ExemptionCertificatesNOTE Underlying Law May Have 2015

What is the Kansas Exemption PDF?

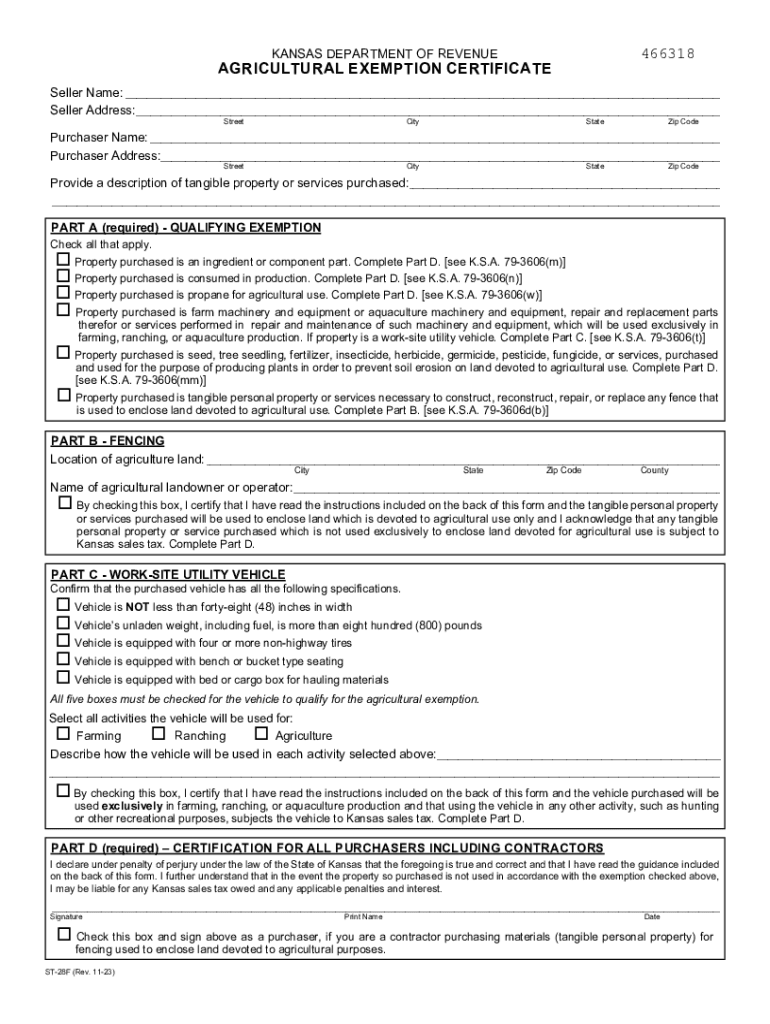

The Kansas Exemption PDF is a crucial document used for claiming tax exemptions in the state of Kansas. This form is primarily utilized by businesses and individuals to certify their eligibility for specific tax exemptions, such as sales tax. Understanding the purpose of this form is essential for compliance with Kansas tax regulations.

How to Obtain the Kansas Exemption PDF

To obtain the Kansas Exemption PDF, you can visit the Kansas Department of Revenue website, where the form is readily available for download. It is important to ensure that you are using the most current version of the form, as updates may occur. Additionally, you can request a physical copy from local tax offices if you prefer a hard copy.

Steps to Complete the Kansas Exemption PDF

Completing the Kansas Exemption PDF involves several straightforward steps:

- Begin by entering your personal or business information, including name, address, and contact details.

- Specify the type of exemption you are claiming by selecting the appropriate category.

- Provide any necessary identification numbers, such as your Kansas sales tax number.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the Kansas Exemption PDF

The Kansas Exemption PDF serves as a legal document that allows eligible individuals and businesses to claim tax exemptions. It is essential to use this form in accordance with Kansas tax laws to avoid penalties. Misuse or fraudulent claims can lead to significant legal consequences, including fines and back taxes.

Key Elements of the Kansas Exemption PDF

Key elements of the Kansas Exemption PDF include:

- Identification of the exempt entity or individual.

- Detailed description of the goods or services for which the exemption is claimed.

- Signature of the authorized representative, confirming the accuracy of the information.

Examples of Using the Kansas Exemption PDF

Common scenarios for using the Kansas Exemption PDF include:

- A business purchasing materials for manufacturing, which are exempt from sales tax.

- An organization claiming exemption on purchases made for charitable purposes.

Quick guide on how to complete exemptioncertificatesnote underlying law may have

Effortlessly prepare ExemptionCertificatesNOTE Underlying Law May Have on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed materials, as you can acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage ExemptionCertificatesNOTE Underlying Law May Have on any platform with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign ExemptionCertificatesNOTE Underlying Law May Have with ease

- Locate ExemptionCertificatesNOTE Underlying Law May Have and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors requiring new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you choose. Alter and electronically sign ExemptionCertificatesNOTE Underlying Law May Have to ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct exemptioncertificatesnote underlying law may have

Create this form in 5 minutes!

How to create an eSignature for the exemptioncertificatesnote underlying law may have

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kansas exemption PDF and how is it used?

The Kansas exemption PDF is a document that helps you outline specific exemptions you may qualify for under Kansas tax laws. Utilizing this PDF allows businesses and individuals to formalize their exemption claims, ensuring compliance with state regulations.

-

How can airSlate SignNow help me manage my Kansas exemption PDF?

airSlate SignNow streamlines the process of creating, signing, and managing your Kansas exemption PDF. With its user-friendly interface, you can easily upload the PDF, fill it out, and get it signed electronically, saving you time and effort in the process.

-

Is there a cost associated with using the Kansas exemption PDF features?

While airSlate SignNow offers various pricing plans, the features related to the Kansas exemption PDF are integrated into our service packages. Pricing varies depending on the level of features you require, but we ensure that our solutions are cost-effective for businesses of all sizes.

-

Can I integrate the Kansas exemption PDF with other applications?

Yes, airSlate SignNow allows seamless integration with various applications to enhance your workflow. You can easily connect your Kansas exemption PDF workflow with popular tools like Google Drive, Dropbox, and CRM systems, improving your document management processes.

-

What are the benefits of using airSlate SignNow for Kansas exemption PDFs?

Using airSlate SignNow for managing your Kansas exemption PDFs offers numerous benefits, including quick electronic signatures, secure document storage, and easy collaboration with others. These features help streamline the documentation process while ensuring compliance with Kansas regulations.

-

Can I share the Kansas exemption PDF with my team?

Absolutely! airSlate SignNow allows you to share your Kansas exemption PDF effortlessly with your team members. You can collaborate in real-time, making it easier to gather feedback and ensure that every detail is accurate before finalizing the document.

-

How secure is my Kansas exemption PDF with airSlate SignNow?

Security is a top priority for airSlate SignNow. Your Kansas exemption PDF and all other documents are protected with industry-standard encryption and secure data storage, ensuring that your sensitive information remains confidential throughout the signing process.

Get more for ExemptionCertificatesNOTE Underlying Law May Have

- Talent showcase flyer form

- Fairfax water landlord tenant form

- Worksheet for labeling the moon form

- Safety egan form

- Theatre company callboard newsletter tcoe form

- 2012 tax form 1099 r distributions from retirement plans form 1099 r reports both full and partial distributions from your

- Fill in the blanks about knights 2001 form

- Form 8995 a

Find out other ExemptionCertificatesNOTE Underlying Law May Have

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will