Every Financial Institution Liable for the Bank Excise Tax Shall File a Declaration of Its Estimated Tax for the Calendar Year I Form

Understanding the Bank Excise Tax Declaration Requirement

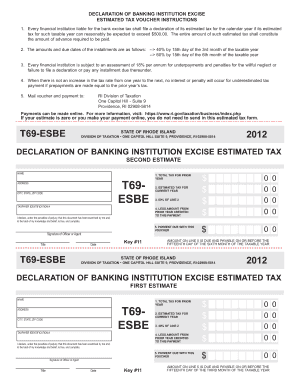

The requirement for every financial institution liable for the bank excise tax to file a declaration of its estimated tax is a crucial aspect of tax compliance. This declaration must be submitted if the institution's estimated tax for the calendar year is expected to exceed five hundred dollars. The declaration serves as a preliminary statement of the tax liability, allowing the institution to plan for its financial obligations throughout the year.

Steps to Complete the Bank Excise Tax Declaration

Completing the declaration involves several steps to ensure accuracy and compliance. First, financial institutions should calculate their estimated tax liability based on their projected income for the year. This involves reviewing past financial performance and considering any changes that may impact revenue. Once the estimated tax is calculated, institutions must fill out the appropriate form accurately, ensuring all required information is included. Finally, the declaration should be submitted by the specified deadline to avoid penalties.

Required Documents for Filing the Declaration

When filing the declaration for the bank excise tax, institutions must gather specific documents to support their estimated tax calculations. This typically includes financial statements, income projections, and any relevant tax forms from previous years. Having these documents readily available can streamline the filing process and help ensure that the estimated tax is calculated correctly.

Filing Deadlines for the Declaration

Timely submission of the bank excise tax declaration is essential to avoid penalties. The deadline for filing the declaration is usually set by the IRS and may vary each year. Institutions should stay informed about these deadlines and mark them on their calendars to ensure compliance. Missing the deadline could result in fines and interest on any unpaid taxes.

Penalties for Non-Compliance

Failure to file the bank excise tax declaration on time can lead to significant penalties. These may include monetary fines and interest charges on the estimated tax owed. Additionally, non-compliance can result in increased scrutiny from tax authorities, leading to potential audits. It is important for financial institutions to understand these risks and prioritize timely filing to maintain good standing with the IRS.

IRS Guidelines for the Bank Excise Tax Declaration

The IRS provides specific guidelines regarding the bank excise tax declaration, detailing the requirements for filing, payment options, and compliance expectations. Institutions should familiarize themselves with these guidelines to ensure they meet all necessary criteria. This includes understanding how to calculate estimated taxes and the implications of any changes in tax law that may affect their obligations.

Quick guide on how to complete every financial institution liable for the bank excise tax shall file a declaration of its estimated tax for the calendar year

Complete Every Financial Institution Liable For The Bank Excise Tax Shall File A Declaration Of Its Estimated Tax For The Calendar Year I effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to produce, modify, and electronically sign your documents promptly without hassles. Manage Every Financial Institution Liable For The Bank Excise Tax Shall File A Declaration Of Its Estimated Tax For The Calendar Year I on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related operation today.

How to modify and electronically sign Every Financial Institution Liable For The Bank Excise Tax Shall File A Declaration Of Its Estimated Tax For The Calendar Year I effortlessly

- Find Every Financial Institution Liable For The Bank Excise Tax Shall File A Declaration Of Its Estimated Tax For The Calendar Year I and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mishandled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Every Financial Institution Liable For The Bank Excise Tax Shall File A Declaration Of Its Estimated Tax For The Calendar Year I and ensure seamless communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the every financial institution liable for the bank excise tax shall file a declaration of its estimated tax for the calendar year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of filing a declaration for the bank excise tax?

Every Financial Institution Liable For The Bank Excise Tax Shall File A Declaration Of Its Estimated Tax For The Calendar Year If Its Estimated Tax For Such Taxable Year Can Reasonably Be Expected To Exceed $500 Tax Ri. This ensures compliance with tax regulations and avoids penalties for late or incorrect filings.

-

How does airSlate SignNow help in preparing tax documents?

airSlate SignNow provides an intuitive platform that helps businesses prepare necessary tax documents efficiently. By streamlining the document management process, Every Financial Institution Liable For The Bank Excise Tax Shall File A Declaration Of Its Estimated Tax For The Calendar Year If Its Estimated Tax For Such Taxable Year Can Reasonably Be Expected To Exceed $500 Tax Ri, ensuring timely submissions.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers features like customizable templates, automated workflows, and secure e-signatures. These features empower every financial institution liable for the bank excise tax to file a declaration of its estimated tax, enhancing efficiency and compliance.

-

Is airSlate SignNow suitable for small financial institutions?

Yes, airSlate SignNow is designed to be cost-effective and accessible for institutions of all sizes. Every Financial Institution Liable For The Bank Excise Tax Shall File A Declaration Of Its Estimated Tax For The Calendar Year If Its Estimated Tax For Such Taxable Year Can Reasonably Be Expected To Exceed $500 Tax Ri, making it a great choice for small financial entities.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates with various CRM and productivity tools like Salesforce, Google Drive, and more. These integrations enable every financial institution liable for the bank excise tax to file a declaration of its estimated tax seamlessly as part of their existing workflows.

-

How can airSlate SignNow enhance document security?

airSlate SignNow ensures top-notch document security through encryption and secure storage. This level of security is crucial for every financial institution liable for the bank excise tax to file a declaration of its estimated tax for the calendar year, safeguarding sensitive information throughout the process.

-

What benefits can my institution expect from using airSlate SignNow?

By using airSlate SignNow, institutions can expect increased efficiency, reduced paperwork, and better compliance with tax regulations. Every Financial Institution Liable For The Bank Excise Tax Shall File A Declaration Of Its Estimated Tax For The Calendar Year If Its Estimated Tax For Such Taxable Year Can Reasonably Be Expected To Exceed $500 Tax Ri, making the overall process smoother and more reliable.

Get more for Every Financial Institution Liable For The Bank Excise Tax Shall File A Declaration Of Its Estimated Tax For The Calendar Year I

Find out other Every Financial Institution Liable For The Bank Excise Tax Shall File A Declaration Of Its Estimated Tax For The Calendar Year I

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter