New Mexico Net Operating Loss Carryforward Schedule for Fiduciary Income Tax 2018

What is the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

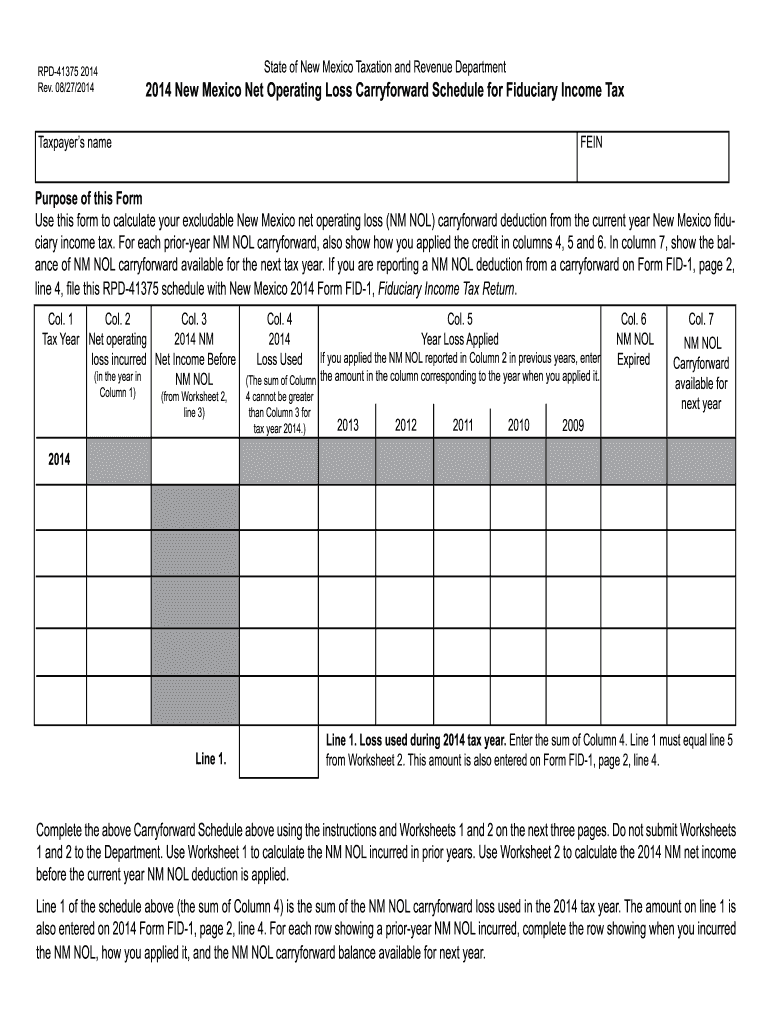

The New Mexico Net Operating Loss Carryforward Schedule for Fiduciary Income Tax is a tax form used by fiduciaries, such as estates and trusts, to report net operating losses that can be carried forward to offset future taxable income. This schedule allows fiduciaries to utilize losses incurred in prior years, providing potential tax relief. The form is essential for ensuring that fiduciaries accurately report their financial activities and comply with state tax regulations.

How to use the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

Using the New Mexico Net Operating Loss Carryforward Schedule involves several steps. First, fiduciaries must calculate their net operating loss for the current tax year. This loss can be carried forward to future years to reduce taxable income. The schedule requires detailed reporting of the losses, including the amount and the year in which the loss was incurred. Proper completion ensures that the fiduciary can benefit from the tax advantages associated with these losses.

Steps to complete the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

Completing the New Mexico Net Operating Loss Carryforward Schedule involves the following steps:

- Gather financial records for the relevant tax years.

- Calculate the total net operating loss for the current tax year.

- Fill out the schedule with accurate figures, specifying the year of the loss.

- Review the completed schedule for accuracy.

- Submit the schedule with the fiduciary income tax return.

Ensuring each step is followed carefully will help prevent errors and potential compliance issues.

Legal use of the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

The legal use of the New Mexico Net Operating Loss Carryforward Schedule is governed by state tax laws. Fiduciaries must adhere to these regulations to ensure that the losses are reported correctly. The schedule must be completed in accordance with the guidelines set forth by the New Mexico Taxation and Revenue Department. Failure to comply with these legal requirements may result in penalties or disallowance of the carryforward losses.

Key elements of the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

Key elements of the New Mexico Net Operating Loss Carryforward Schedule include:

- Identification of the fiduciary: Name and tax identification number of the fiduciary.

- Net operating loss calculation: Detailed calculation of the loss for the current year.

- Year of loss: Specification of the tax year in which the loss was incurred.

- Carryforward amount: Amount of the loss being carried forward to future tax years.

These elements are crucial for accurately reporting and utilizing net operating losses in compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the New Mexico Net Operating Loss Carryforward Schedule are typically aligned with the fiduciary income tax return deadlines. Fiduciaries should be aware of the following important dates:

- Tax return due date: Generally, the 15th day of the fourth month following the end of the tax year.

- Extension deadlines: If an extension is filed, the due date may be extended by six months.

Staying informed about these deadlines helps ensure timely submission and compliance with state tax requirements.

Quick guide on how to complete 2014 new mexico net operating loss carryforward schedule for fiduciary income tax

Prepare New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax with ease

- Obtain New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

No more worries about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Alter and electronically sign New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax to ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 new mexico net operating loss carryforward schedule for fiduciary income tax

Create this form in 5 minutes!

How to create an eSignature for the 2014 new mexico net operating loss carryforward schedule for fiduciary income tax

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax?

The New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax is a document that allows fiduciaries to carry forward net operating losses to offset future taxable income. This schedule is essential for managing tax liabilities and optimizing financial returns for trusts and estates in New Mexico.

-

How can airSlate SignNow assist with the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax?

airSlate SignNow provides a user-friendly platform for electronically signing and managing the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax. Our solution ensures that documents are processed quickly and securely, streamlining your fiduciary tax compliance.

-

Is there a cost associated with using airSlate SignNow for fiduciary tax documents?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. Each plan provides access to features like document management and e-signature capabilities, ensuring you can effectively manage the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax at a cost-effective rate.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow includes features such as document templates, cloud storage, and real-time collaboration. These tools are particularly beneficial for handling the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax, allowing users to streamline the document creation and signing processes.

-

Can I integrate airSlate SignNow with other accounting software for tax preparation?

Yes, airSlate SignNow supports integrations with popular accounting software, enhancing your workflow for handling the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax. This integration allows for seamless data transfer and efficient tax preparation.

-

What benefits does electronic signing provide for fiduciary income tax documents?

Electronic signing simplifies the process of completing the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax. It reduces the time spent on paperwork, minimizes errors, and enhances security, providing peace of mind for fiduciaries managing sensitive tax information.

-

How secure is airSlate SignNow for handling sensitive tax documents?

AirSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Your New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax and other sensitive documents are protected, ensuring confidentiality and integrity throughout the signing process.

Get more for New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

- Borang permohonan ansuran form

- Sample request letter for dole no pending case form

- Nnn agreement template pdf form

- Camera report 2 fotokem form

- Legal capacity to contract marriage form

- Express limited home warranty form

- Dna structure worksheet high school pdf form

- Vcat financial statement and plan form

Find out other New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement