Missouri Form MO 3NR Partnership S Corporation Withholding Exemption 2022

What is the Missouri Form MO 3NR Partnership S Corporation Withholding Exemption

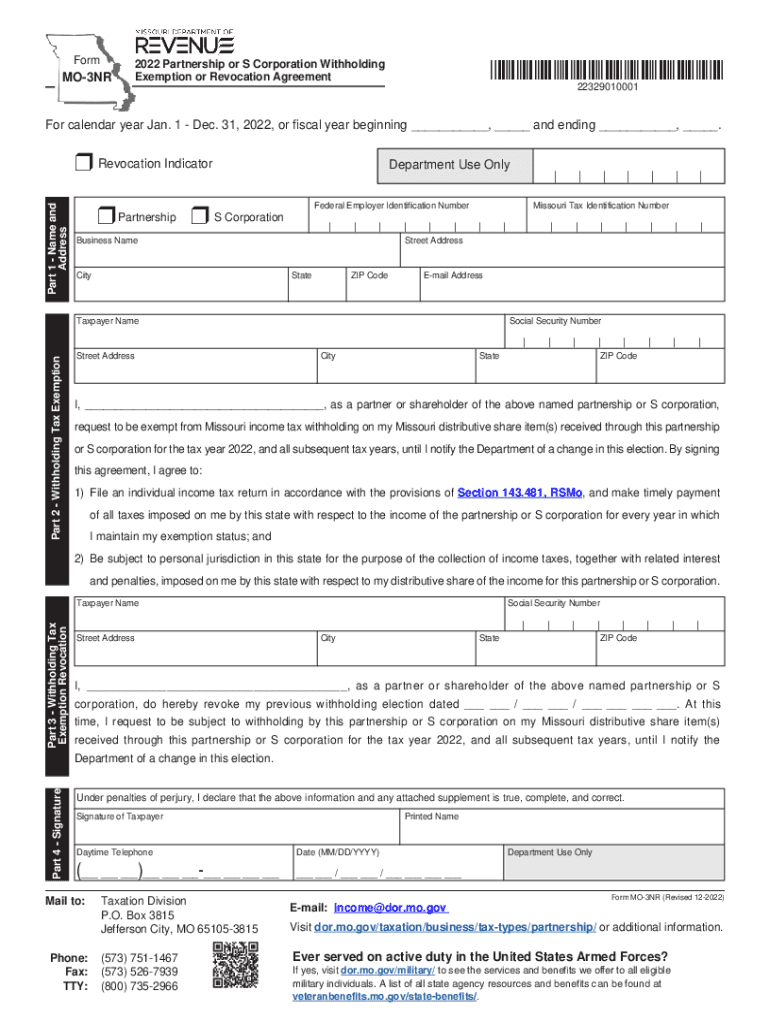

The Missouri Form MO 3NR is designed for partnerships and S corporations to claim an exemption from withholding tax on income earned by non-resident partners. This form allows eligible entities to avoid unnecessary withholding on distributions made to non-resident partners who are not subject to Missouri income tax. Understanding this form is essential for businesses operating in Missouri that have non-resident partners, as it ensures compliance with state tax regulations while optimizing tax obligations.

How to use the Missouri Form MO 3NR Partnership S Corporation Withholding Exemption

To effectively use the Missouri Form MO 3NR, businesses must first confirm eligibility for the withholding exemption. Once eligibility is established, the form should be completed accurately, providing necessary details about the partnership or S corporation, including the names and addresses of non-resident partners. After completing the form, it must be submitted to the Missouri Department of Revenue along with any required documentation to substantiate the exemption claim.

Steps to complete the Missouri Form MO 3NR Partnership S Corporation Withholding Exemption

Completing the Missouri Form MO 3NR involves several key steps:

- Gather necessary information about the partnership or S corporation and its non-resident partners.

- Fill out the form, ensuring all sections are completed accurately, including partner details and income information.

- Review the form for any errors or omissions that could lead to processing delays.

- Submit the completed form to the Missouri Department of Revenue by the specified deadlines.

Eligibility Criteria

Eligibility for the Missouri Form MO 3NR requires that the entity is a partnership or S corporation with non-resident partners who do not have a tax obligation in Missouri. Additionally, the partners must not be engaged in business activities within the state that would create a tax liability. It is crucial for businesses to assess these criteria carefully to ensure compliance and avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri Form MO 3NR are typically aligned with the state’s tax calendar. It is important for businesses to be aware of these dates to ensure timely submission. Generally, the form should be filed by the due date of the partnership or S corporation tax return to avoid any penalties associated with late filing. Keeping track of these deadlines helps maintain compliance with Missouri tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Missouri Form MO 3NR can be submitted through various methods, including online filing via the Missouri Department of Revenue’s website, mailing a paper form, or delivering it in person to a local revenue office. Each method has its own advantages, and businesses should choose the one that best fits their operational needs and ensures timely processing of their exemption claim.

Quick guide on how to complete missouri form mo 3nr partnership s corporation withholding exemption

Effortlessly Prepare Missouri Form MO 3NR Partnership S Corporation Withholding Exemption on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage Missouri Form MO 3NR Partnership S Corporation Withholding Exemption on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Modify and Electronically Sign Missouri Form MO 3NR Partnership S Corporation Withholding Exemption

- Locate Missouri Form MO 3NR Partnership S Corporation Withholding Exemption and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Decide how you want to send your form: via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Modify and electronically sign Missouri Form MO 3NR Partnership S Corporation Withholding Exemption to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri form mo 3nr partnership s corporation withholding exemption

Create this form in 5 minutes!

How to create an eSignature for the missouri form mo 3nr partnership s corporation withholding exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mo 3nr and how does it relate to airSlate SignNow?

Mo 3nr is a key feature of airSlate SignNow that enhances document management and eSigning processes. It allows users to streamline their workflow, improving efficiency and ensuring secure transactions. With mo 3nr, businesses can manage their documents with ease, making signing and sharing seamless.

-

How does airSlate SignNow’s pricing work for mo 3nr?

The pricing for mo 3nr in airSlate SignNow is transparent and competitively structured to fit different business needs. Users can choose from various plans that include access to mo 3nr features, helping them save costs while maximizing functionality. It's advisable to review the pricing tiers to find the best fit for your organizational requirements.

-

What features are included in the mo 3nr package of airSlate SignNow?

The mo 3nr package includes features such as templates, bulk sending, and advanced security options. These features collectively enhance the user experience, facilitating easier document management and eSigning processes. By leveraging these capabilities, teams can work more effectively.

-

What are the benefits of using airSlate SignNow’s mo 3nr for my business?

Using airSlate SignNow’s mo 3nr can greatly benefit your business by increasing efficiency and reducing turnaround times for document signing. Additionally, it provides a secure and legally binding way to manage agreements, which is essential for professional transactions. Ultimately, mo 3nr helps streamline operations, saving time and resources.

-

Can I integrate mo 3nr with other applications?

Yes, airSlate SignNow’s mo 3nr can integrate with many popular third-party applications. This allows for seamless workflows across platforms, enhancing productivity and ease of use. Check the integration options available to see how it can fit into your existing tech ecosystem.

-

Is there a free trial available for airSlate SignNow with mo 3nr features?

Yes, airSlate SignNow often provides a free trial option that includes access to mo 3nr features. This allows prospective customers to explore and evaluate the suite's capabilities without commitment. It’s an excellent way to see how mo 3nr can positively impact your workflow.

-

How secure is my data when using mo 3nr with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially with the use of mo 3nr. The platform employs robust encryption and complies with industry standards to protect your sensitive information. You can trust that your data is safe while using mo 3nr for document management and eSigning.

Get more for Missouri Form MO 3NR Partnership S Corporation Withholding Exemption

Find out other Missouri Form MO 3NR Partnership S Corporation Withholding Exemption

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate