Get the New Mexico Rpd 41375 Form pdfFiller 2020

What is the New Mexico RPD 41375 Form?

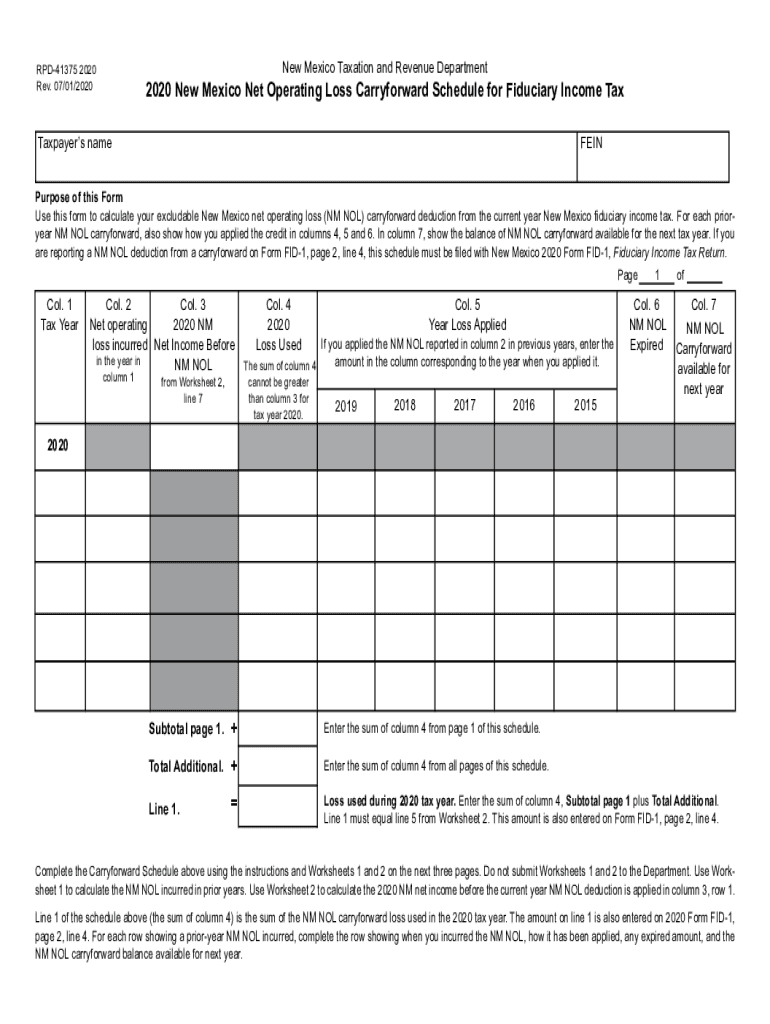

The New Mexico RPD 41375 form, also known as the carryforward schedule, is a tax document used by individuals and businesses to report net operating losses (NOL) that can be carried forward to offset future taxable income. This form is essential for taxpayers who have incurred losses in previous years and wish to utilize those losses to reduce their tax liability in subsequent years. The RPD 41375 allows for the systematic tracking of these losses, ensuring compliance with state tax regulations.

Steps to Complete the New Mexico RPD 41375 Form

Filling out the RPD 41375 form involves several key steps:

- Gather all necessary financial documents, including prior year tax returns and any supporting documentation for your net operating losses.

- Access the RPD 41375 form, which can typically be found on the New Mexico Taxation and Revenue Department's website or through authorized tax software.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Detail your net operating losses from previous years, ensuring that you accurately calculate the amount you wish to carry forward.

- Review the completed form for accuracy, ensuring all calculations are correct and all required fields are filled out.

- Submit the form according to the instructions, whether electronically or by mail, ensuring you meet any applicable deadlines.

Legal Use of the New Mexico RPD 41375 Form

The RPD 41375 form is legally recognized for reporting net operating losses in New Mexico. To ensure that your submission is compliant with state tax laws, it is crucial to follow all guidelines provided by the New Mexico Taxation and Revenue Department. This includes understanding how to accurately report your losses and the rules governing the carryforward of those losses. Failure to comply with these regulations can lead to penalties or disallowance of the losses claimed.

Filing Deadlines for the New Mexico RPD 41375 Form

Timely filing of the RPD 41375 form is critical for taxpayers wishing to utilize their net operating losses. Generally, the form must be submitted by the tax return due date for the year in which the losses were incurred. Taxpayers should be aware of specific deadlines, which may vary depending on whether they are filing for an individual or business entity. It is advisable to check the New Mexico Taxation and Revenue Department's website for the most current filing deadlines.

Required Documents for the New Mexico RPD 41375 Form

When completing the RPD 41375 form, several documents are typically required to substantiate your net operating losses. These may include:

- Prior year tax returns that reflect the losses.

- Financial statements or records detailing income and expenses.

- Any documentation supporting the calculation of your net operating losses.

Having these documents ready will facilitate a smoother filing process and ensure that your claim is well-supported.

Digital vs. Paper Version of the New Mexico RPD 41375 Form

The RPD 41375 form is available in both digital and paper formats. The digital version can be filled out and submitted online, offering convenience and efficiency. Electronic filing often allows for quicker processing times and immediate confirmation of submission. Conversely, the paper version can be printed and mailed, which may be preferred by those who are not comfortable with digital submissions. Regardless of the format chosen, it is essential to ensure that all information is accurate and complete to avoid delays in processing.

Quick guide on how to complete get the free new mexico rpd 41375 2018 2020 form pdffiller

Complete Get The New Mexico Rpd 41375 Form PdfFiller effortlessly on any device

Managing documents online has gained popularity among enterprises and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the proper form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents promptly without delays. Handle Get The New Mexico Rpd 41375 Form PdfFiller on any device using the airSlate SignNow Android or iOS applications and streamline any document-centric task today.

How to modify and eSign Get The New Mexico Rpd 41375 Form PdfFiller with ease

- Obtain Get The New Mexico Rpd 41375 Form PdfFiller and click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize pertinent sections of your documents or redact confidential information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature utilizing the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management with just a few clicks from your preferred device. Modify and eSign Get The New Mexico Rpd 41375 Form PdfFiller and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free new mexico rpd 41375 2018 2020 form pdffiller

Create this form in 5 minutes!

How to create an eSignature for the get the free new mexico rpd 41375 2018 2020 form pdffiller

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the rpd41375 carryforward schedule sample?

The rpd41375 carryforward schedule sample is a template that helps businesses manage their financial carryforwards efficiently. It outlines the necessary data points to record and track carryforward amounts accurately, making it easier to stay compliant and informed.

-

How can I access the rpd41375 carryforward schedule sample?

You can download the rpd41375 carryforward schedule sample directly from our website. Simply navigate to our templates section, and you will find the rpd41375 template available for free, allowing you to start using it immediately.

-

Is the rpd41375 carryforward schedule sample customizable?

Yes, the rpd41375 carryforward schedule sample is fully customizable to fit your business needs. You can easily modify the template to add your specific financial categories or adjust formatting, ensuring it aligns with your accounting processes.

-

What are the benefits of using the rpd41375 carryforward schedule sample?

Using the rpd41375 carryforward schedule sample provides several benefits, including enhanced accuracy in tracking carryforwards and improved organizational efficiency. It helps prevent errors and ensures you have a clear understanding of your financial position at all times.

-

Can I integrate the rpd41375 carryforward schedule sample with other tools?

Yes, our rpd41375 carryforward schedule sample can be easily integrated with various accounting and financial management tools. This integration allows for seamless import and export of data, ensuring that your workflows remain efficient.

-

What pricing options are available for the rpd41375 carryforward schedule sample?

The rpd41375 carryforward schedule sample is available for free on our website. While the sample is free, we offer additional premium templates and services that provide even more features to assist with your financial tracking needs.

-

Who can benefit from using the rpd41375 carryforward schedule sample?

The rpd41375 carryforward schedule sample is beneficial for accountants, financial analysts, and business owners seeking a structured method for managing carryforwards. It’s designed to simplify the process for anyone involved in financial reporting.

Get more for Get The New Mexico Rpd 41375 Form PdfFiller

Find out other Get The New Mexico Rpd 41375 Form PdfFiller

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later