Fillable Form 1120 H for Homeowners Associations US

What is the Fillable Form 1120 H for Homeowners Associations?

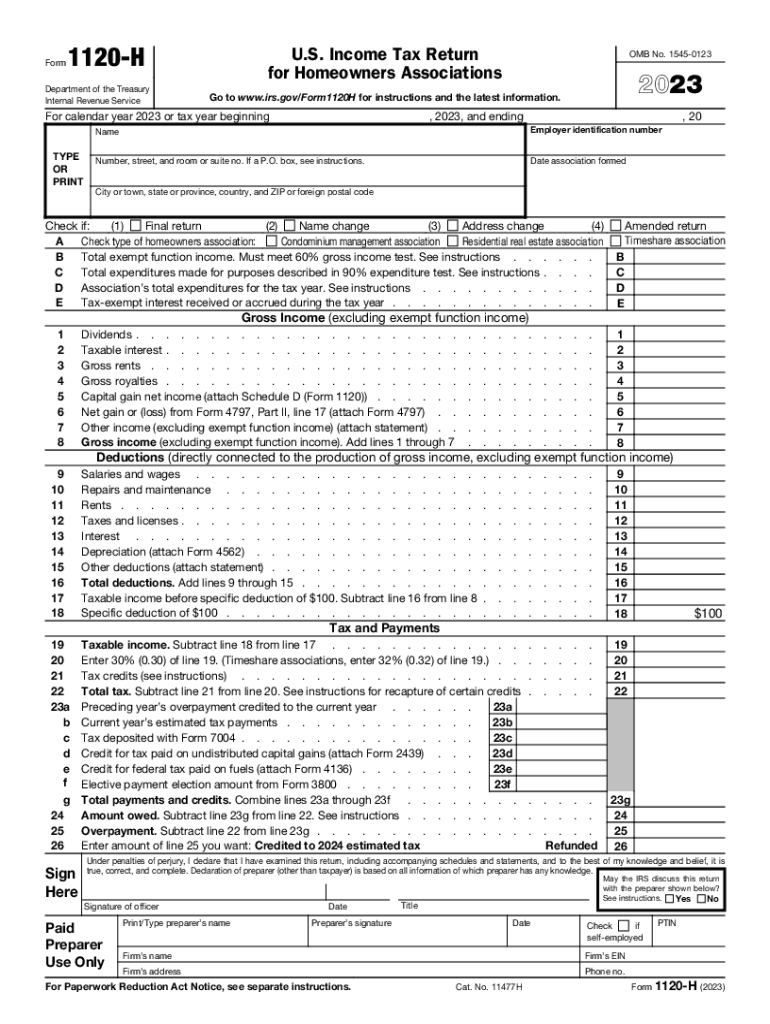

The Fillable Form 1120 H is a tax return specifically designed for homeowners associations (HOAs) in the United States. This form allows these organizations to report their income, deductions, and tax liability to the Internal Revenue Service (IRS). Unlike other tax forms, Form 1120 H is tailored to reflect the unique financial activities of HOAs, which typically operate on a non-profit basis. The form is essential for associations that meet certain criteria, including those that primarily collect membership dues and other assessments to maintain common areas and provide services to their members.

How to Use the Fillable Form 1120 H for Homeowners Associations

Using the Fillable Form 1120 H involves several steps. First, ensure that your homeowners association qualifies to file this form by meeting the eligibility criteria set by the IRS. Next, gather all necessary financial documents, including income statements and expense reports. The form can be completed electronically, allowing for easy input of data and calculations. After filling out the form, review all entries for accuracy. Finally, submit the form to the IRS by the designated deadline, ensuring compliance with all regulations.

Steps to Complete the Fillable Form 1120 H for Homeowners Associations

Completing the Fillable Form 1120 H involves a systematic approach:

- Gather financial records, including income and expenses related to the HOA.

- Determine eligibility by ensuring the association meets the IRS criteria for using Form 1120 H.

- Fill out the form electronically, entering all required information accurately.

- Review and verify all data to prevent errors.

- Submit the completed form to the IRS by the specified deadline.

IRS Guidelines for Form 1120 H

The IRS provides specific guidelines for completing and filing Form 1120 H. These guidelines outline the eligibility requirements, necessary documentation, and filing procedures. It is important to familiarize yourself with these guidelines to ensure compliance and avoid penalties. The IRS expects accurate reporting of income and expenditures, and any discrepancies may lead to audits or fines. Associations should also keep records of submitted forms and related financial documents for future reference.

Filing Deadlines for Form 1120 H

Filing deadlines for Form 1120 H are crucial for homeowners associations to observe. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the association's tax year. For associations operating on a calendar year, this means the deadline is April 15. Extensions may be available, but it is essential to file for an extension before the original deadline to avoid penalties. Keeping track of these dates ensures timely compliance with IRS regulations.

Penalties for Non-Compliance with Form 1120 H

Non-compliance with the requirements of Form 1120 H can result in significant penalties for homeowners associations. These penalties may include fines for late filing, inaccuracies, or failure to file altogether. The IRS may impose a penalty based on the amount of unpaid taxes or a fixed amount for late submissions. To avoid these penalties, it is important for associations to file accurately and on time, maintaining proper records of all financial activities.

Quick guide on how to complete fillable form 1120 h for homeowners associations us

Complete Fillable Form 1120 H For Homeowners Associations US effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the features you need to create, modify, and eSign your documents quickly without delays. Handle Fillable Form 1120 H For Homeowners Associations US on any device with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to adjust and eSign Fillable Form 1120 H For Homeowners Associations US with ease

- Locate Fillable Form 1120 H For Homeowners Associations US and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to finalize your changes.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the concerns of lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Adjust and eSign Fillable Form 1120 H For Homeowners Associations US and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable form 1120 h for homeowners associations us

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 1120 H?

IRS Form 1120 H is the tax return for homeowners associations, used to report income, deductions, gains, losses, and tax credits. It is specifically designed for associations that meet certain criteria, ensuring they are taxed appropriately under subchapter F of the Internal Revenue Code.

-

How can airSlate SignNow assist with IRS Form 1120 H filings?

With airSlate SignNow, you can easily prepare and send IRS Form 1120 H for eSignature without any hassle. Our platform streamlines the document signing process, ensuring you can complete necessary filings with confidence and ease.

-

What features does airSlate SignNow offer for completing IRS Form 1120 H?

airSlate SignNow provides easy-to-use templates and customizable forms that allow you to fill out IRS Form 1120 H efficiently. You can also track the status of your documents and ensure all signatures are obtained promptly.

-

Is airSlate SignNow cost-effective for filing IRS Form 1120 H?

Yes, airSlate SignNow offers competitive pricing plans designed to accommodate various budgets, making it a cost-effective solution for filing IRS Form 1120 H. You can choose a plan that fits your business needs and scale as necessary.

-

Can I integrate airSlate SignNow with other tools for IRS Form 1120 H preparation?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, allowing for efficient collaboration. This means you can import data directly into your IRS Form 1120 H and manage it within your existing workflows.

-

What are the benefits of using airSlate SignNow for IRS Form 1120 H?

Using airSlate SignNow for IRS Form 1120 H allows for a faster, smoother filing process while ensuring compliance with all necessary regulations. The platform enhances security through encryption and offers real-time updates on document progress.

-

How secure is my data when using airSlate SignNow for IRS Form 1120 H filings?

airSlate SignNow prioritizes the security of your data, employing bank-level encryption and robust security protocols. This ensures that your IRS Form 1120 H and any associated data remain confidential and safe throughout the process.

Get more for Fillable Form 1120 H For Homeowners Associations US

Find out other Fillable Form 1120 H For Homeowners Associations US

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application