Schedule K to Form 990 and Fundamentals of Tax Exempt 2022

Understanding Schedule K To Form 990

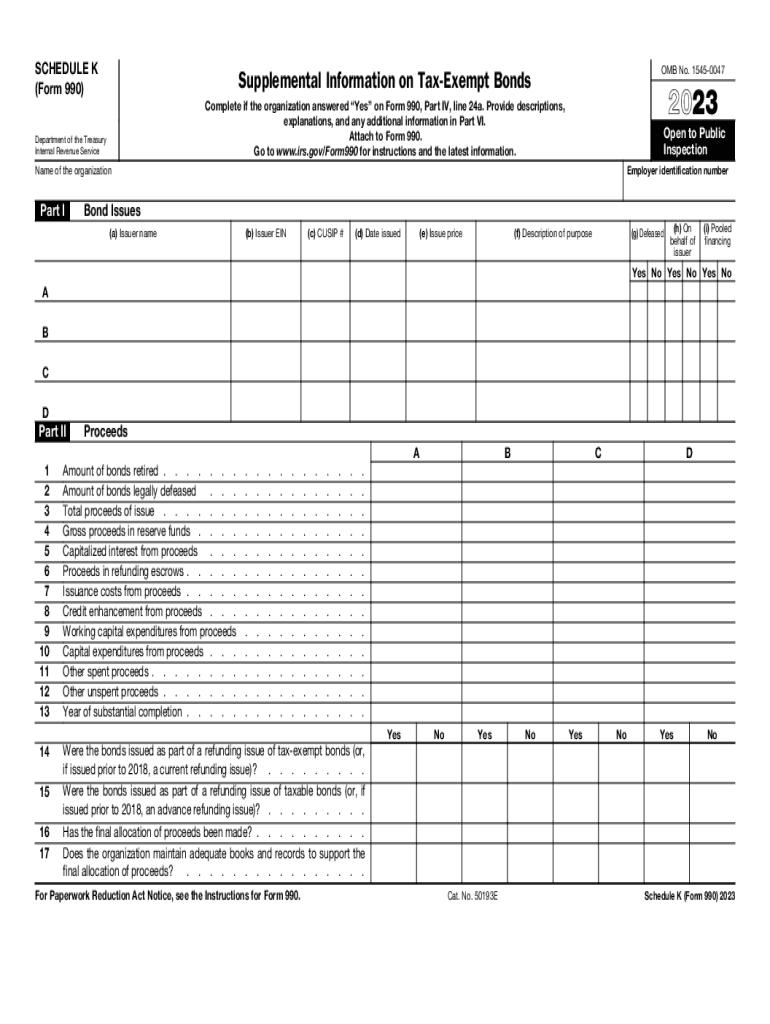

Schedule K is a supplemental form that accompanies Form 990, which is filed by tax-exempt organizations in the United States. This schedule is specifically designed to provide detailed information about the organization's activities related to tax-exempt purposes. It includes disclosures about the organization’s governance, financial activities, and compliance with federal tax laws. Understanding this form is crucial for maintaining tax-exempt status and ensuring transparency in operations.

Steps to Complete Schedule K To Form 990

Completing Schedule K involves several key steps to ensure accuracy and compliance. Begin by gathering necessary financial records and documentation related to the organization's activities. Next, fill out the form by providing detailed information about the organization's governance structure, including board members and their roles. Ensure that all financial data is accurately reported, including revenue and expenditures related to tax-exempt activities. Review the completed form for accuracy before submission.

Key Elements of Schedule K To Form 990

Schedule K includes several important sections that require careful attention. Key elements include:

- Governance Information: Details about the board of directors and management practices.

- Financial Activities: Reporting of revenue and expenses related to tax-exempt operations.

- Compliance Information: Disclosures regarding adherence to federal tax laws and regulations.

Each section plays a vital role in demonstrating the organization's commitment to transparency and compliance with tax-exempt requirements.

IRS Guidelines for Schedule K To Form 990

The IRS provides specific guidelines for completing Schedule K. Organizations must adhere to these guidelines to avoid penalties and maintain their tax-exempt status. Key guidelines include accurate reporting of financial data, timely submission of the form, and ensuring that all required disclosures are included. Organizations should regularly review IRS updates to stay informed about any changes in requirements.

Filing Deadlines for Schedule K To Form 990

Filing deadlines for Schedule K align with those for Form 990. Generally, the form is due on the 15th day of the fifth month after the end of the organization’s fiscal year. Organizations can apply for an extension, but it is essential to file Form 8868 to avoid late penalties. Keeping track of these deadlines is crucial for compliance and maintaining tax-exempt status.

Penalties for Non-Compliance with Schedule K To Form 990

Failure to comply with the requirements of Schedule K can result in significant penalties. Organizations may face fines for late filings, inaccuracies, or omissions in the form. Additionally, non-compliance can jeopardize an organization’s tax-exempt status, leading to further financial and operational challenges. It is important for organizations to prioritize accurate and timely completion of this form to avoid these consequences.

Quick guide on how to complete schedule k to form 990 and fundamentals of tax exempt

Effortlessly Prepare Schedule K To Form 990 And Fundamentals Of Tax Exempt on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle Schedule K To Form 990 And Fundamentals Of Tax Exempt on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

How to Modify and eSign Schedule K To Form 990 And Fundamentals Of Tax Exempt with Ease

- Locate Schedule K To Form 990 And Fundamentals Of Tax Exempt and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information carefully and click on the Done button to save your changes.

- Select your preferred method of delivering your document, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Modify and eSign Schedule K To Form 990 And Fundamentals Of Tax Exempt and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k to form 990 and fundamentals of tax exempt

Create this form in 5 minutes!

How to create an eSignature for the schedule k to form 990 and fundamentals of tax exempt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule K To Form 990?

Schedule K To Form 990 details the governance practices of tax-exempt organizations, focusing on how they approach their compliance responsibilities. Understanding Schedule K is crucial for ensuring transparency and accountability in the operations of tax-exempt entities. This schedule helps organizations report on their financial activities and adherence to IRS regulations.

-

Why is Schedule K important for tax-exempt organizations?

Schedule K is vital for tax-exempt organizations as it provides information that demonstrates compliance with IRS requirements. By accurately completing Schedule K To Form 990, organizations can maintain their tax-exempt status while showcasing their governance structures. This transparency fosters trust among stakeholders and the public.

-

How can airSlate SignNow assist with completing Schedule K To Form 990?

airSlate SignNow streamlines the document preparation process by offering eSigning and document management solutions. With our platform, organizations can easily collaborate on the completion of Schedule K To Form 990, ensuring that all necessary signatures and documents are collected efficiently. This saves time and reduces the potential for errors.

-

What are the benefits of using airSlate SignNow for tax-exempt documents?

Using airSlate SignNow for managing tax-exempt documents, including Schedule K To Form 990, offers several advantages. Our platform is user-friendly, cost-effective, and increases efficiency through easy document sharing and eSigning features. Additionally, you can ensure compliance and simplify the review process with built-in tracking and management tools.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow provides various pricing plans designed to meet the needs of different organizations. Our plans are cost-effective, making it easy for tax-exempt entities to utilize our services for managing Schedule K To Form 990 efficiently. You can choose a plan based on your usage and document management needs, ensuring you only pay for what you need.

-

Does airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow integrates with numerous accounting and financial software solutions to enhance your workflow. These integrations allow for seamless data transfer, making it easier to manage documents related to Schedule K To Form 990 while syncing financial information directly with your existing systems. This versatility improves accuracy and efficiency.

-

Can airSlate SignNow help with document security and compliance?

Absolutely! airSlate SignNow prioritizes document security and compliance with industry standards. When preparing schedules like Schedule K To Form 990, you can rest assured that your documents are stored securely, encrypted, and accessible only to authorized users, helping you meet compliance requirements effectively.

Get more for Schedule K To Form 990 And Fundamentals Of Tax Exempt

Find out other Schedule K To Form 990 And Fundamentals Of Tax Exempt

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word