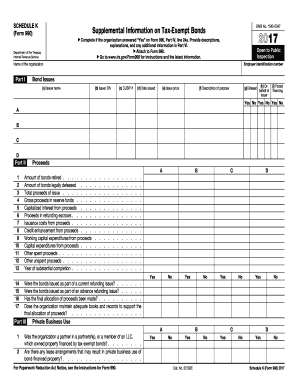

990 K Form 2017

What is the 990 K Form

The 990 K Form is a tax document that nonprofit organizations in the United States must file annually with the Internal Revenue Service (IRS). This form provides essential information about the organization's financial activities, governance, and compliance with tax regulations. It is designed to promote transparency and accountability among nonprofits, ensuring they operate in accordance with their exempt status. The 990 K Form is crucial for maintaining public trust and facilitating informed decision-making by stakeholders, including donors and regulatory authorities.

How to obtain the 990 K Form

To obtain the 990 K Form, organizations can visit the IRS website, where they can download the form directly. It is also available through various tax preparation software that supports nonprofit filings. Additionally, organizations may request a copy from their tax advisor or accountant, who can assist in ensuring the form is filled out correctly and submitted on time. It is important to ensure that the correct version of the form is used, as updates may occur annually.

Steps to complete the 990 K Form

Completing the 990 K Form involves several key steps:

- Gather financial records: Collect all necessary financial documents, including income statements, balance sheets, and statements of functional expenses.

- Fill out the form: Complete all sections of the form, ensuring accuracy in reporting income, expenses, and assets.

- Review governance information: Provide details about the organization’s governance structure, including board members and their roles.

- Check for compliance: Ensure that all information adheres to IRS guidelines and reflects the organization’s activities accurately.

- File the form: Submit the completed form electronically or by mail, depending on the organization's preference and requirements.

Legal use of the 990 K Form

The legal use of the 990 K Form is governed by IRS regulations, which stipulate that nonprofit organizations must file this form annually to maintain their tax-exempt status. Failure to file can result in penalties, including the loss of tax-exempt status. The information provided in the form must be truthful and complete, as inaccuracies can lead to legal repercussions. Organizations are encouraged to keep detailed records that support the information reported on the form, ensuring compliance with federal laws.

Filing Deadlines / Important Dates

Nonprofit organizations must adhere to specific filing deadlines for the 990 K Form. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if an organization’s fiscal year ends on December thirty-first, the form would be due on May fifteenth of the following year. Organizations can apply for an automatic six-month extension if needed, but they must file the extension request before the original deadline. It is crucial to stay informed about these dates to avoid penalties.

Penalties for Non-Compliance

Noncompliance with the filing requirements for the 990 K Form can result in significant penalties. Organizations that fail to file on time may face fines, which can accumulate for each month the form is late. Additionally, repeated failures to file can lead to the automatic revocation of tax-exempt status, which would require the organization to pay taxes on its income. To mitigate these risks, it is advisable for organizations to establish a reliable filing schedule and maintain accurate records throughout the year.

Quick guide on how to complete 990 k form 2017

Prepare 990 K Form effortlessly on any device

Web-based document administration has become widely accepted by businesses and individuals alike. It serves as an excellent eco-conscious substitute for conventional printed and signed papers, allowing you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Manage 990 K Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to alter and eSign 990 K Form with ease

- Locate 990 K Form and then click Get Form to begin.

- Employ the tools we supply to finish your document.

- Emphasize crucial sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your edits.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign 990 K Form and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 990 k form 2017

Create this form in 5 minutes!

How to create an eSignature for the 990 k form 2017

How to generate an eSignature for the 990 K Form 2017 online

How to create an eSignature for the 990 K Form 2017 in Google Chrome

How to generate an electronic signature for signing the 990 K Form 2017 in Gmail

How to create an eSignature for the 990 K Form 2017 straight from your mobile device

How to make an eSignature for the 990 K Form 2017 on iOS

How to create an electronic signature for the 990 K Form 2017 on Android OS

People also ask

-

What is the 990 K Form and why is it important?

The 990 K Form is a key document used by tax-exempt organizations to report their financial activities to the IRS. It ensures transparency and compliance with federal regulations, making it essential for non-profits. Understanding the 990 K Form helps organizations maintain good standing and avoid penalties.

-

How can airSlate SignNow help with the 990 K Form?

airSlate SignNow simplifies the process of filling out and submitting the 990 K Form by providing an intuitive eSignature solution. You can easily send, sign, and store your documents securely, ensuring that your 990 K Form is completed accurately and on time. This streamlines your compliance efforts, allowing you to focus on your organization's mission.

-

Is airSlate SignNow suitable for non-profits handling the 990 K Form?

Yes, airSlate SignNow is specifically designed to cater to non-profits and organizations that need to manage their documentation efficiently. With features that streamline the signing process for the 990 K Form, airSlate SignNow empowers non-profits to stay organized and compliant with their filing requirements.

-

What are the pricing options for airSlate SignNow when preparing the 990 K Form?

airSlate SignNow offers flexible pricing plans that cater to different organizational needs, including options for non-profits. You can choose a plan that suits your budget while still gaining access to powerful features to manage your 990 K Form and other important documents effectively.

-

Does airSlate SignNow integrate with other accounting software for the 990 K Form?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, allowing for easy management of the 990 K Form. This integration helps you streamline data transfer and ensures that all necessary information is readily available when preparing your tax filings.

-

What security features does airSlate SignNow offer for the 990 K Form?

airSlate SignNow prioritizes the security of your documents, including the 990 K Form, with advanced encryption and secure cloud storage. These features ensure that your sensitive information remains protected throughout the signing and submission process, giving you peace of mind.

-

Can I track the status of my 990 K Form with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your documents, including the 990 K Form. You can easily monitor who has signed, who still needs to sign, and when the document has been completed, ensuring that you stay on top of your filing deadlines.

Get more for 990 K Form

- Blank mortgage note form

- Kelly scott santa barbara county district attorney email form

- Power of attorney form refinance nc

- Generic building permit form

- Mildred colodny scholarship application national trust for historic preservationnation form

- Arizona acknowledgement of paternity form

- Xvifeid 2012 form

- Fha 203k loan disbursement request form

Find out other 990 K Form

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe