New Mexico Net Operating Loss Carryforward Schedule for Fiduciary Income Tax 2015

Understanding the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

The New Mexico Net Operating Loss Carryforward Schedule for Fiduciary Income Tax is a crucial form for fiduciaries managing estates or trusts that have incurred net operating losses. This form allows these entities to carry forward losses to offset future taxable income, which can significantly reduce tax liabilities in subsequent years. Understanding how this schedule works is essential for effective tax planning and compliance.

Steps to Complete the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

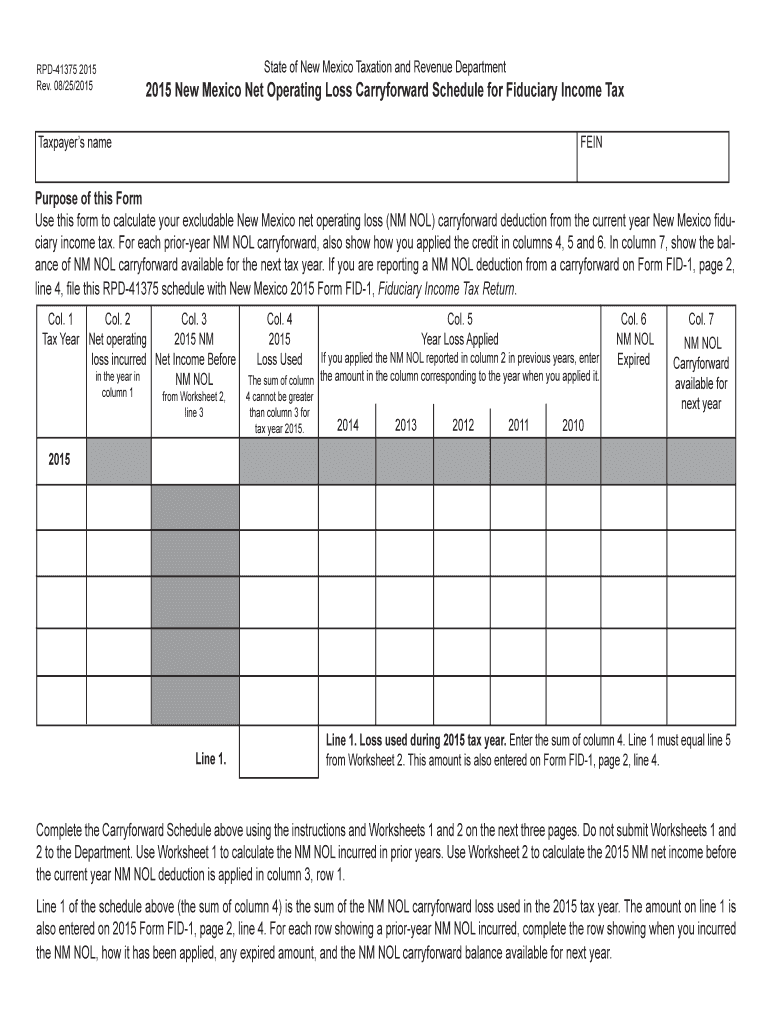

Completing the New Mexico Net Operating Loss Carryforward Schedule involves several key steps:

- Gather financial statements and tax documents from the relevant tax year.

- Calculate the total net operating loss for the year, ensuring that all allowable deductions are included.

- Fill out the schedule by entering the calculated loss and any prior year losses being carried forward.

- Review the completed schedule for accuracy before submission.

- Submit the schedule along with the fiduciary income tax return.

Legal Use of the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

The legal use of the New Mexico Net Operating Loss Carryforward Schedule is governed by state tax laws. To ensure compliance, fiduciaries must follow specific regulations regarding the reporting of losses. Proper completion and submission of the form are essential for maintaining the legal validity of the carryforward claims. Additionally, adhering to deadlines and maintaining accurate records is crucial to avoid penalties.

Eligibility Criteria for the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

Eligibility to use the New Mexico Net Operating Loss Carryforward Schedule primarily depends on the type of fiduciary entity and the nature of the losses incurred. Generally, estates and trusts that have reported net operating losses on their federal tax returns may qualify. It is important to review both state and federal guidelines to determine eligibility and ensure that all requirements are met.

How to Obtain the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

The New Mexico Net Operating Loss Carryforward Schedule can be obtained through the New Mexico Taxation and Revenue Department's official website. It is also available in tax preparation software that supports state tax forms. Users can download and print the schedule or fill it out electronically using compatible software solutions, ensuring a smooth filing process.

Filing Deadlines for the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

Filing deadlines for the New Mexico Net Operating Loss Carryforward Schedule align with the due dates for fiduciary income tax returns. Typically, fiduciary returns are due on the 15th day of the fourth month following the end of the tax year. It is essential to be aware of these deadlines to avoid late filing penalties and ensure that carryforward claims are processed in a timely manner.

Quick guide on how to complete 2015 new mexico net operating loss carryforward schedule for fiduciary income tax

Complete New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to alter and electronically sign New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax with ease

- Locate New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searching, or mistakes that require issuing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Alter and electronically sign New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 new mexico net operating loss carryforward schedule for fiduciary income tax

Create this form in 5 minutes!

How to create an eSignature for the 2015 new mexico net operating loss carryforward schedule for fiduciary income tax

How to create an eSignature for your 2015 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax in the online mode

How to make an electronic signature for the 2015 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax in Google Chrome

How to make an electronic signature for putting it on the 2015 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax in Gmail

How to generate an eSignature for the 2015 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax right from your mobile device

How to make an electronic signature for the 2015 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax on iOS devices

How to create an electronic signature for the 2015 New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax on Android devices

People also ask

-

What is the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax?

The New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax allows fiduciaries to utilize their net operating losses to offset future taxable income. This schedule enables taxpayers to carry forward losses, providing signNow tax relief in subsequent years. It is essential for fiduciaries to understand how to manage these losses effectively.

-

How can airSlate SignNow assist with the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax?

airSlate SignNow streamlines the process of signing and managing documents related to the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax. With our easy-to-use platform, fiduciaries can securely eSign necessary forms and documents. This ensures compliance and boosts efficiency in tax reporting.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as document templates, in-platform eSigning, and secure cloud storage, all tailored for managing the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax. These tools make it easy for fiduciaries to prepare, sign, and store essential tax documents. Our platform ensures that all documents are organized and easily accessible.

-

Is airSlate SignNow a cost-effective solution for fiduciaries dealing with tax forms?

Yes, airSlate SignNow provides a cost-effective solution for fiduciaries managing the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that effective document management doesn't break the bank. With flexible pricing, it's easier for fiduciaries to stay compliant while saving on administrative costs.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, aiding in the efficient management of the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax. These integrations ensure that all of your important documents sync automatically, reducing manual entry and potential errors. This streamlines your workflow, making tax preparation more straightforward.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax, offers numerous benefits. You can create, edit, and eSign documents with minimal hassle, ensuring compliance and accuracy. Additionally, the user-friendly interface simplifies document management, helping save time and reducing stress.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes the security of your documents, including the New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax. We utilize advanced encryption and secure cloud storage to protect your data. By ensuring that your sensitive tax documents are safe, we help you meet compliance requirements while maintaining peace of mind.

Get more for New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

- Xlsplpl135 form

- Form hcb 002p

- Louisiana department of insurance application form speciality insurer

- Th amp wendyamp39s workplace inspection recording form

- Alabama am intent to vacate form

- Acl 08 29 cdss cdss ca form

- Generate fillable qr code form

- Special diet request form comal independent school district comalisd

Find out other New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later