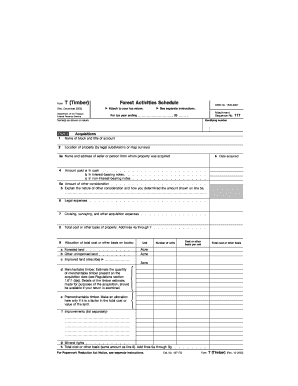

Timber Sales and Income Describes How to Treat Income from Selling Timber for Income Tax Purposes Form

Understanding Timber Sales and Income for Tax Purposes

The Timber Sales and Income form outlines how to treat income generated from selling timber when filing income taxes. This income can be classified as either capital gains or ordinary income, depending on various factors such as the duration of ownership and the nature of the sale. Understanding these distinctions is crucial for accurate tax reporting and compliance.

Steps to Complete the Timber Sales and Income Form

Completing the Timber Sales and Income form involves several key steps:

- Gather all relevant documentation, including sales contracts and receipts.

- Determine the total income from timber sales for the tax year.

- Assess whether the income qualifies as capital gains or ordinary income.

- Fill out the form accurately, ensuring all figures reflect the actual transactions.

- Review the form for any errors before submission.

IRS Guidelines for Timber Sales Income

The IRS provides specific guidelines on how to report income from timber sales. It's essential to refer to IRS publications, such as Publication 225, which offers insights into farming and timber operations. These guidelines clarify how to calculate the basis of the timber and any allowable deductions related to the sale.

Required Documents for Filing

When filing the Timber Sales and Income form, certain documents are necessary to substantiate your claims. These may include:

- Sales receipts or contracts detailing the sale of timber.

- Records of expenses incurred related to the timber sale, such as management costs.

- Previous tax returns that may influence the current filing.

State-Specific Rules for Timber Income

Each state may have its own regulations regarding the taxation of timber sales. It is important to review state tax laws to ensure compliance. Some states may offer specific deductions or credits related to timber income, which can significantly affect overall tax liability.

Penalties for Non-Compliance

Failing to report timber sales income accurately can result in penalties from the IRS. These can include fines, interest on unpaid taxes, and potential audits. It is crucial to maintain accurate records and seek professional advice if unsure about the reporting process.

Quick guide on how to complete timber sales and income describes how to treat income from selling timber for income tax purposes

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without any holdups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and eSign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential parts of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Timber Sales And Income Describes How To Treat Income From Selling Timber For Income Tax Purposes

Create this form in 5 minutes!

How to create an eSignature for the timber sales and income describes how to treat income from selling timber for income tax purposes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are timber sales and how do they impact income tax?

Timber sales refer to the process of selling timber for profit, which can influence your income tax calculations. Understanding how timber sales and income describes how to treat income from selling timber for income tax purposes is crucial for compliance. It’s recommended to consult a tax professional for personalized advice on reporting timber sales.

-

How does airSlate SignNow help in managing timber sales documents?

airSlate SignNow provides an efficient solution for managing documents related to timber sales. It simplifies the process of signing and sending contracts and agreements tied to timber sales. By using airSlate SignNow, you can ensure that all paperwork is handled smoothly, which aligns with how income from selling timber can be documented for tax purposes.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial for new users interested in exploring the software. This allows you to experience how airSlate SignNow can assist with timber sales documents and understanding how timber sales and income describes how to treat income from selling timber for income tax purposes without any upfront costs.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Choosing the right plan can signNowly enhance your efficiency when dealing with timber sales documentation and ensure that you understand how timber sales and income describes how to treat income from selling timber for income tax purposes.

-

Can airSlate SignNow integrate with other tools I use?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of applications and tools. This functionality can help in streamlining your operations, especially when dealing with documentation for timber sales, thereby clarifying how timber sales and income describes how to treat income from selling timber for income tax purposes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow boasts a variety of features, including eSignature capabilities, robust templates, and automated workflows. These tools make it easy to manage timber sales paperwork while ensuring compliance with how timber sales and income describes how to treat income from selling timber for income tax purposes.

-

What are the benefits of using airSlate SignNow for timber sales?

Using airSlate SignNow for timber sales has numerous benefits, including time savings and improved accuracy in documentation. This platform aids in simplifying processes associated with how timber sales and income describes how to treat income from selling timber for income tax purposes. This efficiency can ultimately lead to better business management and tax compliance.

Get more for Timber Sales And Income Describes How To Treat Income From Selling Timber For Income Tax Purposes

- Nmc1 non material change planning application form planningni gov

- General guidelines for job application forms updated for general guidelines for job application forms updated for hiring

- Orthodontic referral form vac orthodontics

- Nc medicaid application form

- Verification form

- Dhp virginia form

- Licensed child care center home consent forms in gov ius

- New alabama business application form

Find out other Timber Sales And Income Describes How To Treat Income From Selling Timber For Income Tax Purposes

- Add Sign PDF Online

- Add Sign PDF Free

- Add Sign PDF Android

- Add Sign PDF iPad

- How To Add Sign PDF

- How Can I Add Sign PDF

- Help Me With Request Sign Presentation

- Add Sign Word Online

- Add Sign Word Computer

- Add Sign Word Android

- How To Add Sign Word

- How To Add Sign Document

- How To Remove Sign PDF

- Add Sign PPT Now

- Remove Sign PDF Safe

- How To Remove Sign Word

- How Do I Remove Sign Word

- Remove Sign PPT Free

- Certify Sign PDF Free

- Certify Sign PDF Secure