Form OIC Fee Virginia Department of Taxation Fee for Doubtful 2022

Understanding the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful

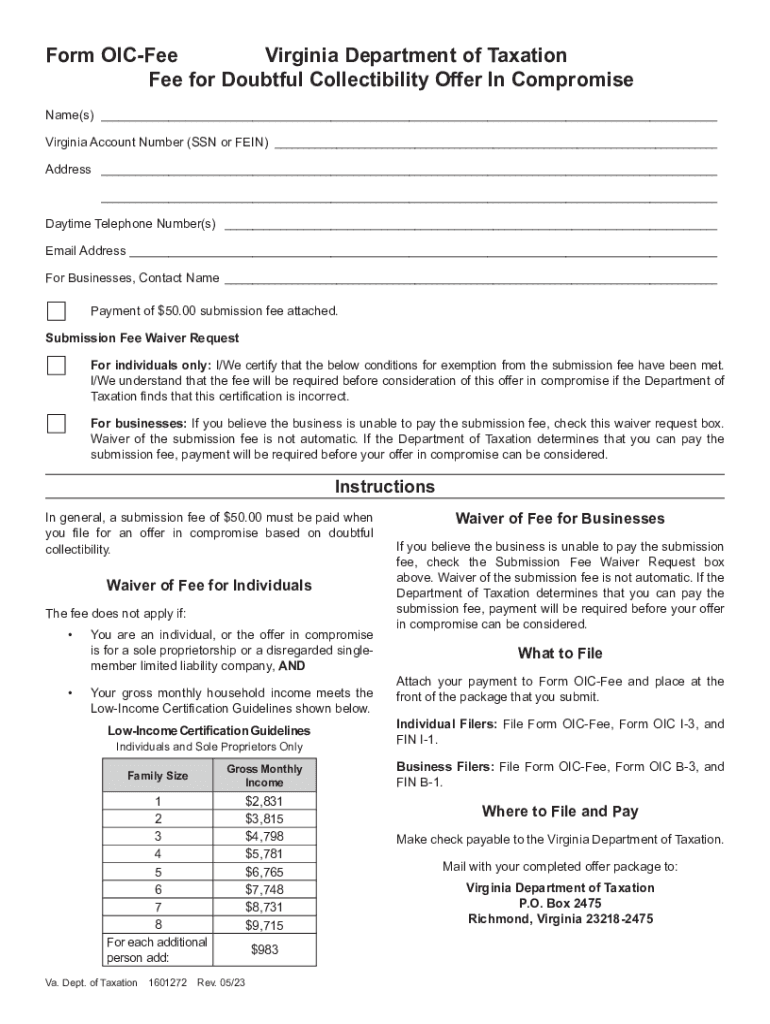

The Form OIC Fee Virginia Department Of Taxation Fee For Doubtful is a specific form used within the Virginia Department of Taxation. It is designed for taxpayers who wish to submit an Offer in Compromise (OIC) due to doubts regarding their ability to pay the full tax liability. This form allows individuals to negotiate a settlement with the state, potentially reducing the amount owed. Understanding this form is crucial for those seeking financial relief from tax debts.

Steps to Complete the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful

Completing the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful involves several key steps:

- Gather necessary financial documents, including income statements, bank statements, and any relevant tax returns.

- Fill out the form accurately, ensuring all personal and financial information is current and correct.

- Provide a detailed explanation of your financial situation, including any hardships that justify the offer.

- Calculate the proposed offer amount based on your ability to pay, which should be realistic and supported by your financial data.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful

To qualify for the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful, taxpayers must meet specific eligibility criteria. These include:

- Demonstrating a genuine inability to pay the full tax liability.

- Providing accurate and complete financial information.

- Being compliant with all filing and payment requirements for prior tax years.

- Submitting the form within the designated time frame set by the Virginia Department of Taxation.

Required Documents for the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful

When submitting the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful, certain documents are required to support your application. These documents typically include:

- Recent pay stubs or proof of income.

- Bank statements for the past few months.

- Tax returns for the last three years.

- Documentation of any debts or financial obligations.

- Any other relevant financial information that supports your offer.

Form Submission Methods for the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful

Taxpayers can submit the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful through various methods. These include:

- Online submission via the Virginia Department of Taxation's official website.

- Mailing the completed form to the designated address provided by the department.

- In-person submission at local tax offices, if applicable.

Penalties for Non-Compliance with the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful

Failure to comply with the requirements of the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful can result in several penalties. These may include:

- Rejection of the offer, leading to the full tax liability remaining due.

- Potential legal action by the Virginia Department of Taxation to collect the owed amount.

- Accrual of additional interest and penalties on the outstanding tax balance.

Quick guide on how to complete form oic fee virginia department of taxation fee for doubtful

Complete Form OIC Fee Virginia Department Of Taxation Fee For Doubtful seamlessly on any device

Digital document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents promptly without delay. Manage Form OIC Fee Virginia Department Of Taxation Fee For Doubtful on any device with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to alter and eSign Form OIC Fee Virginia Department Of Taxation Fee For Doubtful effortlessly

- Locate Form OIC Fee Virginia Department Of Taxation Fee For Doubtful and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes a few seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Edit and eSign Form OIC Fee Virginia Department Of Taxation Fee For Doubtful and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form oic fee virginia department of taxation fee for doubtful

Create this form in 5 minutes!

How to create an eSignature for the form oic fee virginia department of taxation fee for doubtful

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful?

The Form OIC Fee Virginia Department Of Taxation Fee For Doubtful is a fee associated with submitting an Offer in Compromise to settle outstanding tax liabilities. This fee is essential for those taxpayers who believe their tax debts are uncollectible. Understanding this fee can help you determine if pursuing an Offer in Compromise is the right choice for your financial situation.

-

How much is the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful?

The Form OIC Fee Virginia Department Of Taxation Fee For Doubtful is typically set at a specific amount, which can vary. It is advisable to check the Virginia Department of Taxation's website for the most current fee structure. Being aware of this fee helps in budgeting for your tax compliance process.

-

What features does airSlate SignNow offer for handling Form OIC submissions?

airSlate SignNow offers a range of features tailored for handling Form OIC submissions, including eSigning, document tracking, and advanced templates. These features streamline the submission process and ensure that all necessary documents are completed accurately. Using airSlate SignNow can simplify the management of your Form OIC Fee Virginia Department Of Taxation Fee For Doubtful.

-

How can airSlate SignNow benefit businesses preparing Form OIC?

airSlate SignNow benefits businesses by providing an efficient and cost-effective platform for preparing and submitting Form OIC. It ensures quick turnaround times and enhances collaboration within teams. This can signNowly reduce the stress associated with handling the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful and other related documentation.

-

Are there integrations available with airSlate SignNow for tax-related software?

Yes, airSlate SignNow offers integrations with various tax-related software and platforms. This compatibility allows for seamless data transfer and document management, making the process of handling the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful more streamlined. Users can enhance their productivity by leveraging these integrations.

-

Is airSlate SignNow secure for submitting sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security to protect sensitive tax documents. With robust encryption and compliance with industry standards, users can confidently submit their Form OIC and related documents. This security ensures that the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful and other information remain confidential.

-

How does airSlate SignNow simplify the documentation process for Form OIC?

airSlate SignNow simplifies the documentation process for Form OIC by offering intuitive templates and easy-to-use editing tools. This allows users to quickly fill out the necessary forms and eSign them in a matter of minutes. By making the process easier, airSlate SignNow helps you handle the Form OIC Fee Virginia Department Of Taxation Fee For Doubtful more efficiently.

Get more for Form OIC Fee Virginia Department Of Taxation Fee For Doubtful

- Phone 706 446 1430 form

- Application verificationtroy university form

- Ordering an official transcript andor diploma in person form

- International travel policydocx form

- Deltatravel toiletrymakeup bagutopia creations form

- Cardiovascular sciences and perfusion medicine observation form

- University of north florida transcripts form

- Student conduct records request form student conduct records request form

Find out other Form OIC Fee Virginia Department Of Taxation Fee For Doubtful

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT