Solicitud De Prrroga Para Rendir El Comprobante De Retencin Form

Understanding the Solicitud De Prórroga Para Rendir El Comprobante De Retención

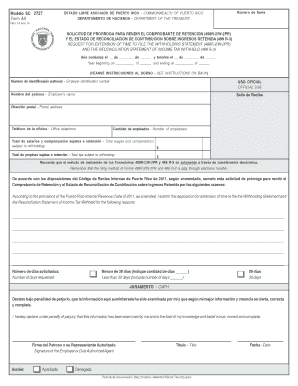

The Solicitud De Prórroga Para Rendir El Comprobante De Retención is a formal request used by taxpayers to extend the deadline for submitting withholding tax returns. This form is essential for individuals and businesses that may require additional time to gather necessary documentation or complete their tax obligations accurately. It ensures compliance with tax regulations while allowing for flexibility in filing.

Steps to Complete the Solicitud De Prórroga Para Rendir El Comprobante De Retención

Completing the Solicitud De Prórroga Para Rendir El Comprobante De Retención involves several key steps:

- Gather all relevant information, including taxpayer identification numbers and details of the withholding tax.

- Fill out the form accurately, ensuring that all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form by the specified deadline to ensure that the extension is granted.

Legal Use of the Solicitud De Prórroga Para Rendir El Comprobante De Retención

The legal use of this form is crucial for maintaining compliance with tax laws. By submitting the Solicitud De Prórroga, taxpayers formally request an extension, which protects them from potential penalties associated with late filings. It is important to understand the legal implications and ensure that the request is made within the allowed timeframe to avoid complications.

Filing Deadlines and Important Dates

Filing deadlines for the Solicitud De Prórroga Para Rendir El Comprobante De Retención are critical to adhere to. Taxpayers must submit the form prior to the original due date of the withholding tax return. Missing this deadline may result in penalties or loss of extension privileges. It is advisable to keep track of these dates each tax year to ensure timely submissions.

Required Documents for Submission

When submitting the Solicitud De Prórroga Para Rendir El Comprobante De Retención, certain documents may be required to support the request. These can include:

- Proof of prior tax filings.

- Documentation of any extenuating circumstances that justify the need for an extension.

- Identification information, such as Social Security numbers or Employer Identification Numbers.

Eligibility Criteria for the Solicitud De Prórroga Para Rendir El Comprobante De Retención

Eligibility for using the Solicitud De Prórroga Para Rendir El Comprobante De Retención typically includes any individual or business entity that is subject to withholding tax requirements. Taxpayers must demonstrate a valid reason for requesting an extension, which can include unforeseen circumstances or the need for additional time to compile necessary information.

Quick guide on how to complete solicitud de prrroga para rendir el comprobante de retencin

Complete Solicitud De Prrroga Para Rendir El Comprobante De Retencin effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Solicitud De Prrroga Para Rendir El Comprobante De Retencin on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Solicitud De Prrroga Para Rendir El Comprobante De Retencin with ease

- Locate Solicitud De Prrroga Para Rendir El Comprobante De Retencin and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tiresome form searches, or mistakes that require recreating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Solicitud De Prrroga Para Rendir El Comprobante De Retencin and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the solicitud de prrroga para rendir el comprobante de retencin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to AS 2727?

airSlate SignNow is a powerful e-signature platform that streamlines document signing processes. It aligns with AS 2727 standards to ensure secure and compliant electronic signatures, making it an ideal choice for businesses needing reliable document management.

-

How does airSlate SignNow pricing work in relation to AS 2727 compliance?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Each plan is designed to ensure compliance with AS 2727, providing cost-effective options while maintaining high standards for security and usability.

-

What key features does airSlate SignNow provide that support AS 2727 compliance?

Key features of airSlate SignNow include advanced authentication methods, audit trails, and customizable templates. These features are crucial for adhering to AS 2727, ensuring that every document signing meets legal requirements.

-

How can airSlate SignNow benefit my business while following AS 2727 regulations?

Using airSlate SignNow can signNowly enhance your business’s efficiency by reducing turnaround times for document signing. By ensuring compliance with AS 2727, you can also build trust with clients by protecting sensitive information throughout the e-signing process.

-

What integrations does airSlate SignNow offer to enhance AS 2727 compliance?

airSlate SignNow integrates seamlessly with popular tools like Google Drive and Salesforce. These integrations facilitate workflow automation while ensuring that all electronic signatures captured remain in compliance with AS 2727 requirements.

-

Is airSlate SignNow user-friendly for those unfamiliar with AS 2727?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate the platform, regardless of their familiarity with AS 2727. The intuitive interface helps users focus on document signing without the hassle of complex procedures.

-

Can I customize documents in airSlate SignNow to meet AS 2727 standards?

Yes, airSlate SignNow allows for extensive customization of documents, which is vital for aligning with AS 2727 standards. You can create and modify templates to fit your business requirements while ensuring legal compliance.

Get more for Solicitud De Prrroga Para Rendir El Comprobante De Retencin

Find out other Solicitud De Prrroga Para Rendir El Comprobante De Retencin

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement