E File Signature Authorization for RCT 101, PA Corporate Net Income Tax Report PA 8879 C FormsPublications

Understanding the E-file Signature Authorization for RCT-101

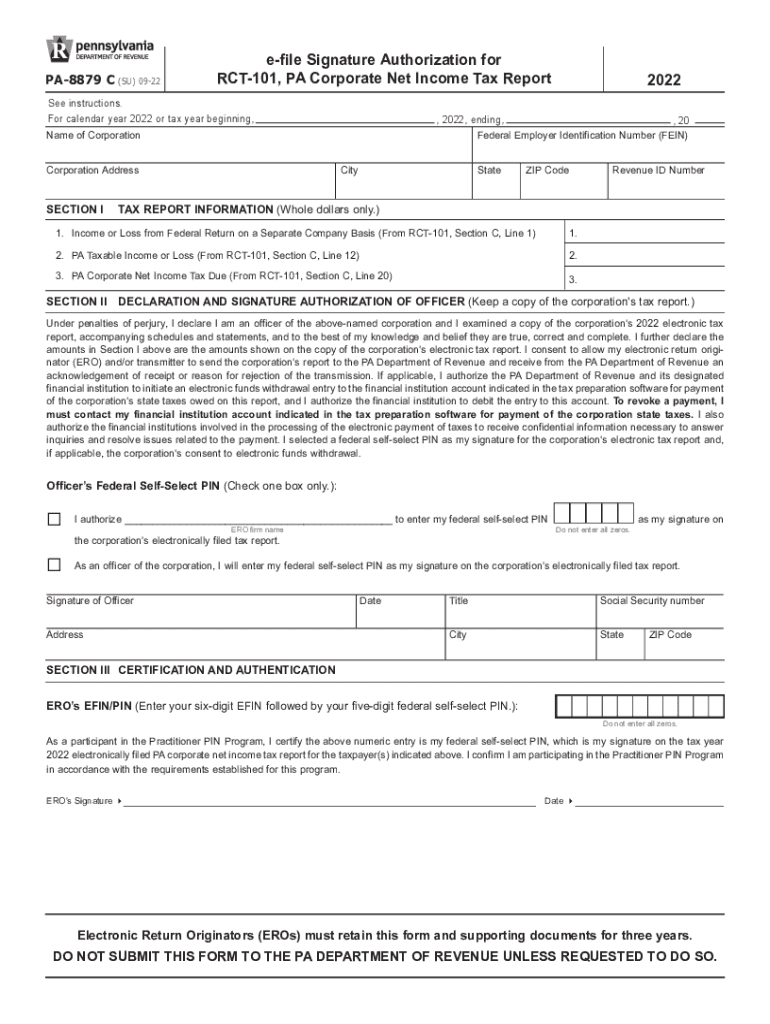

The E-file Signature Authorization for RCT-101, also known as the PA 8879 C form, is a crucial document for businesses filing the Pennsylvania Corporate Net Income Tax. This form serves as a declaration that the taxpayer authorizes the electronic filing of their tax return. It is essential for ensuring compliance with Pennsylvania tax regulations and streamlining the filing process.

By submitting the PA 8879 C, businesses confirm that the information provided in the RCT-101 is accurate and complete. This signature authorization is particularly important for corporations that wish to file their taxes electronically, as it provides a secure method for submitting sensitive tax information.

Steps to Complete the E-file Signature Authorization for RCT-101

Completing the PA 8879 C form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide to help you through the process:

- Gather necessary information, including your business details, tax identification number, and the preparer's information if applicable.

- Fill out the PA 8879 C form accurately, ensuring all fields are completed as required.

- Review the completed form for any errors or omissions before submission.

- Sign the form electronically, if applicable, or print and sign it manually.

- Submit the signed PA 8879 C along with your RCT-101 form to the appropriate tax authority.

Following these steps will help ensure that your electronic filing is processed smoothly and without delay.

Legal Use of the E-file Signature Authorization for RCT-101

The PA 8879 C form has legal significance in the context of Pennsylvania tax law. By signing this form, the taxpayer confirms their intent to file electronically and acknowledges their responsibility for the accuracy of the information provided. The legal implications of the PA 8879 C include potential penalties for false statements or failure to comply with filing requirements.

It is important for businesses to understand that the PA 8879 C is not just a formality; it is a legally binding document that can be subject to review by the Pennsylvania Department of Revenue. Therefore, ensuring that all information is correct and that the form is properly executed is vital to avoid legal complications.

Key Elements of the E-file Signature Authorization for RCT-101

The PA 8879 C form includes several key elements that are important for both taxpayers and tax preparers:

- Taxpayer Information: Includes the business name, address, and federal employer identification number (FEIN).

- Preparer Information: If applicable, this section includes details about the tax preparer, including their name and PTIN (Preparer Tax Identification Number).

- Signature Section: This section requires the taxpayer's signature, which indicates authorization for electronic filing.

- Declaration Statement: A statement affirming the accuracy and completeness of the information provided.

Understanding these elements helps ensure that the form is filled out correctly and meets all legal requirements.

Filing Deadlines for the E-file Signature Authorization for RCT-101

Timely filing of the PA 8879 C is essential to avoid penalties and ensure compliance with Pennsylvania tax laws. The deadline for submitting the PA 8879 C typically aligns with the due date for the RCT-101 form, which is generally the fifteenth day of the fourth month following the close of the corporation's tax year.

For corporations operating on a calendar year, this means the PA 8879 C must be filed by April 15. Corporations with a fiscal year should check the specific due date based on their fiscal year-end. It is advisable to submit the PA 8879 C well in advance of the deadline to allow for any potential issues that may arise during the filing process.

Quick guide on how to complete e file signature authorization for rct 101 pa corporate net income tax report pa 8879 c formspublications

Complete E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C FormsPublications seamlessly on any gadget

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Manage E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C FormsPublications on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C FormsPublications effortlessly

- Locate E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C FormsPublications and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C FormsPublications and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e file signature authorization for rct 101 pa corporate net income tax report pa 8879 c formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 8879 C form used for?

The PA 8879 C form is used to electronically sign and submit your Pennsylvania state tax return. It allows taxpayers to authorize their e-filed tax returns without the need for a physical signature. Understanding this form is essential for a smooth e-filing process.

-

How can airSlate SignNow help with PA 8879 C e-signatures?

airSlate SignNow provides a secure and efficient way to e-sign the PA 8879 C form. By using our easy-to-navigate platform, you can quickly send, sign, and store your tax documents digitally, streamlining your filing process. Our solution is designed to simplify compliance with state tax requirements.

-

What features does airSlate SignNow offer for handling PA 8879 C forms?

airSlate SignNow offers features like customizable templates, in-app signing, and document tracking for PA 8879 C forms. Our platform ensures that you can manage your tax documents effectively, allowing for quick revisions and updates. These features make handling essential forms seamless and hassle-free.

-

Is airSlate SignNow cost-effective for signing the PA 8879 C?

Yes, airSlate SignNow is a cost-effective solution for handling the PA 8879 C form and other documentation needs. With various pricing plans available, businesses can choose the one that fits their budget without sacrificing quality. Our competitive pricing ensures you get value while meeting your e-signature requirements.

-

Can airSlate SignNow integrate with other software for managing PA 8879 C?

Absolutely, airSlate SignNow integrates seamlessly with various software applications to manage PA 8879 C forms effectively. Whether you use accounting software or customer relationship management tools, our platform can connect to streamline your processes. This integration ensures you maintain a smooth workflow throughout tax season.

-

What are the benefits of using airSlate SignNow for the PA 8879 C?

Using airSlate SignNow for the PA 8879 C offers numerous benefits, including enhanced security, improved efficiency, and compliance with e-signature laws. Our solution reduces paperwork and accelerates the filing process, allowing you to focus more on your business. Additionally, all data is stored securely, ensuring peace of mind.

-

How secure is airSlate SignNow when handling PA 8879 C forms?

airSlate SignNow prioritizes security when handling PA 8879 C forms. We employ advanced encryption methods to protect your documents and ensure that your personal information remains confidential. Our platform complies with industry standards for data protection, making it a safe choice for e-signatures and document management.

Get more for E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C FormsPublications

- Request for hearing miami dade county 2018 2019 form

- 12 943 2015 2019 form

- I hereby grant authorization to form

- Instructions for florida supreme court approved family law forms 12931a notice of production from nonparty and 12931b subpoena

- Forms packet counterpetition florida 2015 2019

- No administration necessary 2016 2019 form

- Ils prob 48a request for net worth statement and financial records form

- Landlord tenant and michigan courts form

Find out other E file Signature Authorization For RCT 101, PA Corporate Net Income Tax Report PA 8879 C FormsPublications

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe