Form SS 4 Rev December

What is the Form SS-4?

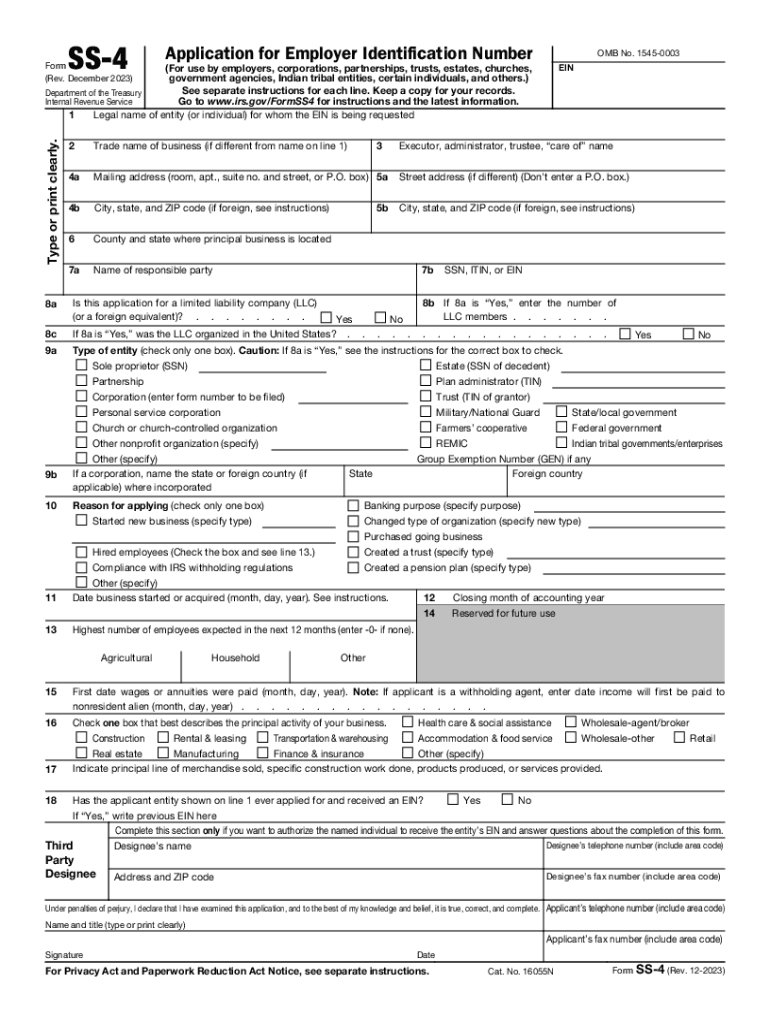

The Form SS-4 is an application used to apply for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This unique nine-digit number is essential for businesses operating in the United States, as it identifies them for tax purposes. The form is typically required for various business structures, including corporations, partnerships, and limited liability companies (LLCs). Understanding the purpose of the SS-4 form is crucial for any business owner looking to comply with federal regulations.

How to Obtain the Form SS-4

The Form SS-4 can be obtained easily through several methods. It is available for download directly from the IRS website in PDF format. Additionally, businesses can request a copy by calling the IRS or visiting a local IRS office. For those who prefer a digital approach, the form can also be completed online through the IRS website, which allows for immediate submission and processing.

Steps to Complete the Form SS-4

Completing the Form SS-4 involves several key steps:

- Provide the legal name of the business entity.

- Include the trade name, if different from the legal name.

- Specify the type of entity, such as corporation, partnership, or sole proprietorship.

- Provide the responsible party's name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Indicate the reason for applying for an EIN.

- Complete the remaining sections as needed, including business address and date of formation.

After filling out the form, it can be submitted online or mailed to the IRS for processing.

Legal Use of the Form SS-4

The Form SS-4 is legally required for businesses that need to obtain an EIN. This number is necessary for various activities, including filing taxes, opening a business bank account, and hiring employees. Failing to apply for an EIN when required can lead to penalties and complications with tax compliance. Therefore, understanding the legal implications of the SS-4 form is essential for maintaining proper business operations.

IRS Guidelines for the Form SS-4

The IRS provides specific guidelines regarding the completion and submission of the Form SS-4. It is important to ensure that all information is accurate and complete to avoid delays in processing. The IRS recommends that businesses apply for their EIN as soon as they are established or when they need to hire employees. Additionally, the IRS offers resources and support for those who have questions about the form or the application process.

Form Submission Methods

There are several methods for submitting the Form SS-4 to the IRS:

- Online: Businesses can complete and submit the form through the IRS website, receiving their EIN immediately upon approval.

- Mail: The completed form can be mailed to the appropriate IRS address, with processing times varying based on the volume of applications.

- Fax: In some cases, businesses can fax the completed form to the IRS for faster processing.

Choosing the right submission method can significantly impact how quickly a business receives its EIN.

Quick guide on how to complete form ss 4 rev december

Complete Form SS 4 Rev December effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them digitally. airSlate SignNow equips you with all the tools required to create, modify, and eSign your paperwork quickly and smoothly. Handle Form SS 4 Rev December on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Form SS 4 Rev December with ease

- Obtain Form SS 4 Rev December and then click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to preserve your alterations.

- Select your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tiring document searches, or inaccuracies that necessitate printing new copies. airSlate SignNow addresses all your document management needs within a few clicks from your preferred device. Modify and eSign Form SS 4 Rev December and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ss 4 rev december

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ss 4 and how do I use it with airSlate SignNow?

The form ss 4 is an application form used to apply for an Employer Identification Number (EIN) from the IRS. With airSlate SignNow, you can easily fill out and eSign the form ss 4 online, streamlining the application process without the need for printing or mailing physical documents.

-

Is there a cost associated with using airSlate SignNow for the form ss 4?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Depending on the plan you choose, you'll have access to features that allow you to fill out and eSign the form ss 4 efficiently and securely, making it a cost-effective solution for your business.

-

What features does airSlate SignNow offer for completing the form ss 4?

AirSlate SignNow provides a user-friendly interface for completing the form ss 4, including fillable fields, templates, and eSignature capabilities. You can also collaborate with your team in real-time, ensuring that all necessary information is accurately captured before signing.

-

Can I store my filled form ss 4 securely in airSlate SignNow?

Absolutely! airSlate SignNow offers secure cloud storage for your documents, including filled form ss 4. Your data is encrypted and protected, ensuring that sensitive information remains safe and accessible whenever you need it.

-

Does airSlate SignNow integrate with other applications for form ss 4 processing?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This integration allows you to streamline your workflow and access your filled form ss 4 from multiple platforms, enhancing productivity.

-

How can airSlate SignNow help me track the status of my form ss 4?

With airSlate SignNow’s tracking features, you can easily monitor the status of your form ss 4 submissions. You will receive notifications when recipients view or sign the document, keeping you informed throughout the process.

-

Is it easy to get started with airSlate SignNow for form ss 4?

Yes, getting started with airSlate SignNow for your form ss 4 is simple. You can create an account, access templates, and begin filling out the form ss 4 in minutes, all from a user-friendly dashboard.

Get more for Form SS 4 Rev December

Find out other Form SS 4 Rev December

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement