CUNJ FED Employer Payrolldeductionauthorizationv1 0 Form

What is the CUNJ FED employer payrolldeductionauthorizationv1 0

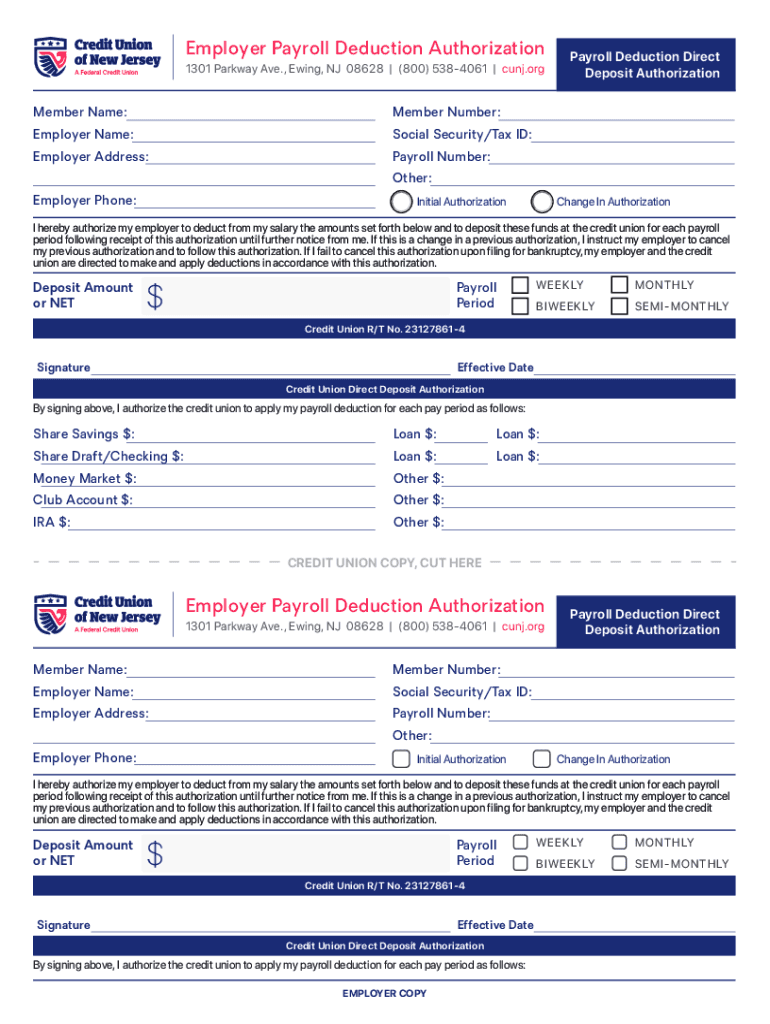

The CUNJ FED employer payrolldeductionauthorizationv1 0 is a specific form used by employers to authorize payroll deductions for various purposes. This form enables employees to consent to have a certain amount deducted from their paychecks for specific benefits, contributions, or other financial obligations. It ensures that both the employer and employee have a clear understanding of the deductions being made, promoting transparency and compliance with applicable regulations.

How to use the CUNJ FED employer payrolldeductionauthorizationv1 0

Using the CUNJ FED employer payrolldeductionauthorizationv1 0 involves several straightforward steps. First, employers should provide the form to employees who wish to authorize deductions. Employees must fill out the form accurately, indicating the amount and purpose of the deductions. Once completed, the form should be submitted to the payroll department for processing. It is essential for both parties to retain a copy of the signed form for their records.

Steps to complete the CUNJ FED employer payrolldeductionauthorizationv1 0

Completing the CUNJ FED employer payrolldeductionauthorizationv1 0 requires attention to detail. Follow these steps:

- Obtain the form from your employer or download it from the appropriate source.

- Fill in your personal information, including your name, employee ID, and department.

- Specify the amount to be deducted and the purpose of the deduction.

- Sign and date the form to confirm your authorization.

- Submit the completed form to your payroll department.

Key elements of the CUNJ FED employer payrolldeductionauthorizationv1 0

Several key elements are crucial for the CUNJ FED employer payrolldeductionauthorizationv1 0 to be valid and effective:

- Employee Information: Accurate personal details must be provided.

- Deduction Amount: Clearly state the amount to be deducted from each paycheck.

- Purpose of Deduction: Specify what the deductions are for, such as retirement contributions or insurance premiums.

- Signature: The employee’s signature is required to validate the authorization.

- Date: The date of signing is essential for record-keeping and compliance.

Legal use of the CUNJ FED employer payrolldeductionauthorizationv1 0

The CUNJ FED employer payrolldeductionauthorizationv1 0 must be used in accordance with applicable labor laws and regulations. Employers are responsible for ensuring that deductions comply with federal and state laws, including limits on the amount that can be deducted and the purposes for which deductions are allowed. Proper use of this form helps protect both the employer and employee from potential legal issues related to unauthorized deductions.

Examples of using the CUNJ FED employer payrolldeductionauthorizationv1 0

There are various scenarios in which the CUNJ FED employer payrolldeductionauthorizationv1 0 may be utilized:

- Employees wishing to contribute to a retirement savings plan can authorize deductions from their paychecks.

- Workers may choose to have a portion of their salary deducted for health insurance premiums.

- Some employees may authorize deductions for charitable contributions or union dues.

Quick guide on how to complete cunj fed employer payrolldeductionauthorizationv1 0

Complete CUNJ FED employer payrolldeductionauthorizationv1 0 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage CUNJ FED employer payrolldeductionauthorizationv1 0 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign CUNJ FED employer payrolldeductionauthorizationv1 0 effortlessly

- Find CUNJ FED employer payrolldeductionauthorizationv1 0 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign CUNJ FED employer payrolldeductionauthorizationv1 0 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cunj fed employer payrolldeductionauthorizationv1 0

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CUNJ FED employer payrolldeductionauthorizationv1 0?

CUNJ FED employer payrolldeductionauthorizationv1 0 is a specialized document designed for employers to authorize payroll deductions efficiently. This tool streamlines the process for both employers and employees, ensuring clarity and compliance. With airSlate SignNow, this document can be easily created, eSigned, and managed digitally.

-

How can airSlate SignNow facilitate the use of CUNJ FED employer payrolldeductionauthorizationv1 0?

airSlate SignNow enhances the use of CUNJ FED employer payrolldeductionauthorizationv1 0 by providing a user-friendly platform to send, sign, and store documents securely. The platform automates notifications and reminders, thereby minimizing delays in the authorization process. This results in faster payroll processing and improved operational efficiency.

-

What are the key features of CUNJ FED employer payrolldeductionauthorizationv1 0 in airSlate SignNow?

Key features of CUNJ FED employer payrolldeductionauthorizationv1 0 include customizable templates, easy eSigning, and seamless integration with various HR and payroll systems. This ensures a smooth user experience by reducing the time spent on paperwork. Additionally, the platform offers tracking and audit trails for enhanced security and compliance.

-

Is airSlate SignNow affordable for small businesses needing CUNJ FED employer payrolldeductionauthorizationv1 0?

Yes, airSlate SignNow offers affordable pricing plans that cater to small businesses requiring CUNJ FED employer payrolldeductionauthorizationv1 0. The flexible pricing structure allows businesses to choose packages that fit their needs without overspending. Enhanced functionality comes at a competitive rate, making it an ideal choice for effective document management.

-

How does CUNJ FED employer payrolldeductionauthorizationv1 0 ensure compliance?

CUNJ FED employer payrolldeductionauthorizationv1 0 in airSlate SignNow is designed to meet regulatory requirements, ensuring compliance with employment laws and payroll regulations. Each document is generated with proper formatting and legal language, reducing the risk of errors. Additionally, electronic signatures are legally binding, providing legal protection for employers and employees alike.

-

Can CUNJ FED employer payrolldeductionauthorizationv1 0 integrate with other software?

Absolutely, CUNJ FED employer payrolldeductionauthorizationv1 0 can seamlessly integrate with various HR and payroll software through airSlate SignNow's API. This integration simplifies the document workflow, allowing for automatic updates and data synchronization across platforms. By connecting with existing systems, businesses can enhance user experience and streamline operations.

-

What benefits does using CUNJ FED employer payrolldeductionauthorizationv1 0 offer?

Using CUNJ FED employer payrolldeductionauthorizationv1 0 provides numerous benefits, including speed, efficiency, and increased accuracy in payroll processing. It also improves employee satisfaction by making the deduction authorization process transparent and easy. Overall, this tool empowers businesses to optimize their payroll systems and maintain a professional appearance.

Get more for CUNJ FED employer payrolldeductionauthorizationv1 0

- Sample form k sample briefs california courts

- Fillable form 12 980a instructions for florida supreme court

- Request to issue subpoena form

- Instructions to plaintiff the small claims court i form

- Delegate reimbursement form

- Ayudas e incentivos para empresas portal pyme form

- Paper form ssa 2 application for wifes or husbands

- Form ssa 1 bkfill online printable fillable

Find out other CUNJ FED employer payrolldeductionauthorizationv1 0

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now