Irs Schedule K Form 2016

What is the IRS Schedule K Form

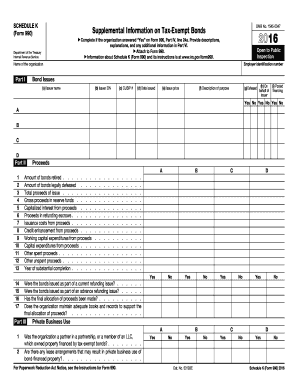

The IRS Schedule K Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for entities that pass their income through to their owners or beneficiaries, allowing them to report their share of the income on their personal tax returns. The information on Schedule K helps the IRS ensure that all income is accurately reported and taxed appropriately.

How to use the IRS Schedule K Form

To effectively use the IRS Schedule K Form, individuals and entities must first gather all necessary financial information, including income, deductions, and credits. After completing the form, it should be attached to the appropriate tax return, such as Form 1040 for individuals or Form 1065 for partnerships. It is crucial to ensure that all figures are accurate and consistent with the entity's financial records to avoid discrepancies with the IRS.

Steps to complete the IRS Schedule K Form

Completing the IRS Schedule K Form involves several key steps:

- Gather financial statements and records related to income and expenses.

- Fill out the basic information section, including the entity's name, address, and identification number.

- Report income, deductions, and credits accurately on the respective lines of the form.

- Review the completed form for accuracy and completeness.

- Attach the Schedule K Form to the main tax return and submit it to the IRS by the filing deadline.

Legal use of the IRS Schedule K Form

The IRS Schedule K Form is legally binding when completed accurately and submitted in compliance with IRS regulations. It is important for taxpayers to understand that any misreporting or failure to file the form can result in penalties and interest. Utilizing a reliable eSignature solution can help ensure that the form is signed and submitted securely, maintaining compliance with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Schedule K Form vary depending on the type of entity. Generally, partnerships and S corporations must file by the fifteenth day of the third month after the end of their tax year. For most entities operating on a calendar year, this means the deadline is March 15. It is essential to be aware of these dates to avoid late filing penalties.

Required Documents

To complete the IRS Schedule K Form, several documents are typically required, including:

- Financial statements detailing income and expenses.

- Previous year's tax return for reference.

- Documentation of any deductions or credits being claimed.

- Partnership agreements or corporate bylaws, if applicable.

Form Submission Methods

The IRS Schedule K Form can be submitted in various ways. Taxpayers can file it electronically using IRS-approved e-filing software, which often simplifies the process and reduces errors. Alternatively, the form can be printed, signed, and mailed to the IRS. In-person submission is generally not an option for tax forms, so electronic or mail methods are recommended.

Quick guide on how to complete 2016 irs schedule k form

Easily Prepare Irs Schedule K Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly, without any delays. Manage Irs Schedule K Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Irs Schedule K Form with ease

- Find Irs Schedule K Form and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Irs Schedule K Form to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 irs schedule k form

Create this form in 5 minutes!

How to create an eSignature for the 2016 irs schedule k form

How to create an eSignature for your 2016 Irs Schedule K Form in the online mode

How to generate an eSignature for your 2016 Irs Schedule K Form in Google Chrome

How to create an eSignature for putting it on the 2016 Irs Schedule K Form in Gmail

How to make an eSignature for the 2016 Irs Schedule K Form right from your mobile device

How to generate an electronic signature for the 2016 Irs Schedule K Form on iOS

How to make an electronic signature for the 2016 Irs Schedule K Form on Android

People also ask

-

What is the purpose of the IRS Schedule K Form?

The IRS Schedule K Form is used to report income, deductions, and credits from partnerships and S corporations. It provides crucial information necessary for partners and shareholders when preparing their individual tax returns, ensuring compliance with tax regulations.

-

How can airSlate SignNow help with managing IRS Schedule K Form?

airSlate SignNow offers a user-friendly platform to eSign and send your IRS Schedule K Form documents quickly and securely. Our solution enables easy document management, so you can focus on your business while ensuring your tax forms are completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for IRS Schedule K Form?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. Each plan includes features for handling your IRS Schedule K Form and other documents, ensuring you find an option that fits your budget and requirements.

-

What features does airSlate SignNow offer for IRS Schedule K Form management?

Our platform includes features such as customizable templates for IRS Schedule K Form, real-time collaboration, and secure eSigning capabilities. These tools streamline the document process, making it easier to manage and submit your tax forms promptly.

-

Can I integrate airSlate SignNow with other software for IRS Schedule K Form management?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for IRS Schedule K Form management. Whether you use accounting software or CRM systems, our integrations ensure all your documents are organized and accessible.

-

How secure is the airSlate SignNow platform for handling IRS Schedule K Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication measures to protect your IRS Schedule K Form and other sensitive documents, giving you peace of mind while managing your important tax records.

-

Can I track the status of my IRS Schedule K Form through airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your IRS Schedule K Form in real-time. You'll receive notifications when documents are viewed, signed, or completed, ensuring you're always informed about your tax document's progress.

Get more for Irs Schedule K Form

Find out other Irs Schedule K Form

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online