New Mexico Net Operating Loss Carryforward Schedule for 2020

What is the New Mexico Net Operating Loss Carryforward Schedule For

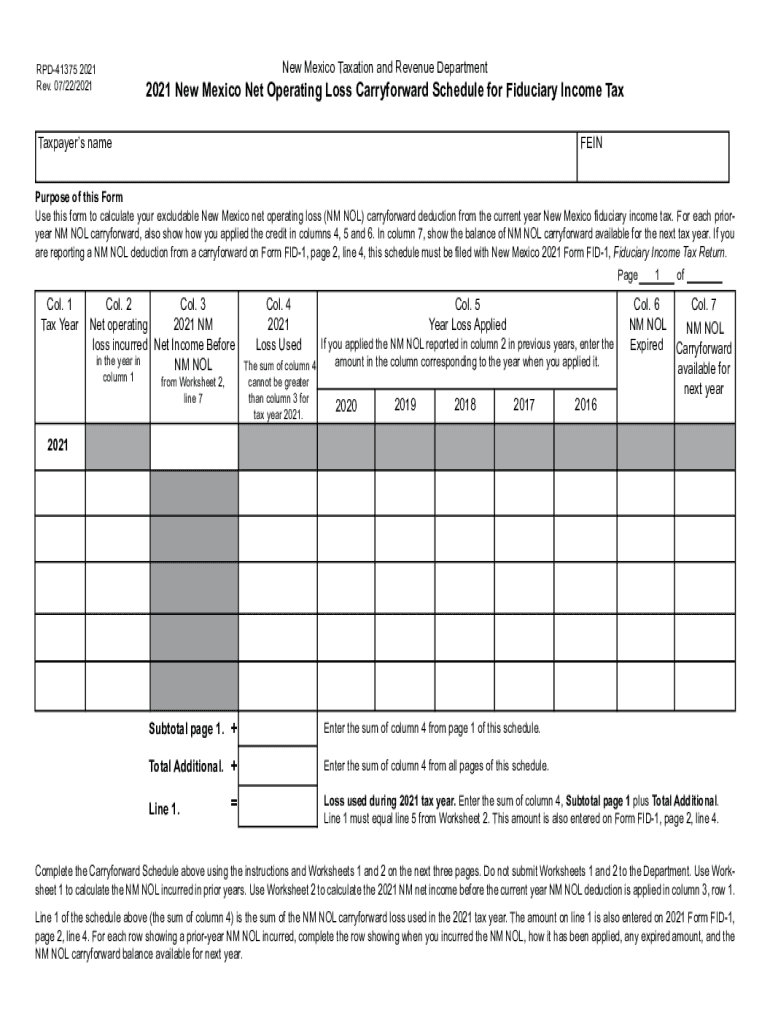

The New Mexico Net Operating Loss Carryforward Schedule is a tax document used by businesses to report net operating losses (NOLs) that can be carried forward to offset future taxable income. This schedule allows taxpayers to utilize losses from previous tax years, thereby reducing their overall tax liability in profitable years. Understanding this schedule is crucial for businesses looking to maximize their tax benefits and ensure compliance with state tax regulations.

How to use the New Mexico Net Operating Loss Carryforward Schedule For

To effectively use the New Mexico Net Operating Loss Carryforward Schedule, taxpayers must first determine their net operating loss for the current tax year. This involves calculating total income and allowable deductions. Once the NOL is identified, it should be reported on the schedule, indicating the amount to be carried forward. It is important to follow the specific instructions provided by the New Mexico Taxation and Revenue Department to ensure accurate reporting.

Steps to complete the New Mexico Net Operating Loss Carryforward Schedule For

Completing the New Mexico Net Operating Loss Carryforward Schedule involves several key steps:

- Calculate your net operating loss for the tax year by subtracting total deductions from total income.

- Review prior year returns to determine any unused losses that can be carried forward.

- Fill out the schedule, detailing the current year's NOL and any applicable carryforwards from previous years.

- Ensure all calculations are accurate and that the schedule is signed and dated before submission.

Key elements of the New Mexico Net Operating Loss Carryforward Schedule For

Important elements of the New Mexico Net Operating Loss Carryforward Schedule include:

- Taxpayer Information: Basic details about the business, including name and identification number.

- Current Year NOL: The amount of net operating loss incurred in the tax year.

- Carryforward Amount: Any losses from prior years that are being carried forward to the current year.

- Signature: Required for validation of the information provided on the schedule.

Eligibility Criteria

To be eligible to use the New Mexico Net Operating Loss Carryforward Schedule, businesses must meet specific criteria, including:

- Operating as a registered business entity in New Mexico.

- Experiencing a net operating loss in the current tax year.

- Having prior year losses that have not yet been fully utilized.

Filing Deadlines / Important Dates

Filing deadlines for the New Mexico Net Operating Loss Carryforward Schedule typically align with the overall tax filing deadlines. Businesses should be aware of the following important dates:

- Annual tax return due date, usually on the fifteenth day of the fourth month following the end of the tax year.

- Extensions may be available, but they do not extend the time to pay any taxes owed.

Quick guide on how to complete new mexico net operating loss carryforward schedule for

Complete New Mexico Net Operating Loss Carryforward Schedule For effortlessly on any device

Online document management has become increasingly popular with organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage New Mexico Net Operating Loss Carryforward Schedule For on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign New Mexico Net Operating Loss Carryforward Schedule For with ease

- Locate New Mexico Net Operating Loss Carryforward Schedule For and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign New Mexico Net Operating Loss Carryforward Schedule For and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexico net operating loss carryforward schedule for

Create this form in 5 minutes!

How to create an eSignature for the new mexico net operating loss carryforward schedule for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Mexico Net Operating Loss Carryforward Schedule for?

The New Mexico Net Operating Loss Carryforward Schedule for is a tax document used by businesses in New Mexico to carry forward net operating losses to future tax years. This schedule can help minimize tax liabilities by allowing businesses to offset future income with past losses.

-

How does airSlate SignNow assist with the New Mexico Net Operating Loss Carryforward Schedule for?

AirSlate SignNow provides an easy-to-use platform for electronically signing and sending the New Mexico Net Operating Loss Carryforward Schedule for. This simplifies the process of document management and ensures that your schedules are securely signed and archived.

-

Is there a cost associated with using airSlate SignNow for the New Mexico Net Operating Loss Carryforward Schedule for?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Our pricing plans cater to various needs, ensuring that you only pay for what you require while efficiently handling documents like the New Mexico Net Operating Loss Carryforward Schedule for.

-

What are the key features of airSlate SignNow for managing the New Mexico Net Operating Loss Carryforward Schedule for?

Key features include electronic signatures, document templates, and easy sharing options that streamline the entire process. These features allow businesses to efficiently manage the New Mexico Net Operating Loss Carryforward Schedule for, reducing time spent on paperwork.

-

Can I integrate airSlate SignNow with other software for the New Mexico Net Operating Loss Carryforward Schedule for?

Absolutely! AirSlate SignNow offers integrations with various software solutions, making it easy to manage your documents, including the New Mexico Net Operating Loss Carryforward Schedule for, within the systems you already use. This compatibility enhances workflow efficiency and reduces redundancy.

-

What benefits can I expect from using airSlate SignNow for the New Mexico Net Operating Loss Carryforward Schedule for?

By using airSlate SignNow for the New Mexico Net Operating Loss Carryforward Schedule for, businesses can save time, reduce errors, and ensure compliance. Our platform also enhances security and provides a clear audit trail for all signed documents.

-

Is it easy to use airSlate SignNow for the New Mexico Net Operating Loss Carryforward Schedule for?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows users to quickly navigate the platform and effectively manage their New Mexico Net Operating Loss Carryforward Schedule for with minimal training.

Get more for New Mexico Net Operating Loss Carryforward Schedule For

- Walkability checklist form

- Driver education practices in selected states form

- Easternwoodlandmetisnationns caformsewmnnscanadian soaring eagle metis nation ns

- Laboratory requisition contract service robinson lab form

- Declaration spouse form quebec

- Canada criminal records check form

- Emergency information and health history form name of child care

- Steering testimonial fill and sign printable template form

Find out other New Mexico Net Operating Loss Carryforward Schedule For

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document