About Schedule K Form 990, Supplemental Information on 2020

Understanding the Schedule K Form 990

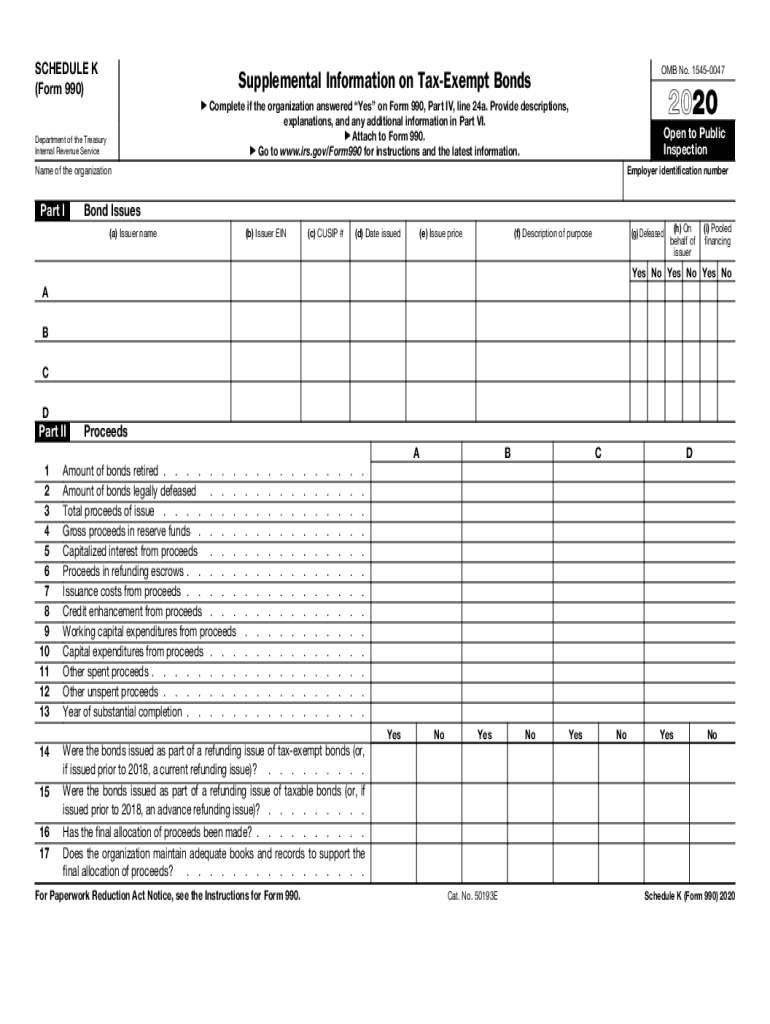

The Schedule K Form 990 provides supplemental information for tax-exempt organizations. It is essential for organizations to disclose their activities, including any relationships with related organizations and the nature of their financial transactions. This form helps the IRS and the public understand the financial health and operational structure of these entities. It is particularly important for organizations that have significant relationships with other tax-exempt entities or for those that provide financial assistance to other organizations.

Steps to Complete the Schedule K Form 990

Completing the Schedule K Form 990 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and balance sheets. Next, identify any related organizations and gather details about their financial activities. When filling out the form, provide clear and concise descriptions of the relationships and transactions. Finally, review the completed form for accuracy before submission to avoid penalties.

Legal Use of the Schedule K Form 990

The Schedule K Form 990 must be completed in accordance with IRS regulations. It is legally binding, meaning that the information provided must be accurate and truthful. Misrepresentation or failure to disclose required information can lead to penalties, including fines or loss of tax-exempt status. Organizations should consult with tax professionals to ensure compliance with all legal requirements when completing this form.

Filing Deadlines for the Schedule K Form 990

Organizations must adhere to specific filing deadlines for the Schedule K Form 990. Generally, the form is due on the 15th day of the fifth month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the form would be due by May 15 of the following year. Organizations can apply for an extension, but they must ensure that any extension request is submitted before the original deadline.

Required Documents for the Schedule K Form 990

To complete the Schedule K Form 990, organizations need to gather several key documents. These typically include financial statements, details of related organizations, and records of any financial transactions. Additional documentation may be required depending on the specific activities of the organization. Ensuring that all necessary documents are collected beforehand can streamline the completion process.

IRS Guidelines for Completing the Schedule K Form 990

The IRS provides specific guidelines for completing the Schedule K Form 990. These guidelines outline the necessary information to include, as well as the format in which it should be presented. Organizations should refer to the IRS instructions for the most current requirements and ensure that they follow all guidelines closely to avoid errors in their submissions.

Quick guide on how to complete about schedule k form 990 supplemental information on

Complete About Schedule K Form 990, Supplemental Information On effortlessly on any device

Managing documents online has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the correct form and securely store it in the cloud. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle About Schedule K Form 990, Supplemental Information On on any system with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign About Schedule K Form 990, Supplemental Information On without any hassle

- Obtain About Schedule K Form 990, Supplemental Information On and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign About Schedule K Form 990, Supplemental Information On to ensure effective communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about schedule k form 990 supplemental information on

Create this form in 5 minutes!

How to create an eSignature for the about schedule k form 990 supplemental information on

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the 'irs k tax form get' and how does it work?

The 'irs k tax form get' refers to the process of obtaining the IRS K-1 tax form, which reports income, deductions, and credits from partnerships. airSlate SignNow streamlines this process by allowing users to eSign and send documents electronically, ensuring faster submission and processing. With our platform, tracking and managing these forms becomes efficient and hassle-free.

-

How can airSlate SignNow simplify the process of handling IRS K-1 forms?

airSlate SignNow provides robust features for handling IRS K-1 forms, such as customizable templates and secure document storage. Users can easily create, send, and eSign these forms, ensuring compliance with IRS requirements. This reduces the manual workload and speeds up the time it takes to 'irs k tax form get' completed.

-

What is the cost associated with using airSlate SignNow for tax forms like the IRS K-1?

airSlate SignNow offers competitive pricing plans tailored to different business sizes and needs. Users can start with a free trial to explore features and determine the best fit for their requirements. The affordability of our plans makes it easy to manage your IRS K-1 forms without breaking the bank.

-

Are there integrations available for managing IRS K-1 tax forms in airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for managing IRS K-1 tax forms. This allows for automatic data population and easy retrieval of necessary documents. Integrations streamline the process, making it even easier to 'irs k tax form get' status updates.

-

What features does airSlate SignNow offer for document management related to tax forms?

airSlate SignNow offers a suite of features including eSigning, document storage, and template creation specifically for managing IRS tax forms like the K-1. Users can securely store and organize their documents, collaborate in real-time, and ensure all forms comply with current regulations. This enhances productivity when you need to 'irs k tax form get' filed.

-

Can I track the status of IRS K-1 forms sent via airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking options for documents sent, including IRS K-1 forms. This feature allows you to know when your forms have been viewed, signed, or completed, simplifying your workflow and ensuring timely submissions. You can effortlessly manage the entire process as you 'irs k tax form get' completed.

-

Is airSlate SignNow suitable for businesses of all sizes in handling IRS tax forms?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, providing a flexible solution for managing IRS tax forms like K-1. Whether you're a small partnership or a large corporation, our platform can adapt to your needs and scale accordingly. This versatility ensures that any business can efficiently 'irs k tax form get' completed.

Get more for About Schedule K Form 990, Supplemental Information On

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings wisconsin form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises wisconsin form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles wisconsin form

- Letter from tenant to landlord about landlords failure to make repairs wisconsin form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497430591 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession wisconsin form

- Letter from tenant to landlord about illegal entry by landlord wisconsin form

- Letter from landlord to tenant about time of intent to enter premises wisconsin form

Find out other About Schedule K Form 990, Supplemental Information On

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe