NY DTF it 2664 Fill Out Tax Template Online US Legal Forms 2022

What is the NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms

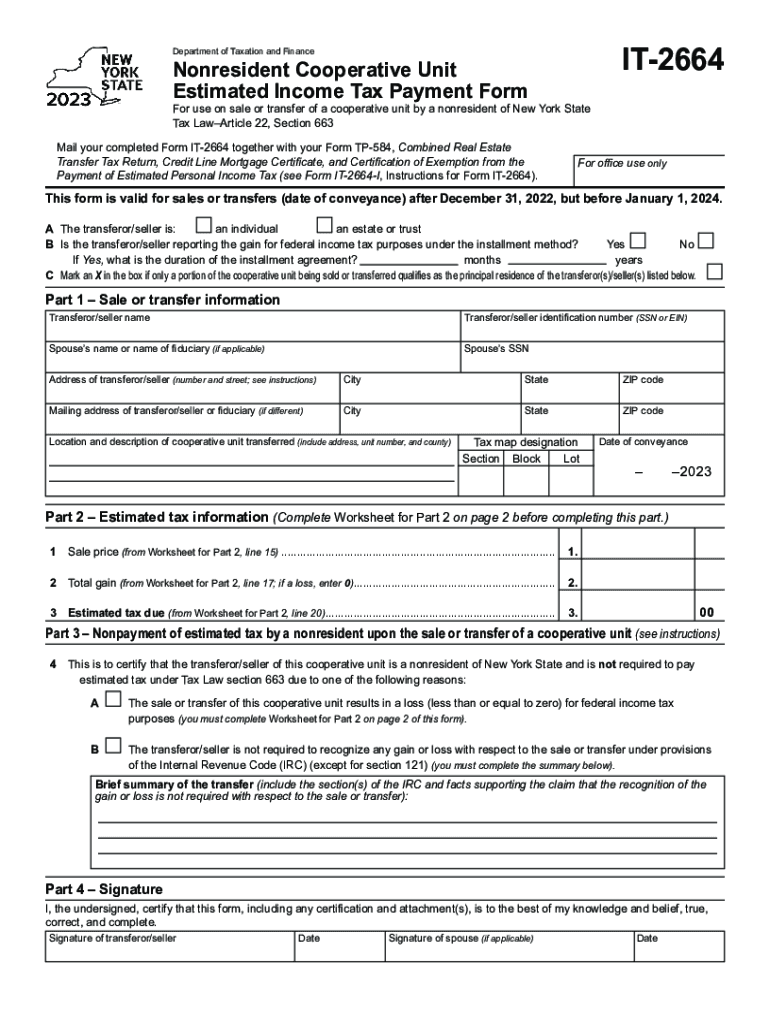

The NY DTF IT 2664 is a tax form used by individuals and businesses in New York State to report and pay certain taxes. This form is essential for ensuring compliance with state tax laws and is often required for various tax-related purposes. It allows taxpayers to provide necessary information regarding their income, deductions, and tax credits, which are crucial for accurate tax calculations. By filling out this form online, users can streamline the process, reduce errors, and ensure timely submissions.

Steps to complete the NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms

Completing the NY DTF IT 2664 online involves several straightforward steps:

- Access the online form through a reliable platform.

- Enter personal information, including your name, address, and Social Security number.

- Provide details about your income sources and any applicable deductions.

- Review the information for accuracy before submission.

- Submit the form electronically, ensuring you receive a confirmation of submission.

Following these steps can help ensure that your tax information is submitted correctly and efficiently.

Legal use of the NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms

The NY DTF IT 2664 is legally recognized for tax reporting in New York State. It is crucial for taxpayers to use this form as part of their compliance with state tax regulations. Failing to submit this form or submitting inaccurate information can lead to penalties or legal issues. Therefore, understanding the legal implications of using this form is essential for all taxpayers.

Required Documents for the NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms

To complete the NY DTF IT 2664, you will need several documents, including:

- Your previous year’s tax return for reference.

- W-2 forms from employers showing your earnings.

- Any 1099 forms for additional income sources.

- Documentation for deductions, such as receipts or statements.

Having these documents ready can simplify the process of filling out the form and ensure that you provide accurate information.

Filing Deadlines / Important Dates for the NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms

It is important to be aware of the filing deadlines associated with the NY DTF IT 2664. Typically, these deadlines align with the federal tax filing deadlines, which are usually April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or specific tax situations. Staying informed about these dates can help you avoid late fees and penalties.

Examples of using the NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms

The NY DTF IT 2664 can be used in various scenarios, including:

- Individuals reporting income from multiple sources.

- Self-employed individuals calculating their estimated taxes.

- Businesses filing for tax credits or deductions.

These examples illustrate the versatility of the form and its importance in different tax situations.

Quick guide on how to complete ny dtf it 2664 fill out tax template online us legal forms

Effortlessly Prepare NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Manage NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms on any device using the airSlate SignNow applications for Android or iOS and simplify your document-related processes today.

How to Edit and Electronically Sign NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms with Ease

- Locate NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms and select Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from whichever device you choose. Edit and electronically sign NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ny dtf it 2664 fill out tax template online us legal forms

Create this form in 5 minutes!

How to create an eSignature for the ny dtf it 2664 fill out tax template online us legal forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NY DTF IT 2664 Fill Out Tax Template?

The NY DTF IT 2664 Fill Out Tax Template is a legal form specifically designed for tax-related submissions in New York. With airSlate SignNow, you can efficiently fill out and eSign this tax template online, ensuring compliance with state regulations.

-

How can I access the NY DTF IT 2664 Fill Out Tax Template Online?

You can easily access the NY DTF IT 2664 Fill Out Tax Template online through the airSlate SignNow platform. Simply sign up, and you will have the ability to fill out and eSign the document at your convenience, streamlining your tax filing process.

-

What are the benefits of using airSlate SignNow for the NY DTF IT 2664 Fill Out Tax Template?

Using airSlate SignNow for the NY DTF IT 2664 Fill Out Tax Template allows for a hassle-free, efficient, and legally compliant way to manage your tax forms. The platform provides you with an easy-to-use interface and advanced eSigning capabilities to expedite your tax documentation.

-

Is there a cost associated with using the NY DTF IT 2664 Fill Out Tax Template on airSlate SignNow?

Yes, there may be a subscription or usage fee associated with using the NY DTF IT 2664 Fill Out Tax Template on airSlate SignNow. However, the platform is designed to be cost-effective and offers various pricing plans to fit different needs and budgets.

-

Can I integrate airSlate SignNow with other applications while using the NY DTF IT 2664 Fill Out Tax Template?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, allowing you to easily manage your workflows while filling out the NY DTF IT 2664 Fill Out Tax Template online. This enhances your efficiency and keeps all your documents organized.

-

What features does airSlate SignNow provide for filling out the NY DTF IT 2664 Tax Template?

airSlate SignNow includes various features such as customizable templates, auto-fill options, and secure eSignature functionality for the NY DTF IT 2664 Fill Out Tax Template. These features are designed to simplify your experience and ensure accuracy in your tax documentation.

-

Is the NY DTF IT 2664 Fill Out Tax Template secure when using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. The platform provides end-to-end encryption and complies with industry standards to ensure that your NY DTF IT 2664 Fill Out Tax Template and personal information remain safe and confidential.

Get more for NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms

Find out other NY DTF IT 2664 Fill Out Tax Template Online US Legal Forms

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy