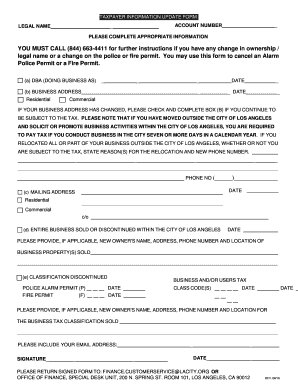

Taxpayer Information Update Form 2016

What is the Taxpayer Information Update Form

The taxpayer information update form is a crucial document used by individuals and businesses to communicate changes in their tax-related information to the Internal Revenue Service (IRS) or relevant tax authorities. This form is essential for ensuring that the IRS has accurate and up-to-date information regarding your tax status, which can include changes in address, name, or taxpayer identification number. Keeping this information current helps prevent delays in processing tax returns and ensures that any correspondence from the IRS reaches you promptly.

Steps to Complete the Taxpayer Information Update Form

Completing the taxpayer information update form involves several straightforward steps. First, gather all necessary information, including your current taxpayer identification number and any new details you wish to update. Next, fill out the form accurately, ensuring that all sections are completed. Pay special attention to providing your updated address and any other relevant changes. After filling out the form, review it for accuracy before submitting it. This careful review helps avoid potential issues with your tax records.

Legal Use of the Taxpayer Information Update Form

The taxpayer information update form is legally binding when completed and submitted correctly. To ensure its validity, it must be signed and dated appropriately. The form is governed by the same regulations that apply to other tax documents, meaning it must comply with IRS guidelines. Using a reliable platform for electronic signatures can enhance the form's legitimacy, as it provides a digital certificate that verifies the signer's identity and intent.

How to Use the Taxpayer Information Update Form

Using the taxpayer information update form is a straightforward process. Start by accessing the form through the IRS website or a trusted tax preparation service. Fill out the required fields with your updated information. If you are submitting the form electronically, ensure that you use a secure eSignature platform to sign the document. Once completed, submit the form according to the instructions provided, whether by mail or electronically, to ensure it is processed efficiently.

Required Documents

When filling out the taxpayer information update form, certain documents may be necessary to verify your identity and the changes being made. Commonly required documents include a government-issued identification, such as a driver's license or passport, and any relevant tax documents that support your updates, such as previous tax returns or notices from the IRS. Having these documents ready can streamline the process and help ensure that your updates are processed without delay.

Form Submission Methods

The taxpayer information update form can be submitted through various methods, depending on your preference and the requirements set by the IRS. You may choose to submit the form online using a secure eSignature platform, which allows for quick processing. Alternatively, you can mail the completed form to the appropriate IRS address or deliver it in person to a local IRS office. Each method has its advantages, so consider factors such as convenience and processing time when deciding how to submit your form.

Quick guide on how to complete taxpayer information update form

Prepare Taxpayer Information Update Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and safely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without holdups. Handle Taxpayer Information Update Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Taxpayer Information Update Form effortlessly

- Obtain Taxpayer Information Update Form and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes just a few seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Taxpayer Information Update Form and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxpayer information update form

Create this form in 5 minutes!

How to create an eSignature for the taxpayer information update form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a taxpayer information update form?

A taxpayer information update form is a crucial document that allows individuals and businesses to keep their tax records accurate. By using this form, you can update your name, address, or other personal information with the tax authorities. This ensures that you receive important notifications and maintain compliance with tax regulations.

-

How can airSlate SignNow help with the taxpayer information update form?

airSlate SignNow provides an efficient way to electronically sign and send your taxpayer information update form. With our user-friendly platform, you can easily manage your documents without the hassle of printing or mailing. This streamlines the process and saves you time, allowing you to focus on essential tasks.

-

Is there a cost to use airSlate SignNow for submitting a taxpayer information update form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our plans are designed to be cost-effective while providing advanced features for managing your taxpayer information update form and other documents. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing taxpayer information update forms?

airSlate SignNow includes features such as template creation, real-time tracking, and secure cloud storage, all beneficial for managing taxpayer information update forms. Users can also collaborate on documents seamlessly and ensure that sensitive information is protected. This comprehensive solution enhances document management efficiency.

-

Can I integrate airSlate SignNow with other tools for handling taxpayer information update forms?

Absolutely! airSlate SignNow can be integrated with various third-party applications and tools, increasing its functionality when handling taxpayer information update forms. This allows for a smoother workflow and better data management, ensuring that your information is always up to date and easily accessible.

-

What benefits does airSlate SignNow provide for businesses using taxpayer information update forms?

By adopting airSlate SignNow for your taxpayer information update forms, your business can experience improved efficiency and faster turnaround times. Our platform reduces paperwork and administrative tasks, enabling your team to focus on more strategic initiatives. Additionally, you can use our analytics features to track document progress and performance.

-

Is airSlate SignNow secure for managing taxpayer information update forms?

Yes, security is a top priority for airSlate SignNow. We use advanced encryption and compliance measures to ensure that your taxpayer information update form and associated data are protected. Our platform adheres to strict security standards, providing peace of mind as you manage important tax documents.

Get more for Taxpayer Information Update Form

- Florida simple will form for married person

- Legal last will and testament form for married person with adult and minor children florida

- Mutual wills package with last wills and testaments for married couple with adult and minor children florida form

- Florida widow form

- Legal last will and testament form for widow or widower with minor children florida

- Legal last will form for a widow or widower with no children florida

- Legal last will and testament form for a widow or widower with adult and minor children florida

- Legal last will and testament form for divorced and remarried person with mine yours and ours children florida

Find out other Taxpayer Information Update Form

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement