S Corp Tax Treatment in California Guide for Lancers Form

Understanding the S Corp Tax Treatment in California

The S Corporation tax treatment allows certain corporations to avoid double taxation on their income. In California, S Corps are taxed at the state level, but they benefit from pass-through taxation, meaning the income is reported on the shareholders' personal tax returns. This structure can be advantageous for small business owners and freelancers, as it may reduce overall tax liability. It's essential to understand both federal and state regulations to ensure compliance and optimize tax benefits.

Steps to Complete the S Corp Tax Treatment in California

Completing the S Corp tax treatment involves several key steps:

- Choose a Business Name: Ensure the name is unique and complies with California naming requirements.

- File Articles of Incorporation: Submit the necessary forms to the California Secretary of State to officially establish your corporation.

- Obtain an Employer Identification Number (EIN): This is required for tax purposes and can be obtained from the IRS.

- File Form 2553: To elect S Corporation status, complete and submit this form to the IRS within the specified timeframe.

- Comply with State Regulations: Register with the California Franchise Tax Board and ensure adherence to state-specific tax obligations.

Filing Deadlines and Important Dates

Understanding filing deadlines is crucial for maintaining compliance and avoiding penalties. For California S Corps, key dates include:

- Form 2553 Submission: Must be filed within two months and fifteen days of the beginning of the tax year.

- California Franchise Tax Return (Form 100S): Due on the 15th day of the third month after the end of the fiscal year.

- Estimated Tax Payments: Generally due on the 15th of April, June, September, and January for the following year.

Required Documents for S Corp Tax Treatment

When establishing and maintaining S Corp status in California, several documents are essential:

- Articles of Incorporation: Legal document filed with the state to create the corporation.

- Bylaws: Internal rules governing the management of the corporation.

- Form 2553: Election to be treated as an S Corporation for tax purposes.

- California Form 100S: The state tax return for S Corporations.

- Shareholder Agreements: Documents outlining the rights and responsibilities of shareholders.

IRS Guidelines for S Corporations

The IRS provides specific guidelines for S Corporations, which include:

- Eligibility Requirements: To qualify, the corporation must meet criteria such as having a limited number of shareholders and only one class of stock.

- Tax Reporting: S Corps must file an annual tax return using Form 1120S, reporting income, deductions, and credits.

- Shareholder Taxation: Income is passed through to shareholders, who report it on their personal tax returns.

Penalties for Non-Compliance

Failing to comply with S Corporation regulations can lead to significant penalties, including:

- Loss of S Corp Status: If requirements are not met, the corporation may lose its S Corp status, resulting in double taxation.

- Late Filing Penalties: Failing to file required forms on time can incur fines and interest on unpaid taxes.

- Increased Audit Risk: Non-compliance may trigger audits by the IRS or state tax authorities, leading to further complications.

Quick guide on how to complete s corp tax treatment in california guide for lancers

Complete S Corp Tax Treatment In California Guide For lancers effortlessly on any device

Digital document management has become widely adopted by businesses and individuals. It offers an optimal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage S Corp Tax Treatment In California Guide For lancers on any device using airSlate SignNow Android or iOS applications and streamline any document-oriented process today.

The easiest way to modify and eSign S Corp Tax Treatment In California Guide For lancers with ease

- Locate S Corp Tax Treatment In California Guide For lancers and click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize key portions of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your demands in document management in just a few clicks from any device you prefer. Edit and eSign S Corp Tax Treatment In California Guide For lancers and ensure effective communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s corp tax treatment in california guide for lancers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

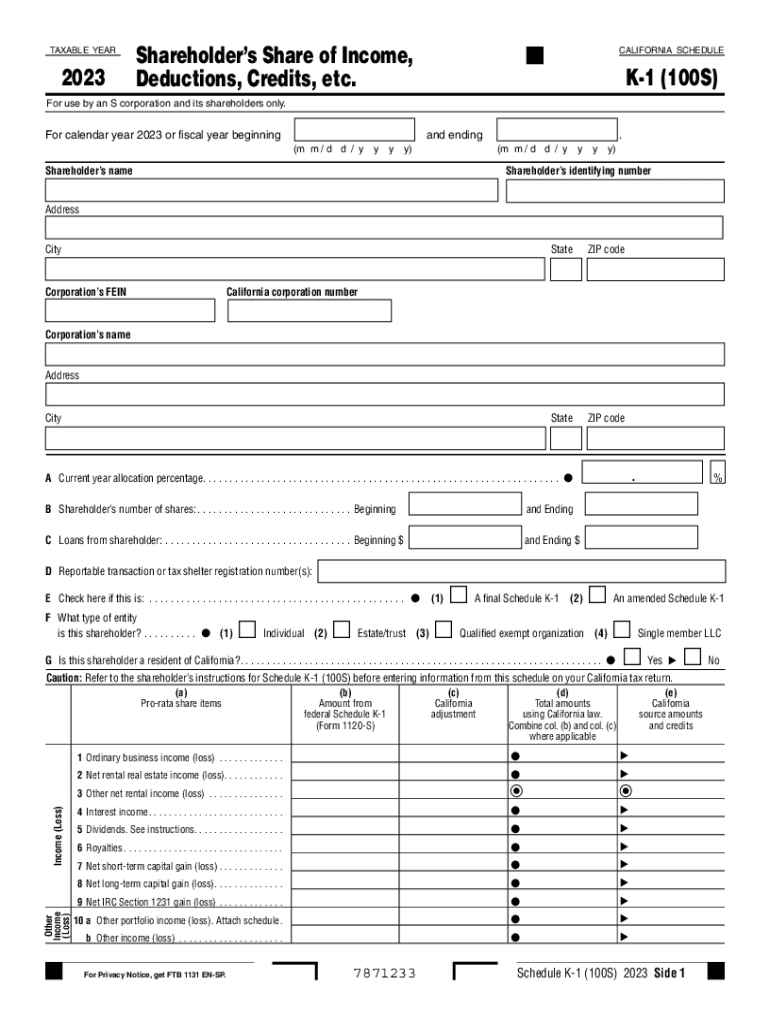

What is the 2023 Schedule K-1 form and why is it important?

The 2023 Schedule K-1 form is a document issued by partnerships and S corporations to report income, deductions, and credits. It is essential for partners and shareholders as it outlines their share of the entity's earnings. Completing the 2023 Schedule K-1 form accurately ensures compliance with IRS regulations and helps in individual tax preparation.

-

How can airSlate SignNow help with the 2023 Schedule K-1 form?

airSlate SignNow simplifies the process of completing and eSigning the 2023 Schedule K-1 form. Our platform allows you to easily fill out the necessary fields and securely send the form to relevant parties for electronic signatures. This streamlines tax reporting and ensures that all documents are efficiently handled.

-

Is airSlate SignNow a cost-effective solution for managing the 2023 Schedule K-1 form?

Yes, airSlate SignNow provides an affordable solution for managing your 2023 Schedule K-1 form. With our flexible pricing plans, you can choose a package that suits your needs while enjoying all the features necessary for efficient document management and signature processes. This can ultimately save you time and money in tax preparation.

-

What features does airSlate SignNow offer for handling the 2023 Schedule K-1 form?

airSlate SignNow offers features such as customizable templates, secure storage, and real-time collaboration for the 2023 Schedule K-1 form. Our platform allows users to track the status of their documents, send reminders, and ensure that all necessary parties can review and sign promptly. These features improve efficiency and accuracy in tax filing.

-

Can I integrate airSlate SignNow with my existing accounting software for the 2023 Schedule K-1 form?

Absolutely! airSlate SignNow supports integrations with various accounting software, making it easy to manage the 2023 Schedule K-1 form within your existing workflows. This integration allows for seamless data transfer between systems, thereby reducing duplicated efforts and enhancing accuracy in financial reporting.

-

Is it easy to eSign the 2023 Schedule K-1 form using airSlate SignNow?

Yes, eSigning the 2023 Schedule K-1 form with airSlate SignNow is very straightforward. Users can invite others to sign electronically via email, providing a secure and quick method to obtain signatures. This convenience accelerates the completion of tax-related documents signNowly.

-

What benefits does using airSlate SignNow provide for filing the 2023 Schedule K-1 form?

Using airSlate SignNow for filing the 2023 Schedule K-1 form provides benefits such as enhanced security, reduced processing time, and increased accuracy. Our platform supports a user-friendly experience, making it easier for users to manage complex tax documents without stress. Additionally, real-time tracking ensures that all parties are informed every step of the way.

Get more for S Corp Tax Treatment In California Guide For lancers

- Unicare fitness form reimbursement 2018 2019

- Nflpn gerontology certification 2018 2019 form

- Nflpn gerontology certification 2016 form

- Printable invoice for a homecare service provided 2018 2019 form

- Informal caregiver invoice ltcfedscom federal long term care

- Wesco nj 2016 2019 form

- To be used when a member changes from another health plan to anthem blue cross and blue shield form

- Care 1st arizona prior authorization form 2018 2019

Find out other S Corp Tax Treatment In California Guide For lancers

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document