Form 1098 T Tuition Statement

What is the Form 1098-T Tuition Statement

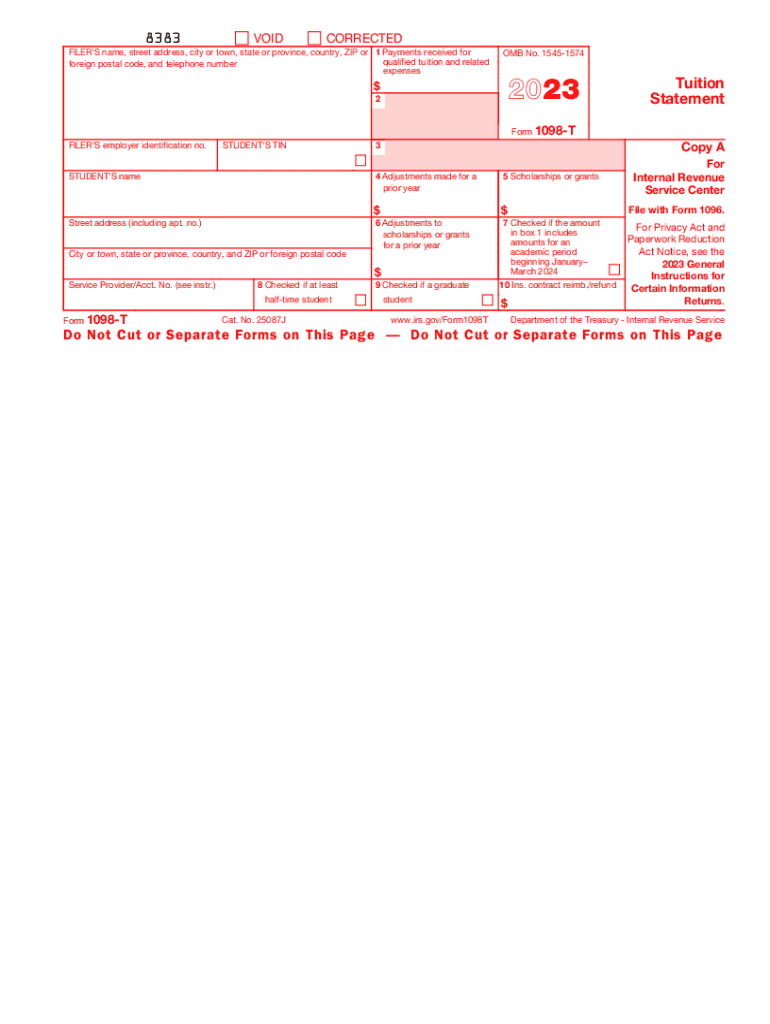

The Form 1098-T, also known as the Tuition Statement, is an essential document that colleges and universities in the United States use to report qualified tuition and related expenses to both the Internal Revenue Service (IRS) and students. This form provides information on amounts billed for tuition, scholarships, and grants received, which can assist students in determining their eligibility for education tax credits such as the American Opportunity Credit and the Lifetime Learning Credit.

How to Use the Form 1098-T Tuition Statement

Students can utilize the Form 1098-T to help prepare their federal income tax returns. The information reported on the form can guide them in claiming education-related tax benefits. It is important to review the form carefully to ensure that the amounts reported align with the actual tuition paid and any scholarships or grants received. Students should keep this form with their tax records for at least three years, as it may be needed for future reference or audits.

Key Elements of the Form 1098-T Tuition Statement

The Form 1098-T contains several key elements that are crucial for understanding tuition costs and tax benefits. These elements include:

- Student Information: Name, address, and taxpayer identification number.

- Institution Information: Name and Employer Identification Number (EIN) of the educational institution.

- Qualified Tuition and Related Expenses: Amounts billed for tuition and fees.

- Scholarships and Grants: Total amount of scholarships and grants received by the student.

- Box 1 and Box 2: Indicate whether the amounts reported are based on payments received or amounts billed.

Steps to Complete the Form 1098-T Tuition Statement

Completing the Form 1098-T involves several steps to ensure accuracy and compliance with IRS regulations. Educational institutions typically complete the form as follows:

- Gather student information, including names and taxpayer identification numbers.

- Calculate qualified tuition and related expenses for the academic year.

- Determine any scholarships or grants awarded to the student.

- Fill out the form accurately, ensuring all amounts are correct.

- Distribute the completed forms to students by the IRS deadline, usually by January 31 of the following year.

IRS Guidelines for the Form 1098-T Tuition Statement

The IRS has established specific guidelines for the completion and submission of the Form 1098-T. Educational institutions must ensure compliance with these regulations to avoid penalties. Key guidelines include:

- Institutions must report amounts in the correct boxes based on whether they are reporting payments received or amounts billed.

- All information must be accurate and reflect the actual financial transactions for the tax year.

- Institutions must provide a copy of the form to students and submit it to the IRS by the designated deadline.

Obtaining the Form 1098-T Tuition Statement

Students can obtain their Form 1098-T from their educational institution. Most colleges and universities provide electronic access to this form through their student portals. If a student does not receive their form by the end of January, they should contact their school's financial aid office or registrar to request a copy. It is important for students to ensure they have the correct form for the tax year they are filing.

Quick guide on how to complete form 1098 t tuition statement

Effortlessly prepare Form 1098 T Tuition Statement on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, modify, and electronically sign your documents quickly and without holdups. Manage Form 1098 T Tuition Statement across any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to modify and eSign Form 1098 T Tuition Statement with ease

- Obtain Form 1098 T Tuition Statement and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred delivery method for the form, whether through email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Edit and eSign Form 1098 T Tuition Statement to guarantee outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1098 t tuition statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1098 T form?

The 1098 T form is an IRS document used to report qualified tuition and related expenses for students. It's essential for tax purposes, especially for those who claim education credits in their tax returns. Understanding the 1098 T can help students and taxpayers maximize their deductions.

-

How can airSlate SignNow assist with 1098 T forms?

airSlate SignNow streamlines the process of completing and signing 1098 T forms electronically. Our eSignature solution ensures that your documents are secure and compliant, making it easy to manage your educational tax documents efficiently. With signNow, you can focus more on your studies and less on paperwork.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans, ensuring access for individuals and businesses alike. Our pricing models cater to different budget needs while providing the essential features necessary for managing documents like the 1098 T. Check our website for current promotions and discounted rates.

-

Is airSlate SignNow secure for handling sensitive documents like the 1098 T?

Absolutely! airSlate SignNow employs industry-standard security measures to protect your sensitive documents, including the 1098 T form. Our robust encryption and secure access protocols ensure that your information is safe throughout the signing process.

-

What benefits does eSigning a 1098 T offer?

Using airSlate SignNow to eSign your 1098 T form simplifies the entire process by eliminating paper handling and delays associated with traditional signatures. eSigning is not only faster but also environmentally friendly. Plus, you can conveniently access and manage your signed documents online at any time.

-

Can I integrate airSlate SignNow with other software for better document management?

Yes, airSlate SignNow seamlessly integrates with various software tools to enhance document management, including accounting and tax software. This integration helps you automatically populate and manage your 1098 T forms, making your workflow more efficient. Explore our integration options on our website.

-

What features does airSlate SignNow provide for managing forms like the 1098 T?

airSlate SignNow offers a range of features tailored for managing forms like the 1098 T, including customizable templates, status tracking, and automated reminders. These features ensure that you are always updated and able to manage your documents effectively. Utilizing our platform can signNowly reduce errors and enhance accuracy.

Get more for Form 1098 T Tuition Statement

Find out other Form 1098 T Tuition Statement

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement