Schedule C Form 1040

What is the Schedule C Form 1040

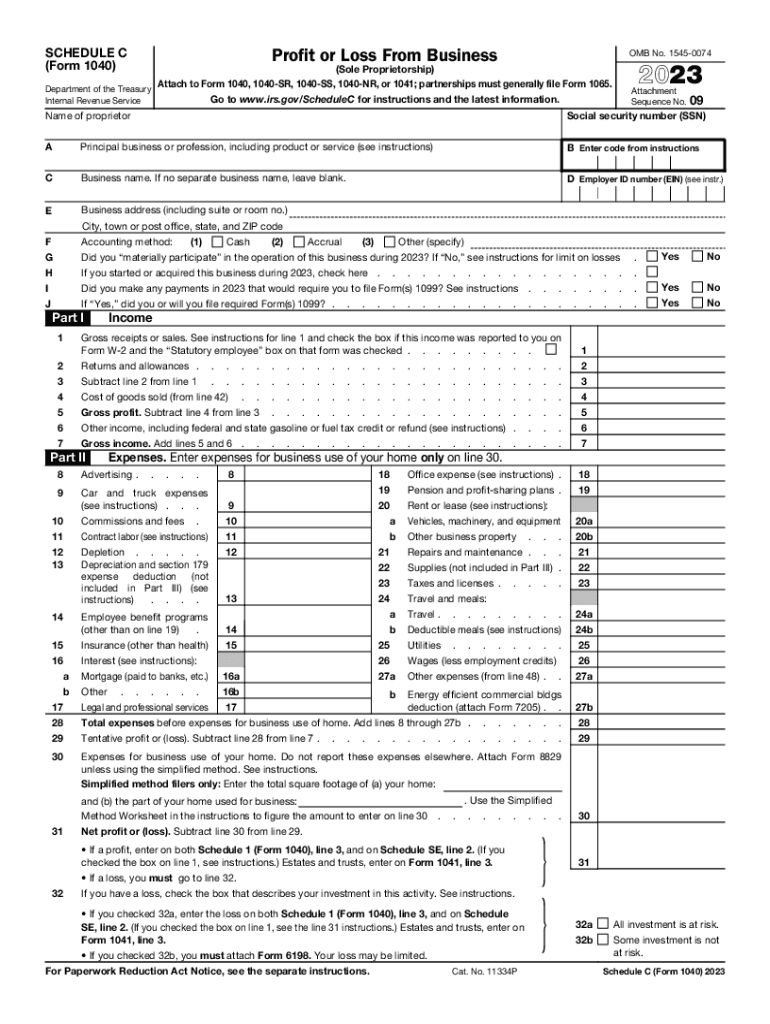

The Schedule C form, officially known as the Schedule C (Form 1040), is a tax document used by sole proprietors to report income or loss from their business. This form is essential for individuals who operate their own businesses and is filed alongside the Form 1040, which is the standard individual income tax return in the United States. The Schedule C allows taxpayers to detail their business earnings and expenses, ultimately determining their net profit or loss for the tax year.

How to use the Schedule C Form 1040

To effectively use the Schedule C form, taxpayers must first gather all relevant financial information related to their business activities. This includes income earned, expenses incurred, and any cost of goods sold. The form is divided into sections that guide users through reporting their income, detailing expenses, and calculating the net profit or loss. It is important to accurately complete each section to ensure compliance with IRS regulations and to maximize potential deductions.

Steps to complete the Schedule C Form 1040

Completing the Schedule C form involves several key steps:

- Gather all necessary financial documents, including income statements and receipts for business expenses.

- Fill out the top section of the form with basic information about the business, such as its name and address.

- Report total income earned from the business in the designated section.

- List all deductible expenses, such as advertising, supplies, and travel costs, in the appropriate categories.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Transfer the net profit or loss amount to the Form 1040 to complete the tax return.

Key elements of the Schedule C Form 1040

Several key elements are crucial when filling out the Schedule C form:

- Business Information: This includes the name, address, and type of business.

- Income Section: Report all income earned from business activities.

- Expenses Section: Categorize and list all deductible expenses related to the business.

- Net Profit or Loss Calculation: This is the final figure that will affect overall tax liability.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C form. It is essential to follow these guidelines to ensure compliance and avoid potential penalties. Taxpayers should refer to the IRS Publication 535, which outlines business expenses, and the 2023 instructions for Schedule C, which detail any changes or updates for the current tax year. Adhering to these guidelines helps ensure accurate reporting and maximizes eligible deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C form align with the general tax return deadlines. Typically, the deadline for submitting Form 1040, along with the Schedule C, is April 15 of the following year. If taxpayers require additional time, they may file for an extension, which typically grants an additional six months. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete schedule c form 1040

Effortlessly prepare Schedule C Form 1040 on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly and without holdups. Manage Schedule C Form 1040 on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Schedule C Form 1040 without hassle

- Obtain Schedule C Form 1040 and click on Get Form to begin.

- Utilize the features we provide to submit your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this function.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors necessitating reprinting of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Schedule C Form 1040 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c form 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule C and why is it important for freelancers?

Schedule C is a tax form used by sole proprietors and single-member LLCs to report income and expenses. Understanding how to accurately fill out Schedule C is crucial for freelancers to ensure they maximize deductions and comply with IRS regulations, ultimately helping them save money during tax season.

-

How can airSlate SignNow help with completing Schedule C?

airSlate SignNow simplifies the process of managing documents related to Schedule C by allowing users to eSign essential tax forms and contracts from any device. This streamlines the documentation process, ensuring that all necessary paperwork for filing Schedule C is easily accessible and securely signed.

-

What are the pricing options for airSlate SignNow, considering Schedule C needs?

airSlate SignNow offers several pricing plans that cater to various business sizes and needs, all of which include features helpful for managing Schedule C documentation. With a cost-effective solution, users can benefit from electronic signatures, document templates, and integration capabilities without breaking the bank, making tax filing easier.

-

Are there any specific features in airSlate SignNow that aid in filing Schedule C?

Yes, airSlate SignNow includes features such as document templates, automated workflows, and secure eSigning that are particularly beneficial when preparing to file Schedule C. These features help streamline the creation and submission of necessary documents, making the tax filing process more efficient.

-

Can I integrate airSlate SignNow with other tools to manage my Schedule C documents?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and productivity tools, allowing users to easily manage their Schedule C documents. This integration ensures that all financial data is synchronized, helping users maintain accurate records and minimize errors during tax filings.

-

How secure is my data when using airSlate SignNow for Schedule C?

airSlate SignNow prioritizes data security by employing advanced encryption methods and secure cloud storage. Users can trust that their sensitive information related to Schedule C, including financial details and signatures, is protected against unauthorized access and cyber threats.

-

Is airSlate SignNow easy to use for individuals unfamiliar with Schedule C?

Yes, airSlate SignNow is designed to be user-friendly, even for those who may not be familiar with Schedule C or other tax-related processes. The intuitive interface and guided workflows make it easy for anyone to create, sign, and manage documents without needing extensive knowledge of tax forms.

Get more for Schedule C Form 1040

Find out other Schedule C Form 1040

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship