California Form 540 X California Explanation of Amended

Understanding the California Schedule X Form

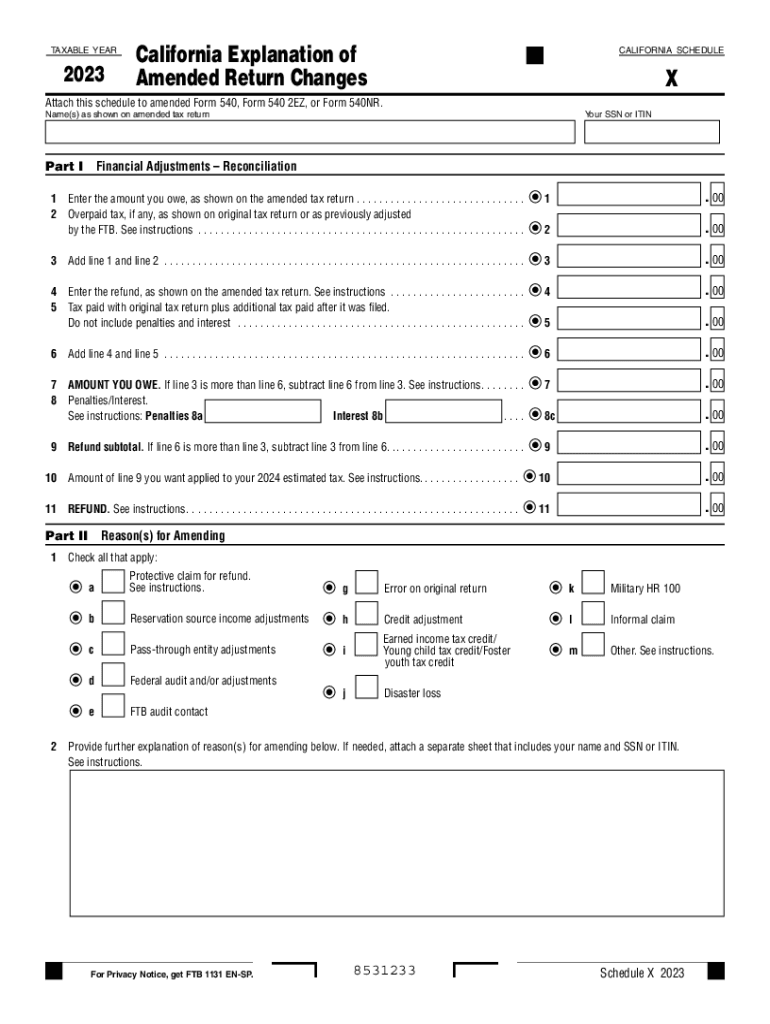

The California Schedule X, also known as the California Explanation of Amended, is a crucial document for taxpayers who need to amend their previously filed California tax returns. This form provides an opportunity for individuals to correct errors or omissions in their original filings. It is specifically designed for use with Form 540, which is the California Resident Income Tax Return. By submitting Schedule X, taxpayers can explain the reasons for the amendments and ensure that their tax records are accurate.

Steps to Complete the California Schedule X Form

Completing the California Schedule X involves several key steps to ensure accuracy and compliance. First, gather all relevant documents, including your original tax return and any supporting documentation for the changes you are making. Next, fill out the Schedule X form, detailing the specific changes to your income, deductions, or credits. Be sure to provide a clear explanation for each amendment in the designated section. Once completed, review the form for any errors before submitting it along with your amended tax return.

Filing Deadlines for the California Schedule X

It is important to be aware of the filing deadlines associated with the California Schedule X. Generally, taxpayers have up to four years from the original due date of the return to file an amended return. For most individuals, this means that the deadline for submitting Schedule X for a tax year is typically April 15 of the fourth year following the tax year in question. However, if the original return was filed late, the deadline for amending may differ, so it is advisable to check the specific dates for your situation.

Required Documents for Filing Schedule X

When preparing to file the California Schedule X, certain documents are necessary to support your amendments. These may include:

- Your original Form 540 tax return.

- Any additional forms or schedules that were part of your original filing.

- Documentation supporting the changes, such as W-2s, 1099s, or receipts for deductions.

- A copy of any correspondence from the California Franchise Tax Board (FTB) related to your original return.

Having these documents ready will facilitate a smoother amendment process.

Legal Use of the California Schedule X Form

The California Schedule X is legally recognized as the formal method for taxpayers to amend their state tax returns. It is essential to use this form to ensure that any changes made to your tax return are documented and processed correctly by the California Franchise Tax Board. Failing to use Schedule X when required could result in penalties or delays in processing your amended return. Always ensure that the information provided is truthful and accurate to comply with state tax laws.

Who Issues the California Schedule X Form

The California Schedule X is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's income tax laws and ensuring compliance among taxpayers. The FTB provides various resources and guidance for taxpayers regarding the completion and submission of Schedule X, helping to clarify any questions about the amendment process.

Quick guide on how to complete california form 540 x california explanation of amended

Complete California Form 540 X California Explanation Of Amended effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, revise, and electronically sign your documents swiftly without delays. Manage California Form 540 X California Explanation Of Amended on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign California Form 540 X California Explanation Of Amended with ease

- Obtain California Form 540 X California Explanation Of Amended and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign California Form 540 X California Explanation Of Amended while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 540 x california explanation of amended

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a franchise tax board amended return?

A franchise tax board amended return is a form that taxpayers can file to correct errors or make changes to their originally submitted tax returns. This process allows businesses to ensure that their tax filings accurately reflect their financial situation, which can help avoid penalties and interest.

-

How can airSlate SignNow help with filing a franchise tax board amended return?

airSlate SignNow provides a streamlined platform that allows businesses to easily prepare and electronically sign their franchise tax board amended return. The easy-to-use interface simplifies the document management process, ensuring that all required amendments are properly completed and submitted on time.

-

What features does airSlate SignNow offer for franchise tax board amended returns?

airSlate SignNow offers features such as customizable templates, document tracking, and secure electronic signatures, all tailored to facilitate the filing of franchise tax board amended returns. These features enhance accuracy and efficiency, ensuring that businesses can submit their amendments with confidence.

-

Is there a cost associated with using airSlate SignNow for my franchise tax board amended return?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Depending on your requirements, you can choose a plan that provides the necessary tools for managing your franchise tax board amended return at an affordable price.

-

Can I integrate airSlate SignNow with other accounting software for my franchise tax board amended return?

Absolutely! airSlate SignNow can be integrated with various accounting and financial software, making it easier to manage your franchise tax board amended return. This integration ensures that all your financial data is consistent and readily accessible when preparing amendments.

-

What are the benefits of using airSlate SignNow for franchise tax board amended returns?

Using airSlate SignNow for your franchise tax board amended return provides benefits such as increased efficiency, reduced paperwork, and improved accuracy. The platform allows you to track changes in real-time and ensures that all your documents are securely stored and easily retrievable.

-

How can I ensure the security of my franchise tax board amended return using airSlate SignNow?

airSlate SignNow employs robust security measures, including encryption and secure user authentication, to protect your franchise tax board amended return. This ensures that your sensitive information remains confidential and secure throughout the filing process.

Get more for California Form 540 X California Explanation Of Amended

- Application psa pass 2015 2019 form

- Form application visa overseas territories 2012 2019

- Bindt form 57b 2018 2019

- Form 10 k wp carey

- Vehicle registration marking and numbering rssb form

- Srg 1601 2012 2019 form

- Bv940b application to register as a number plate supplier govuk form

- Http dmna ny gov forms naval nynm form88 pdf

Find out other California Form 540 X California Explanation Of Amended

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free