Form Rpd 41375 2016

What is the Form RPD 41375

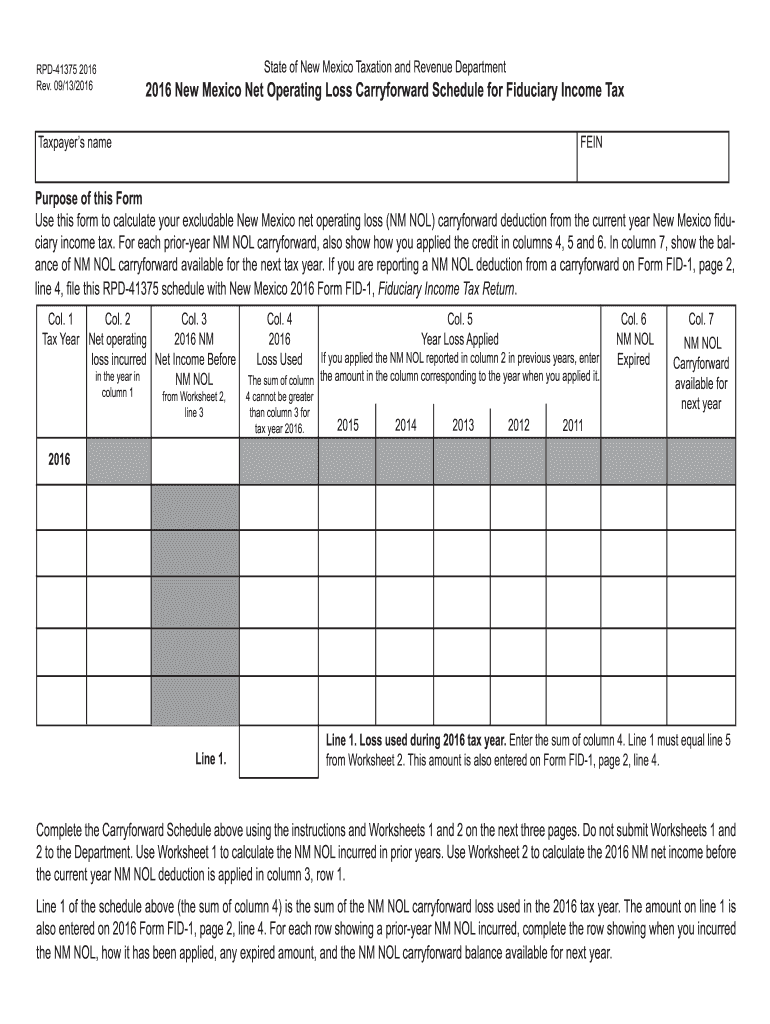

The New Mexico Form RPD 41375 is a tax document specifically designed for reporting certain tax-related information to the New Mexico Taxation and Revenue Department. This form is essential for individuals and businesses to accurately declare their tax liabilities and ensure compliance with state tax regulations. It is important to understand the purpose of this form, as it plays a significant role in the overall tax filing process in New Mexico.

How to use the Form RPD 41375

Using the New Mexico Form RPD 41375 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information relevant to your tax situation. Next, fill out the form by entering the required details in the designated fields. It is crucial to double-check the information for accuracy before submission. Once completed, you can submit the form electronically or via mail, depending on your preference and the requirements set by the New Mexico Taxation and Revenue Department.

Steps to complete the Form RPD 41375

Completing the New Mexico Form RPD 41375 requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Access the form online or obtain a physical copy from the New Mexico Taxation and Revenue Department.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide detailed information regarding your income, deductions, and credits as applicable.

- Review the completed form for accuracy, ensuring all fields are filled correctly.

- Submit the form electronically through an approved platform or mail it to the designated address.

Legal use of the Form RPD 41375

The legal use of the New Mexico Form RPD 41375 is governed by state tax laws and regulations. This form must be filled out accurately and submitted by the designated deadlines to avoid potential penalties. The information provided on this form is used by the state to assess tax liabilities and ensure compliance with tax obligations. Therefore, it is essential to understand the legal implications of submitting this form, including the requirement for truthful and complete disclosures.

Filing Deadlines / Important Dates

Filing deadlines for the New Mexico Form RPD 41375 are critical to ensure compliance and avoid penalties. Generally, the form must be submitted by the state’s tax filing deadline, which typically aligns with the federal tax deadlines. It is advisable to check the New Mexico Taxation and Revenue Department's official calendar for specific dates each year, as they may vary. Staying informed about these deadlines helps taxpayers plan their submissions effectively.

Form Submission Methods (Online / Mail / In-Person)

The New Mexico Form RPD 41375 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can complete and submit the form electronically through the New Mexico Taxation and Revenue Department's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the state.

- In-Person: Some taxpayers may choose to submit the form in person at designated state offices, ensuring immediate receipt.

Quick guide on how to complete non scannable forms revision dates for software real file

Your assistance manual on how to prepare your Form Rpd 41375

If you're unsure about how to create and submit your Form Rpd 41375, below are some brief instructions on how to streamline your tax filing process.

To begin, you simply need to sign up for your airSlate SignNow profile to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to alter, generate, and finalize your income tax forms with ease. With its editor, you can alternate between text, checkboxes, and eSignatures, returning to modify information as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and seamless sharing features.

Follow these steps to complete your Form Rpd 41375 in no time:

- Create your profile and start working on PDFs almost immediately.

- Utilize our directory to obtain any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Form Rpd 41375 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make the most of this guide to file your taxes electronically with airSlate SignNow. Please remember that filing on paper can lead to increased errors and delays in refunds. Moreover, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct non scannable forms revision dates for software real file

FAQs

-

How can I apply to Thapar University if I haven't filled out the form, and the last date for filling it out has passed?

Form filling was the most important thing. So, now you have only one option:- Contact the authorities and if they tell you to visit the campus, then don’t look for any other chance. Just come to campus.

-

How do I get admission to Bhawanipur Education Society College if I have missed the last date for filling out the application form for the UG programme?

You can contact to the Dean of the college or system control room of http://college.So that they can help you further and in most of the cases they consider these things.

Create this form in 5 minutes!

How to create an eSignature for the non scannable forms revision dates for software real file

How to create an eSignature for your Non Scannable Forms Revision Dates For Software Real File in the online mode

How to generate an eSignature for the Non Scannable Forms Revision Dates For Software Real File in Google Chrome

How to make an electronic signature for signing the Non Scannable Forms Revision Dates For Software Real File in Gmail

How to create an eSignature for the Non Scannable Forms Revision Dates For Software Real File straight from your mobile device

How to make an eSignature for the Non Scannable Forms Revision Dates For Software Real File on iOS

How to make an eSignature for the Non Scannable Forms Revision Dates For Software Real File on Android OS

People also ask

-

What is Form Rpd 41375 and how can airSlate SignNow help with it?

Form Rpd 41375 is a document required for various administrative processes. With airSlate SignNow, you can easily upload, fill out, and eSign Form Rpd 41375, streamlining your workflow and ensuring compliance with all necessary regulations.

-

Is there a cost associated with using airSlate SignNow for Form Rpd 41375?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on the features you require for managing Form Rpd 41375, you can choose a plan that is both cost-effective and aligns with your document signing requirements.

-

What features does airSlate SignNow offer for managing Form Rpd 41375?

airSlate SignNow provides a variety of features for managing Form Rpd 41375, including customizable templates, secure eSigning, and automated workflows. These features enhance efficiency and ensure that you can handle all aspects of Form Rpd 41375 with ease.

-

How does airSlate SignNow ensure the security of Form Rpd 41375?

Security is a top priority at airSlate SignNow. When handling Form Rpd 41375, your documents are protected with encryption, secure data storage, and compliance with industry standards, ensuring that your sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other applications for Form Rpd 41375?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as CRM systems and cloud storage services. This allows you to manage Form Rpd 41375 alongside your existing tools, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for Form Rpd 41375?

Using airSlate SignNow for Form Rpd 41375 offers numerous benefits, including time savings, reduced paperwork, and enhanced collaboration. With its user-friendly interface, you can complete and send Form Rpd 41375 quickly and effectively.

-

Is it easy to collaborate on Form Rpd 41375 using airSlate SignNow?

Yes, airSlate SignNow makes collaboration on Form Rpd 41375 straightforward. You can invite team members to review and sign the document, track changes in real-time, and communicate directly within the platform for a smooth collaborative experience.

Get more for Form Rpd 41375

- Weekly report internship form

- Disposition of salvage report ibc form

- Dhhs 2900a form

- Form rd 4279 1a

- Joint supplemental petition and agreement to modify final judgment form

- Fullard review submission package for web postingdoc form

- Owcp 957a medical travel refund requestmileage form

- Non refundable deposit agreement template form

Find out other Form Rpd 41375

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip