Indiana Form CT 40 County Tax Schedule TaxFormFinder 2022-2026

Understanding the Indiana CT 40 County Tax Schedule

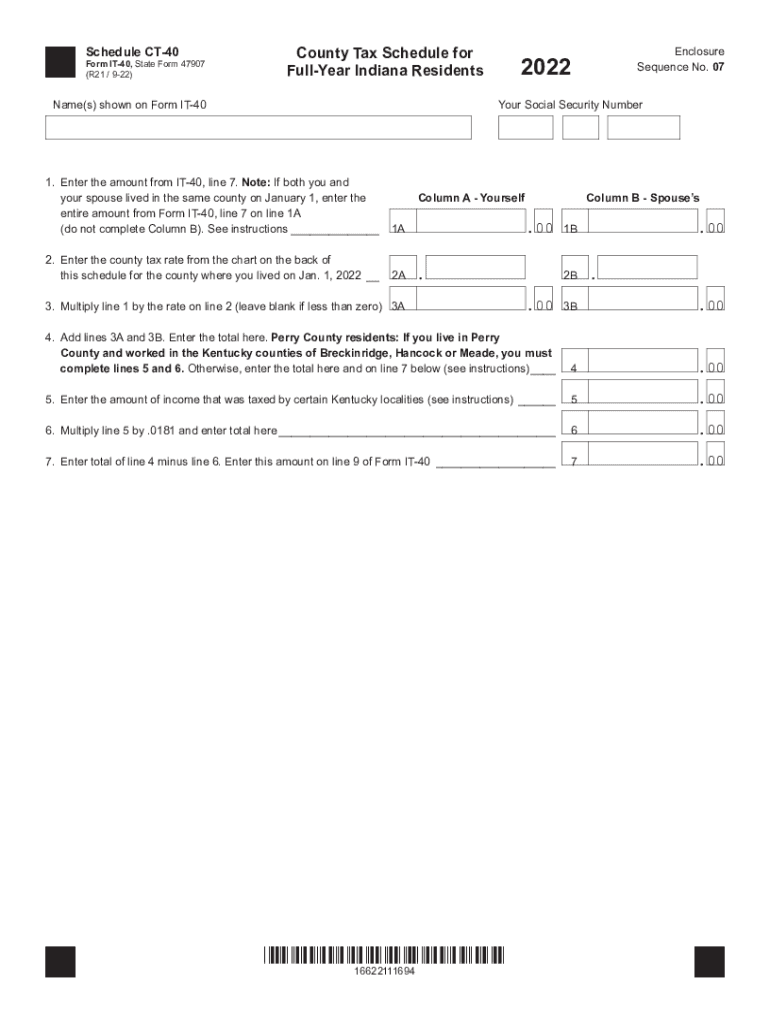

The Indiana CT 40 form is a crucial document for residents who need to report their county income tax. This form is specifically designed for individuals who are subject to county income tax in Indiana. It helps taxpayers calculate their tax liability based on their income and the applicable county tax rates. The CT 40 form is essential for ensuring compliance with state tax laws and for accurate tax reporting.

Steps to Complete the Indiana CT 40 County Tax Schedule

Completing the Indiana CT 40 form involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Determine your residency status and the applicable county tax rate.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and other sources of income.

- Calculate your county income tax based on the provided tax rates.

- Review your completed form for accuracy before submission.

Key Elements of the Indiana CT 40 County Tax Schedule

Several key elements are integral to the Indiana CT 40 form:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: You must report all sources of income, including wages and dividends.

- County Tax Rates: The form includes specific rates based on your county of residence.

- Calculations: Accurate calculations of your tax liability are essential for compliance.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the Indiana CT 40 form:

- Typically, the form must be filed by April 15 of each year.

- If you are unable to meet this deadline, you may request an extension, but it is advisable to check specific state guidelines.

- Keep track of any changes in deadlines that may occur due to state regulations or special circumstances.

Obtaining the Indiana CT 40 County Tax Schedule

The Indiana CT 40 form can be obtained through various means:

- Visit the official Indiana Department of Revenue website for downloadable forms.

- Request a physical copy through your local county tax office.

- Consult tax preparation software that may include the CT 40 form as part of their offerings.

Legal Use of the Indiana CT 40 County Tax Schedule

The Indiana CT 40 form serves a legal purpose in tax compliance:

- Filing the CT 40 is mandatory for residents subject to county income tax.

- Failure to file can result in penalties and interest on unpaid taxes.

- Accurate completion of the form is essential to avoid legal repercussions.

Quick guide on how to complete indiana form ct 40 county tax schedule taxformfinder

Effortlessly Prepare Indiana Form CT 40 County Tax Schedule TaxFormFinder on Any Device

Managing documents online has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage Indiana Form CT 40 County Tax Schedule TaxFormFinder on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign Indiana Form CT 40 County Tax Schedule TaxFormFinder with Ease

- Locate Indiana Form CT 40 County Tax Schedule TaxFormFinder and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that task.

- Create your electronic signature using the Sign tool, which takes only a few seconds and holds the same legal standing as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Indiana Form CT 40 County Tax Schedule TaxFormFinder to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana form ct 40 county tax schedule taxformfinder

Create this form in 5 minutes!

How to create an eSignature for the indiana form ct 40 county tax schedule taxformfinder

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the current Indiana CT40 rates for eSigning documents?

The current Indiana CT40 rates vary depending on the plan you choose with airSlate SignNow. We offer competitive pricing that accommodates businesses of all sizes, ensuring that you receive a cost-effective solution for eSigning documents. For the latest Indiana CT40 rates, please visit our pricing page or contact our sales team directly.

-

How does airSlate SignNow compare in features to other eSignature providers regarding Indiana CT40 rates?

AirSlate SignNow stands out in the eSignature market by offering a robust set of features at an affordable price. With customizable workflows, advanced security measures, and seamless integrations, our service provides excellent value at the current Indiana CT40 rates. This means you benefit from comprehensive solutions without compromising on quality.

-

Are there any hidden fees associated with Indiana CT40 rates for airSlate SignNow?

No, airSlate SignNow prides itself on transparency, and there are no hidden fees when you choose our services at the Indiana CT40 rates. All costs are clearly outlined in our pricing plans, providing you with a clear understanding of your investment. If you have any questions about specific charges, feel free to ask our support team.

-

What benefits do businesses gain from choosing airSlate SignNow at Indiana CT40 rates?

Choosing airSlate SignNow at Indiana CT40 rates offers businesses a flexible, user-friendly eSigning solution that can increase productivity and reduce turnaround time. Our platform supports fast document processing, effortless collaboration, and comprehensive tracking, making it a great investment for modern businesses. Experience increased efficiency without sacrificing budget.

-

Can I integrate airSlate SignNow with other applications to streamline costs related to Indiana CT40 rates?

Yes, airSlate SignNow supports multiple integrations that can help streamline your workflow and ultimately contribute to cost savings related to Indiana CT40 rates. Our platform integrates seamlessly with applications like Google Drive, Salesforce, and more, allowing for a smoother document management process. This means you can optimize your operations without additional expenses.

-

Is there a free trial available for checking out Indiana CT40 rates?

Absolutely! airSlate SignNow offers a free trial that allows potential customers to explore the platform and see how the Indiana CT40 rates can benefit their business. During the trial period, you can access all of our features to understand better how our solution meets your eSigning needs. Sign up today and experience the advantages firsthand!

-

What type of customer support can I expect when using airSlate SignNow at Indiana CT40 rates?

When you choose airSlate SignNow at Indiana CT40 rates, you gain access to a dedicated customer support team that is available to assist you. We offer various support channels, including email, chat, and phone support, ensuring you receive timely help whenever you need it. Our team is knowledgeable and ready to help you maximize your experience with our platform.

Get more for Indiana Form CT 40 County Tax Schedule TaxFormFinder

- Wholesoldier counseling form

- Request record 2018 2019 form

- Imm 5373 2018 2019 form

- Pt 401 i south carolina department of revenue scgov form

- Help filing form fs 5336 treasury dept 2018 2019

- Hillsborough homestead exemption application dr 501 2018 form

- How to file a motion in the superior court of new jersey nj courts form

- Service request statutory declaration brightstar device protection form

Find out other Indiana Form CT 40 County Tax Schedule TaxFormFinder

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer