Schedule a Form 1040 Itemized Deductions

What is the Schedule A Form 1040 Itemized Deductions

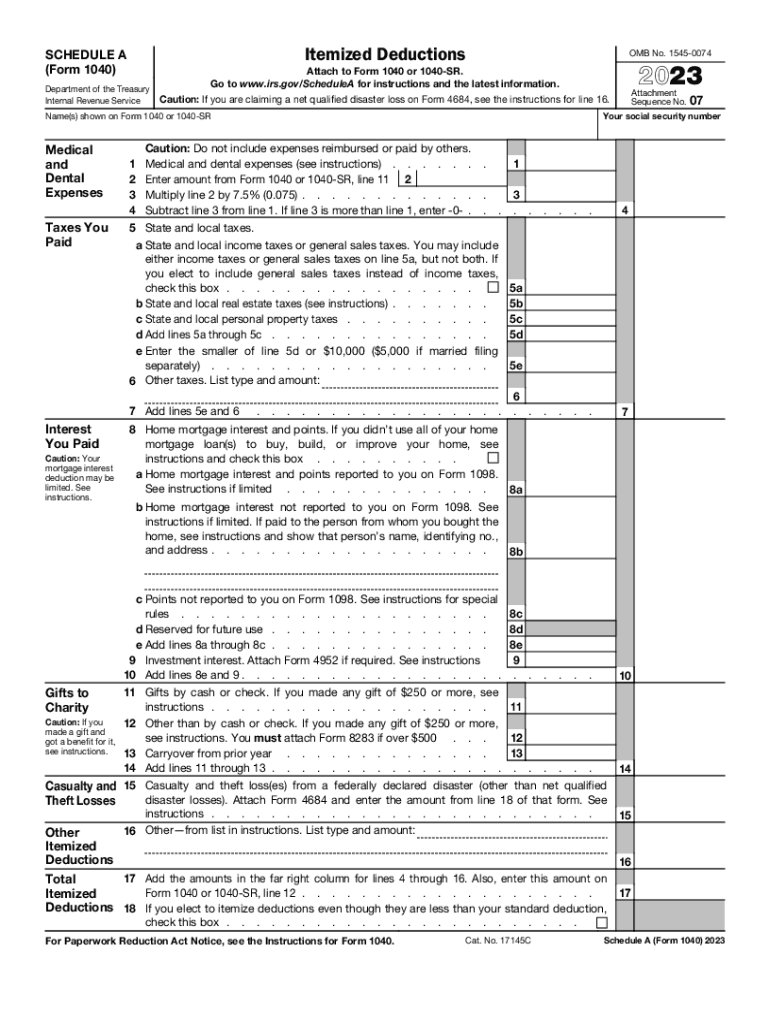

The Schedule A Form 1040 is a crucial document for taxpayers who choose to itemize their deductions instead of taking the standard deduction. This form allows individuals to report various eligible expenses that can reduce their taxable income. Common deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions. Understanding how to use this form effectively can lead to significant tax savings.

How to use the Schedule A Form 1040 Itemized Deductions

Using the Schedule A Form 1040 involves several steps. First, gather all necessary documentation related to your deductions, such as receipts and statements. Next, complete the form by entering your total itemized deductions in the appropriate sections. Ensure that you follow the IRS guidelines for each category to maximize your deductions. Once completed, attach the form to your main tax return and submit it by the filing deadline.

Steps to complete the Schedule A Form 1040 Itemized Deductions

Completing the Schedule A Form 1040 involves a systematic approach:

- Collect all relevant documents, including receipts for medical expenses, mortgage statements, and records of charitable donations.

- Fill in your personal information at the top of the form.

- Carefully enter your deductions in the designated sections, ensuring accuracy to avoid potential issues with the IRS.

- Review the completed form for any errors or omissions.

- Attach the Schedule A to your Form 1040 before filing.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule A Form 1040. Taxpayers must ensure that all deductions claimed are eligible under current tax laws. It is important to keep thorough records to substantiate your claims in case of an audit. The IRS also updates its guidelines annually, so staying informed about any changes is essential for accurate filing.

Eligibility Criteria

To use the Schedule A Form 1040, taxpayers must meet certain eligibility criteria. Generally, you must choose to itemize deductions rather than take the standard deduction. This choice is often beneficial for individuals with significant deductible expenses. Additionally, certain restrictions may apply based on filing status and income levels, which can affect the overall benefit of itemizing deductions.

Required Documents

When preparing to complete the Schedule A Form 1040, it is essential to gather all required documents. Key documents include:

- Receipts for medical and dental expenses.

- Statements for mortgage interest paid.

- Records of state and local taxes paid.

- Documentation for charitable contributions.

- Any other relevant financial statements that support your deductions.

Quick guide on how to complete schedule a form 1040 itemized deductions

Complete Schedule A Form 1040 Itemized Deductions effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, as you can find the necessary form and securely preserve it online. airSlate SignNow provides all the tools you require to create, alter, and eSign your documents promptly without hurdles. Manage Schedule A Form 1040 Itemized Deductions on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Schedule A Form 1040 Itemized Deductions without hassle

- Find Schedule A Form 1040 Itemized Deductions and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your updates.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Modify and eSign Schedule A Form 1040 Itemized Deductions and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule a form 1040 itemized deductions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help me create a schedule for my document signing?

airSlate SignNow allows you to create a schedule for document signing by setting specific time frames for sending and signing. You can automate reminders to keep everyone on track, ensuring that your documents are signed promptly. This feature enhances the efficiency of your workflow and helps you manage deadlines effectively.

-

What pricing options does airSlate SignNow offer for scheduling document signings?

airSlate SignNow provides several pricing plans to accommodate various business needs, including options that allow you to automate the scheduling of document signings. Depending on the plan you choose, you'll gain access to additional features that streamline your document workflows. Visit our pricing page for detailed information on the plans available.

-

Can I integrate airSlate SignNow with my calendar to manage my schedule?

Yes, airSlate SignNow integrates seamlessly with popular calendar applications, allowing you to manage your schedule efficiently. This integration helps ensure that document signing times align with your availability. By linking your calendar, you can receive reminders and notifications related to your scheduled signings.

-

What features of airSlate SignNow support efficient scheduling?

airSlate SignNow offers features like automated reminders, templated document workflows, and the ability to set up signing sequences, all of which support efficient scheduling. These tools help you create a schedule that keeps document signings organized and timely. Additionally, you can track the status of all documents which assists in managing your overall schedule.

-

How does airSlate SignNow ensure document security while scheduling signings?

airSlate SignNow prioritizes document security, offering features such as encryption, secure access, and audit trails for scheduled signings. These security measures ensure that your documents remain confidential and compliant throughout the signing process. You can trust that your information is protected while you create a schedule for signings.

-

Does airSlate SignNow allow for mobile scheduling of document signings?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to manage and create a schedule for document signings on the go. Whether you're in the office or working remotely, you can send documents for signing and keep track of schedules right from your mobile device. This flexibility ensures you won’t miss important deadlines.

-

Can I schedule recurring document signings with airSlate SignNow?

Yes, you can schedule recurring document signings using airSlate SignNow's templating and automation features. This is especially useful for businesses that require regular updates or agreements. By setting up these recurring schedules, you can save time and ensure that all parties are aligned with their signing responsibilities.

Get more for Schedule A Form 1040 Itemized Deductions

Find out other Schedule A Form 1040 Itemized Deductions

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA