Schedule K Form 990 Supplemental Information on Tax Exempt Bonds 2022-2026

What is the Schedule K Form 990 Supplemental Information On Tax Exempt Bonds

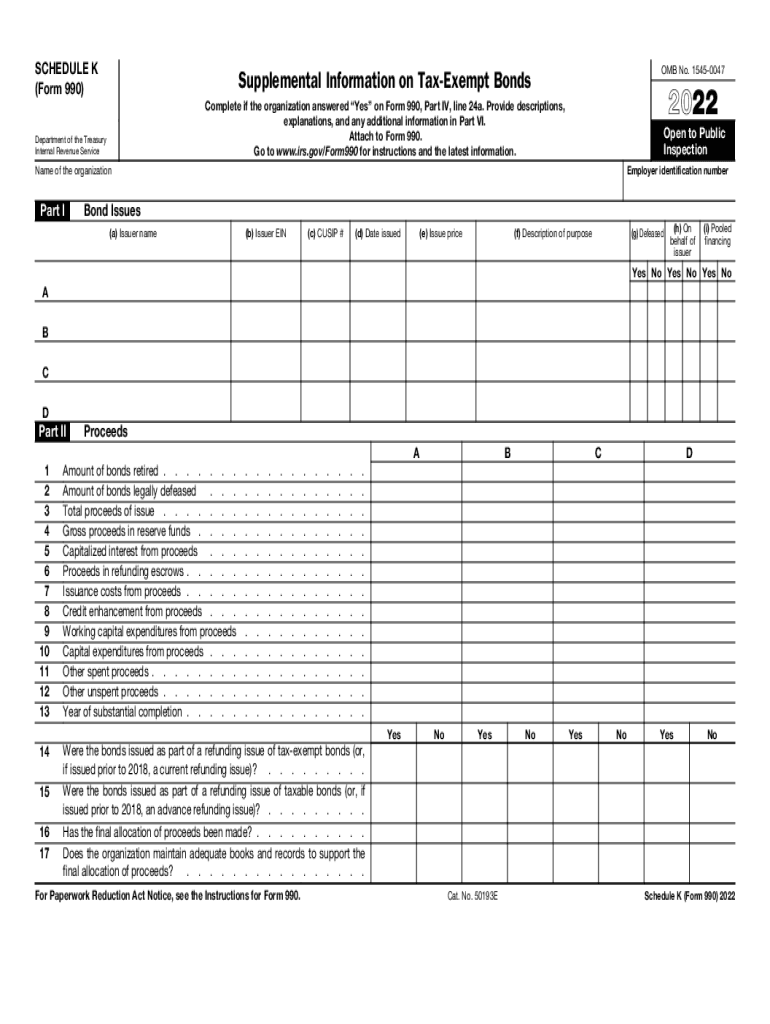

The Schedule K Form 990 is a crucial document for tax-exempt organizations that issue bonds. This form provides supplemental information regarding tax-exempt bonds, specifically focusing on the use and compliance of these financial instruments. It helps the IRS and the public understand the financial activities of tax-exempt entities, ensuring transparency and accountability. The Schedule K includes details about the bonds issued, the proceeds used, and the compliance with federal tax laws, which are essential for maintaining tax-exempt status.

How to use the Schedule K Form 990 Supplemental Information On Tax Exempt Bonds

Using the Schedule K Form 990 involves several steps to ensure accurate reporting of tax-exempt bonds. Organizations must gather all necessary financial information related to the bonds issued, including the purpose of the bonds, the amounts, and any relevant compliance details. This information is then entered into the form, ensuring that all sections are completed accurately. It is essential to review the form for completeness and correctness before submission, as errors can lead to compliance issues with the IRS.

Steps to complete the Schedule K Form 990 Supplemental Information On Tax Exempt Bonds

Completing the Schedule K Form 990 requires a systematic approach:

- Gather all relevant financial documents related to the bonds.

- Identify the specific tax-exempt bonds issued and their purposes.

- Fill out each section of the form, providing accurate and complete information.

- Review the completed form for any discrepancies or missing information.

- Submit the form along with the main Form 990 by the required deadline.

Legal use of the Schedule K Form 990 Supplemental Information On Tax Exempt Bonds

The legal use of the Schedule K Form 990 is governed by IRS regulations that outline the requirements for tax-exempt organizations. This form must be filed annually as part of the organization's Form 990 submission, ensuring compliance with federal tax laws. Accurate reporting on the Schedule K is essential for maintaining tax-exempt status and avoiding potential penalties. Organizations must adhere to guidelines regarding the disclosure of bond-related information to fulfill their legal obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K Form 990 align with the deadlines for Form 990 submissions. Typically, organizations must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. Extensions may be available, but it is crucial to adhere to these deadlines to avoid penalties. Organizations should mark their calendars for these important dates to ensure timely compliance.

Required Documents

To complete the Schedule K Form 990, organizations must gather several key documents:

- Financial statements detailing the bonds issued and their purposes.

- Records of bond proceeds and how they were utilized.

- Documentation of compliance with federal tax regulations.

- Previous years' Form 990 submissions for reference.

Penalties for Non-Compliance

Failure to file the Schedule K Form 990 accurately and on time can result in significant penalties for tax-exempt organizations. The IRS may impose fines for late submissions, and inaccuracies can lead to further scrutiny or loss of tax-exempt status. Organizations should prioritize compliance to avoid these potential consequences and maintain their standing with the IRS.

Quick guide on how to complete 2022 schedule k form 990 supplemental information on tax exempt bonds

Complete Schedule K Form 990 Supplemental Information On Tax Exempt Bonds effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers a great eco-friendly substitute for conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents promptly without delays. Handle Schedule K Form 990 Supplemental Information On Tax Exempt Bonds on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to alter and eSign Schedule K Form 990 Supplemental Information On Tax Exempt Bonds without hassle

- Obtain Schedule K Form 990 Supplemental Information On Tax Exempt Bonds and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Schedule K Form 990 Supplemental Information On Tax Exempt Bonds and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 schedule k form 990 supplemental information on tax exempt bonds

Create this form in 5 minutes!

People also ask

-

What is the 2018 Schedule K form and why is it important?

The 2018 Schedule K form is a tax document used by partnerships, S corporations, and certain trusts to report income, deductions, and credits. It's crucial for ensuring that all partners receive their proper share of income and tax obligations are met accurately.

-

How can airSlate SignNow help with the 2018 Schedule K form?

airSlate SignNow simplifies the process of sending and eSigning the 2018 Schedule K form by providing an easy-to-use platform. Users can quickly prepare, share, and collect signatures on this important tax document, streamlining tax reporting processes.

-

Is there a cost for using airSlate SignNow for the 2018 Schedule K form?

Yes, airSlate SignNow offers flexible pricing plans tailored for businesses that need to process documents like the 2018 Schedule K form efficiently. You can choose from various subscription options to find the one that best fits your needs and budget.

-

Are there any features specific to the 2018 Schedule K form?

airSlate SignNow provides features specifically designed to enhance the eSigning experience for important documents, such as the 2018 Schedule K form. These features include template creation, customizable workflows, and real-time tracking of document status.

-

Can I integrate airSlate SignNow with other tools for managing the 2018 Schedule K form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your 2018 Schedule K form alongside your existing tools. This integration enhances productivity and helps maintain a smooth workflow.

-

What are the benefits of using airSlate SignNow for eSigning the 2018 Schedule K form?

Using airSlate SignNow for the 2018 Schedule K form offers signNow benefits, including increased efficiency and reduced turnaround time for obtaining signatures. Additionally, it provides a secure and legally binding way to sign documents, ensuring compliance with regulations.

-

Is airSlate SignNow secure for filing the 2018 Schedule K form?

Yes, airSlate SignNow prioritizes security, ensuring that your 2018 Schedule K form and all other documents are protected with advanced encryption. This commitment to security helps safeguard sensitive information and maintain confidentiality during the signing process.

Get more for Schedule K Form 990 Supplemental Information On Tax Exempt Bonds

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries new york form

- Warranty deed from limited partnership or llc is the grantor or grantee new york form

- New york executor form

- New york wife form

- Retained life estate form

- Warranty deed form 497321909

- Quitclaim deed form 497321910

- Quitclaim deed form 497321911

Find out other Schedule K Form 990 Supplemental Information On Tax Exempt Bonds

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online