers and coverage dates.

- Fill in your personal information: Enter your name, address, and Social Security number at the top of the form.

- Report coverage details: Complete the sections that outline the months you had coverage, the premium amounts, and any premium tax credits received.

- Review for accuracy: Double-check all entries to ensure that the information matches your records and is free from errors.

Key elements of the Form 1095 A

The blank 1095 A form contains several key elements that are crucial for tax reporting:

- Policy Information: This includes the name of the insurance provider and the policy number.

- Coverage Period: Details about the specific months during which you were enrolled in a health plan.

- Premium Amounts: Total premiums paid for the coverage during the year, which may affect your tax credits.

- Premium Tax Credit: Information regarding any tax credits you received, which are essential for reconciling your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1095 A. It is important to follow these guidelines to avoid penalties and ensure compliance. Taxpayers should refer to the IRS instructions for the 1095 A form, which detail how to report the information accurately on their tax returns. Additionally, the IRS outlines the deadlines for submitting the form, which typically align with the tax filing deadlines.

Penalties for Non-Compliance

Failing to provide accurate information on the Form 1095 A can result in penalties from the IRS. If you do not file the form or provide incorrect information, you may face fines and delays in processing your tax return. It is essential to ensure that all details are correct and that the form is submitted on time to avoid these potential penalties. Understanding the implications of non-compliance can help taxpayers stay informed and compliant with tax laws.

Quick guide on how to complete form 1095 a

Effortlessly Prepare Form 1095 A on Any Device

The management of online documents has gained traction among businesses and individuals alike. It presents a superb eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the right form and securely save it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents swiftly without hindrance. Handle Form 1095 A on any device using airSlate SignNow’s Android or iOS apps and enhance any document-related process today.

How to Edit and eSign Form 1095 A with Ease

- Locate Form 1095 A and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then select the Done button to save your changes.

- Decide how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate new printed copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Form 1095 A and guarantee exceptional communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1095 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a blank 1095 A form?

The blank 1095 A form is a tax document used to report information regarding health insurance coverage. This form is essential for individuals to verify their health insurance status when filing taxes. By providing a blank 1095 A form, users can easily fill out and submit their coverage details.

-

How can I obtain a blank 1095 A form?

You can obtain a blank 1095 A form directly from the IRS website or through your health insurance provider. Additionally, airSlate SignNow simplifies the process by allowing you to create and eSign this form online. Just access our platform to get started with the blank 1095 A form.

-

Is it easy to edit a blank 1095 A form with airSlate SignNow?

Yes, airSlate SignNow provides a user-friendly interface that makes it easy to edit a blank 1095 A form. You can quickly input your information and make necessary changes without hassle. Our platform ensures that the editing process is straightforward and efficient.

-

What features does airSlate SignNow offer for handling a blank 1095 A form?

AirSlate SignNow offers several features for managing a blank 1095 A form, including eSigning, sharing, and secure storage solutions. Our platform allows users to send the form for signatures and track completion status in real-time. These features streamline the process, making it efficient for users.

-

Is airSlate SignNow a cost-effective solution for managing a blank 1095 A form?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By digitizing the process of handling a blank 1095 A form, users can save both time and resources while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other tools for my blank 1095 A form?

Yes, airSlate SignNow integrates seamlessly with various applications, such as CRM systems and document management tools. This makes it easier for users to link their workflows to a blank 1095 A form, enhancing productivity. Explore our integrations to find what best suits your needs.

-

What are the benefits of using airSlate SignNow for a blank 1095 A form?

Using airSlate SignNow for your blank 1095 A form offers numerous benefits, including faster processing times, enhanced security, and ease of use. Our platform allows you to manage multiple forms effortlessly while ensuring that all documents remain compliant with industry standards. Experience the convenience today!

Get more for Form 1095 A

- Insurance incident report form

- Authorization to release information from army records on nonsupportchild custodypaternity inquiries da form 5459 oct 2003 apd

- Enrollment agreement bppe form

- Possession by seller after closing scar ver designpdf pu b5z form

- Tilted kilt printable application form

- Leasing packet philadelphia housing authority pha phila form

- Ca 20 48 02 99 form

- Bgc ciu 001 incident report form state of california oag ca

Find out other Form 1095 A

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA