MO 3NR Partnership or S Corporation Withholding Exemption or Revocation Agreement 2023

What is the MO 3NR Partnership or S Corporation Withholding Exemption or Revocation Agreement

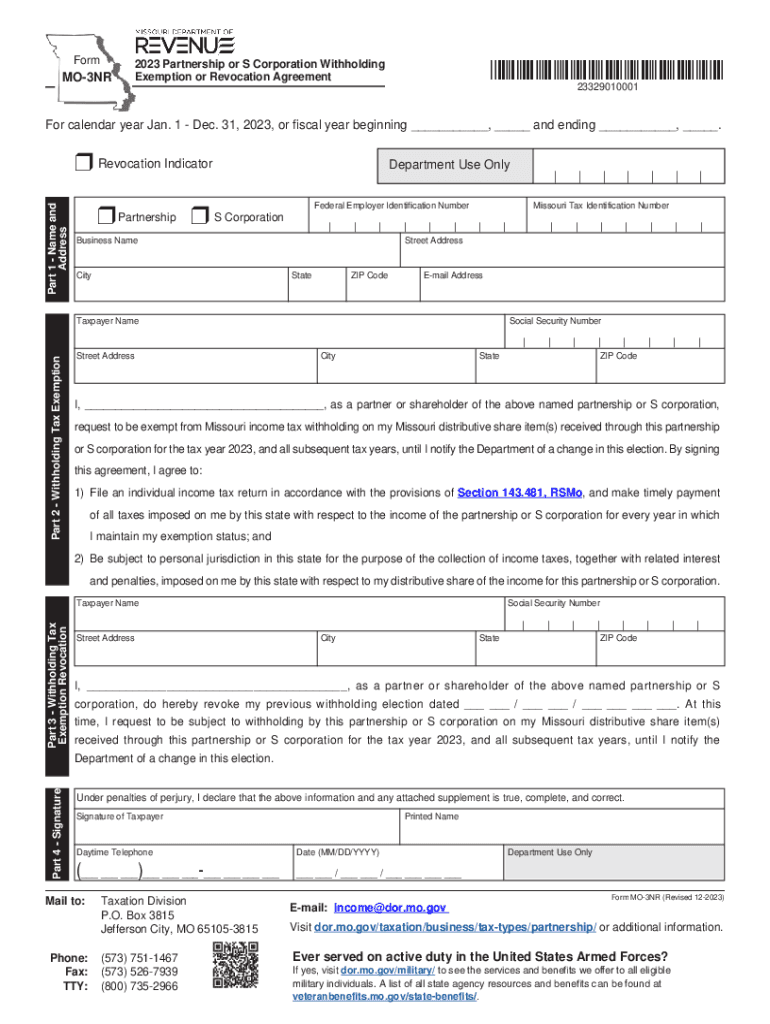

The MO 3NR form is a critical document for partnerships and S corporations operating in Missouri. It serves as a withholding exemption or revocation agreement, allowing eligible entities to request exemption from state income tax withholding on certain types of income. This form is particularly relevant for non-resident partners or shareholders who may not be subject to Missouri income tax. Understanding this form is essential for compliance and accurate tax reporting.

How to Complete the MO 3NR Partnership or S Corporation Withholding Exemption or Revocation Agreement

Completing the MO 3NR form involves several key steps. First, ensure you have the correct version of the form, which can be obtained from the Missouri Department of Revenue. Next, fill in the required information, including the entity's name, address, and federal employer identification number (EIN). It is important to accurately specify the type of income for which you are requesting the exemption. After completing the form, review it for accuracy before submission.

Key Elements of the MO 3NR Partnership or S Corporation Withholding Exemption or Revocation Agreement

Several key elements must be included in the MO 3NR form to ensure its validity. These elements include:

- Entity Information: Name, address, and EIN of the partnership or S corporation.

- Income Type: Clearly specify the type of income for which the exemption is being requested.

- Signature: An authorized representative must sign the form, certifying that the information provided is accurate.

- Date: The date of submission should also be included to establish a timeline for processing.

Eligibility Criteria for the MO 3NR Partnership or S Corporation Withholding Exemption or Revocation Agreement

To qualify for the MO 3NR withholding exemption, certain eligibility criteria must be met. Generally, the partnership or S corporation must be engaged in business activities that generate income not subject to Missouri income tax. Additionally, the entity must have non-resident partners or shareholders who are eligible for the exemption. It is crucial to review the specific requirements set forth by the Missouri Department of Revenue to ensure compliance.

Filing Deadlines for the MO 3NR Partnership or S Corporation Withholding Exemption or Revocation Agreement

Timely submission of the MO 3NR form is essential to avoid penalties. Typically, the form should be filed with the Missouri Department of Revenue by the tax return due date for the partnership or S corporation. This deadline may vary based on the entity's fiscal year and specific circumstances. It is advisable to consult the Missouri Department of Revenue’s guidelines for the most accurate filing deadlines.

Form Submission Methods for the MO 3NR Partnership or S Corporation Withholding Exemption or Revocation Agreement

The MO 3NR form can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Some entities may have the option to submit the form electronically through the Missouri Department of Revenue’s online portal.

- Mail: The completed form can be mailed directly to the appropriate address specified by the Missouri Department of Revenue.

- In-Person: Entities may also choose to deliver the form in person at designated Department of Revenue offices.

Quick guide on how to complete mo 3nr partnership or s corporation withholding exemption or revocation agreement

Effortlessly Prepare MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement with Ease

- Find MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo 3nr partnership or s corporation withholding exemption or revocation agreement

Create this form in 5 minutes!

How to create an eSignature for the mo 3nr partnership or s corporation withholding exemption or revocation agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mo 3nr and how can it benefit my business?

Mo 3nr is an innovative feature within airSlate SignNow that streamlines the document signing process. It allows businesses to send and eSign documents effortlessly, enhancing efficiency and reducing turnaround times. Implementing mo 3nr can signNowly improve your workflow and provide a more seamless experience for both your team and clients.

-

How much does airSlate SignNow with mo 3nr cost?

The pricing for airSlate SignNow featuring mo 3nr is competitive and designed to fit various business budgets. Different plans are available depending on your needs, which include features like document templates, advanced integrations, and more. To get specific pricing details, it’s best to visit our pricing page or contact our sales team for a tailored quote.

-

What features does mo 3nr include?

Mo 3nr includes a range of features such as customizable templates, bulk sending options, and automated reminders. These functionalities are designed to simplify the eSigning process, making it more efficient for your organization. By utilizing mo 3nr, you can also enhance security and compliance in your document handling.

-

Is mo 3nr easy to integrate with other tools?

Absolutely! Mo 3nr is designed for seamless integration with popular tools and applications such as Google Drive, Dropbox, and various CRM systems. This ensures that you can incorporate airSlate SignNow into your existing workflows without any hassle, maximizing your productivity.

-

Can I track the status of documents signed with mo 3nr?

Yes, mo 3nr allows you to easily track the status of your documents at any stage of the eSigning process. You can receive notifications and updates when a document is viewed, signed, or completed, giving you peace of mind and helping you manage your projects more effectively.

-

Is mo 3nr compliant with industry standards?

Mo 3nr adheres to strict compliance standards, including GDPR and eIDAS, ensuring that your documents are handled securely. This compliance is crucial for businesses that deal with sensitive information or operate in regulated industries. With airSlate SignNow, you can trust that your document transactions remain secure and compliant.

-

What benefits can I expect from using airSlate SignNow's mo 3nr?

Using mo 3nr with airSlate SignNow can lead to increased efficiency, reduced paperwork, and faster turnaround times. Businesses experience higher customer satisfaction due to the ease of use and quick access to document signing. Overall, mo 3nr empowers your team to work smarter, not harder.

Get more for MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement

- Pediatric ophthalmologyadult strabismus new patient form

- Premier health form

- Clinical and molecular cytogenetics laboratory form

- Patient registration form romagosa dermatology group

- Optumrx direct member reimbursement form

- General incident form

- Clinical pathology accession form use general uvdl accession form for other testing requests

- Case1 aampquoti i4 i i 1 f r w rl al lil i ul name 403 case form

Find out other MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document